Hive Blockchain (NASDAQ: HIVE) stock price surged to the highest level since September last year as Bitcoin soared above $31,000. The shares were trading at $5, which was much higher than the lowest level this year. It has soared by more than 270% this year, outperforming the Nasdaq 100 and Dow Jones indices.

Bitcoin price breaks out

Hive Blockchain share price has made a strong recovery in the past few months, helped by the resurgent Bitcoin and other digital currencies. This rally mirrors that of other Bitcoin mining companies like Riot Platforms and Marathon Digital.

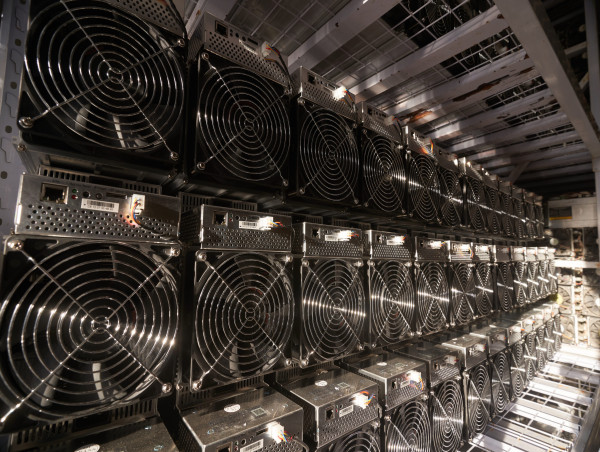

For starters, Hive Blockchain is a Canadian Bitcoin mining company valued at over $399 million. It has operations in Canada and the United States, where it mines and sells Bitcoin. As a result, the company makes more money when Bitcoin is in an uptrend.

Hive Blockchain reported strong financial results in June. Its annual revenue jumped to $106.3 million as it jhiked its ASIC hashrate by 50%. The rate moved from 2.0% Exahash in 2022 to the current 3.0. It increased the number of mined Bitcoins frm 3,258 to 3,503.

Still, Hive Blockchain is in a loss-making area. Its net loss came in at over $236.4 million because of the lower BTC prices and depreciation. It also had a $70.4 million impairment charge on equipment.

Despite these challenges, analysts believe that the company will have a strong performance this year, helped by higher Bitcoin prices. BTC has jumped by more than 100% this year. And as I wrote in this article, there is a likelihood that it will jump to $35,000 in the next few days. This performance will happen if Bitcoin crosses the year-to-date high of $31,400.

Hive Blockchain stock price forecast

The 4H chart shows that the HIVE stock price has been in a strong bullish trend in the past few months. Most importantly, the shares managed to move above the key resistance point at $4.30, the highest point on April 14th. It has also jumped above the 50% retracement point and the 50-day and 25-day moving averages.

The MACD and the Relative Strength Index (RSI) have also continued jumping, with the latter being in the overbought level. Therefore, I suspect that the shares will continue rising as long as Bitcoin’s momentum continues. If this happens, the stock will likely soar to the next key level to watch will be at $6 followed by the 78.2% retracement point at $6.23.

The post Hive Blockchain stock price analysis as Bitcoin breaks out appeared first on Invezz.