Highlights

- The time to start preparing for crypto taxes has come for those who cashed out on any of their virtual currencies over 2021.

- The prospect of making gains attracts people to the equities and cryptocurrency markets.

- As per the Canadian Revenue Agency (CRA), taxable events occurs when an individual sells a cryptocurrency, also known as the disposition of assets.

Cryptocurrencies have become popular worldwide, and despite their high volatility, virtual currencies attract investors as some have provided unrealistic returns to holders within a specific period.

The prospect of making gains attracts people to the equities and cryptocurrency markets. However, profit and taxes come together.

Also Read: What is Catcoin crypto & why its price is skyrocketing?

In this article, let's find out if you have to pay tax on cryptocurrencies in Canada.

What is the rule for tax on cryptocurrencies in Canada?

The time to start preparing for crypto taxes has come for those who cashed out on any of their virtual currencies over 2021. According to reports, the tax returns could be filed as early as this month's last date, and the deadline is April 30.

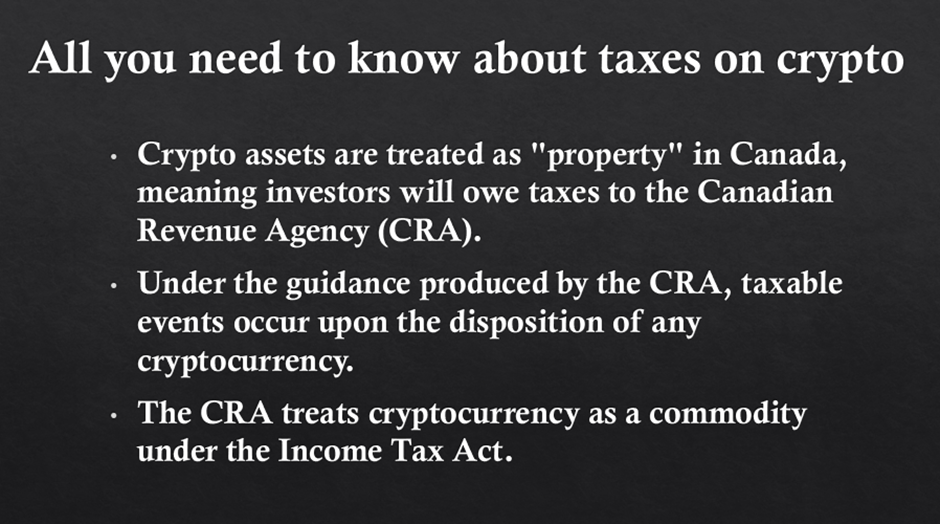

As per the Canadian Revenue Agency (CRA), taxable events occurs when an individual sells a cryptocurrency, also known as the disposition of assets.

Generally, common disposition of crypto assets would be considered like selling cryptocurrencies, paying for goods and services via cryptocurrency, converting cryptocurrency into fiat currency, and gifting crypto.

©2022 Kalkine Media®

Only crypto transactions are considered for taxes in Canada, and there's no tax requirement for holding crypto. The CRA treats a virtual currency as a commodity and considers transactions related to virtual currencies as business income or capital gain.

Bottom line

Crypto traders need to report their income from cryptocurrencies to the CRA. In simple terms, not reporting income from cryptocurrencies could be treated as breaking the law, and the CRA could treat it as a matter of tax evasion.

In Canada, the fine for tax evasion could double up to the amount of tax or a person may even be sentence to prison. Additionally, a person could also be charged with interest and outstanding tax debt, along with tax evasion fines.

To understand what falls under cryptocurrency income, you may visit the Government of Canada's website.