Highlights

- Tesla chief Elon Musk purchased Twitter for US$54.20 per share in a cash deal for US$44 billion.

- On his Twitter handle, Musk suggested that he intends to make Twitter a better place by enhancing the product with new features and algorithms.

- Following the news, the price of Elon Buys Twitter (EBT) started gathering massive momentum registering gains of over 6,000% and a volume spike of over 1,500%.

Tesla chief Elon Musk has finally agreed to purchase the 16-year-old social media platform Twitter Inc for a US$54.20 per share in a cash deal for US$44 billion, which has been a platform of public opinion and debate for years now.

Last 24 hours were quite busy for Musk and his followers as there were many theories doing rounds around the deal, which was later greeted with both delight and skepticism.

Giving details of the purchase, social media giant Twitter announced that it will now be a privately held firm. The deal will still have to go through the approval process of Twitter stockholders and regulators.

Also read: Mantra Dao (OM) crypto: Why is it rallying today?

On his Twitter handle, Musk suggested that he intends to make Twitter a better place by enhancing the product with new features and algorithms, which will increase the trust of the users. The Tesla chief added that free speech is the bedrock of a functioning democracy.

Image credit: Twitter @elonmusk (Elon Musk)

Former Twitter CEO Jack Dorsey was quick to praise Musk's acquisition of Twitter and tweeted that Musk's goal of creating an inclusive and trustworthy platform is the right one.

Image credit: Twitter @jack (Jack)

Image credit: Twitter @jack (Jack)

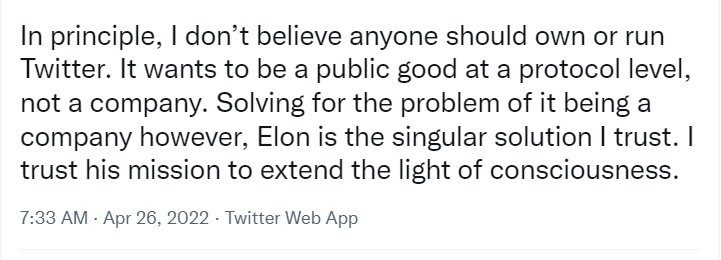

He added that Musk can only be the solution as he trusts and believes that Musk’s mission is to extend the light of consciousness.

Image credit: Twitter @jack (Jack)

Image credit: Twitter @jack (Jack)

The cryptocurrency

Meanwhile, as soon as the news broke, the price of Elon Buys Twitter (EBT) started gathering momentum registering gains of over 6000% and a volume spike of over 1500%.

It is believed that Clemence Guimpied and Hilary Lewis developed the token Elon Musk cryptocurrency, which primarily aims to provide an opportunity to the meme developers to earn rewards for their work. According to the crypto project's whitepaper, its long-term goal is to be an industry leader in the DeFi sector.

Also read: Hedera (HBAR) crypto: How soon can it come out of its bearish phase?

Built on top of the Binance Smart Chain blockchain, the Elon Musk Twitter cryptocurrency aims to give people and enterprises greater control over their finances. Besides, it is also in the planning stage of developing a play-to-earn game for its users.

However, the token does raise an eyebrow when it comes to its reliability of the token. Though it's hard to say whether it's another pump and dump token, the official website and whitepaper do not have significant information about the project. Besides, its official Twitter handle is suspended, which has further raised eyebrows about the project.

Euphoria in the crypto market

The news of Musk buying Twitter seems to have a positive impact on the crypto market. In fact, the overall market was up by 3.45% and reached US$1.87 trillion at the time of writing.

Bitcoin registered gains of 3.74% and was trading at US$40,609.26 with a volume of US$34,493,274,869. Ethereum was up by 4.81% and was trading at US$3,006.18 with a volume of US$21,066,386,155. But Dogecoin was the biggest gainer among the Top 20 tokens after registering gains of over 21% and was trading at US$0.156927 with a trading volume of US$5,777,053,987.

Overall, Musk's Twitter deal seems to have a positive impact on the market, which has been mostly flat due to various reasons, such as the Russia-Ukraine crisis. At the same time, it has also allowed others to cash in on a moment to reap some massive gains, raising eyebrows on whether it's a scam or just a smart marketing strategy adopted by the project.

As the crypto markets are seeing ups and downs, it is advisable that the market participants should tread carefully and do their market research before entering the market.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

.png)