Highlights

- Not all cryptocurrencies do the same thing, a few may be gaming tokens, a few exchanges

- Scam tokens shine the light on why it is important to keep a tab on the utility of any cryptocurrency

- In the longer run, utility may matter more than any other element like Elon Musk’s tweets

Cryptocurrencies are gaining at the moment, with the aggregate market cap of all cryptos inching closer to US$2 trillion, according to data by CoinMarketCap. The value was under US$1.6 trillion just a few days back.

But for this rally to sustain, cryptocurrencies and their linked projects might have to find utility in the market. The space is presently possibly filled with some projects that may just be trying to ride the wave and pocket some quick gains.

The Squid Game crypto is a good example to cite. The crypto rode the Squid Game web series wave, and its quick rise and fall was notable.

In this light, which are the long-term cryptos that seem to have the best use case. Below are the five top contenders.

1. Bitcoin (BTC)

Bitcoin undeniably lies at the heart of the cryptocurrency universe. Bitcoin single-handedly made crypto assets a force to reckon with.

The mainstreaming of Bitcoin saw S&P Dow Jones launch indices in 2021 to track BTC price fluctuations, besides companies like MicroStrategy and Tesla adding Bitcoin to their holdings.

Can Bitcoin go on to become the native currency of the internet? At least Jack Dorsey believes so.

Also read: Top 3 cryptos under $0.0001 to watch in the near term

Bitcoin’s primary focus seemingly is on competing with fiat currencies like the US dollar in the real world. BTC may become a huge part of the global payments system in the coming years.

For now, it is legal tender in El Salvador, besides being the underlying asset of some exchange-traded funds (ETFs) in Canada and the US. A use case of Bitcoin lately came to light when Ukraine sought donations in cryptos, and Bitcoin became a crypto of choice besides Ether and Tether.

Bitcoin has gained over the past couple of days, but the all-time high price of nearly US$68,000 has yet to be reclaimed. It makes for an interesting watch.

2. Ethereum (ETH)

Ethereum is arguably the most popular blockchain network though others like Fantom and Solana have emerged as competitors. Why Ether could be a long-term crypto is because of the Ethereum network’s wide usage.

From non-fungible tokens (NFTs) to ERC-20 tokens, Ethereum provides support to multiple blockchain projects. A number of decentralized applications (DApps), including decentralized exchanges (DEXs), are built on the top of the Ethereum blockchain.

Despite the rise of new blockchains with their unique methods for consensus and validation, Ether has so far maintained its lead in terms of market cap. Ether is also trading below its all-time high price, but it may rise in the long run if the token’s network Ethereum keeps attracting DApp developers.

Which Are Top Cryptos With Best Use Cases?

3. Shiba Inu (SHIB)

One may ridicule Shiba Inu and its nearest rival Dogecoin (DOGE) as meme currencies, but the Shiba Inu project usually remains a top trend, sometimes even outshining Bitcoin. Soon, the project could add a new blockchain to it, which it has named Shibarium.

It is claimed that the Shibarium blockchain could have lower fees as compared to Ethereum. Besides, the project may add to it a stablecoin named SHI. This could pit Shiba Inu against Tether, which for now has the highest trade volume in the entire crypto asset universe.

The SHIB token’s other attraction is its extremely low price but a very high market cap. SHIB’s use case may be in tipping over platforms like Reddit. Users that upload good content may be tipped using coins like SHIB and DOGE. But how this becomes more mainstream has yet to be seen.

Also read: Waves crypto outperforms Bitcoin in 2022, what’s its price prediction?

4. Decentraland (MANA)

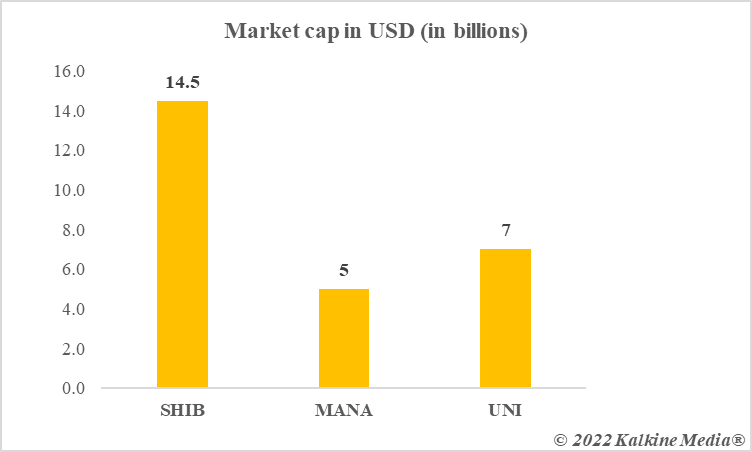

Decentraland has emerged as the biggest metaverse token in virtually no time. Today, its market cap is more than that of Axie Infinity’s AXS or The Sandbox’s SAND. Decentraland seems to have its use in the popular metaverse space. Brands like Samsung, Adidas and even banks like JPMorgan are trying to leverage metaverses to establish better connections with their customers.

Decentraland’s fictional world allows users to purchase virtual land where they can build and showcase their presence to virtual reality enthusiasts. Microsoft also purchased a gaming company recently, and many experts believe the company is tapping into the metaverse space after Mark Zuckerberg’s plunge into it last year.

The MANA token of Decentraland is the project’s utility token, and it may rise on the back of the demand of digital assets within Decentraland’s metaverse. MANA was a top 30 crypto by market cap as of writing.

Data provided by CoinMarketCap.com

Also read: Why are cryptos up today? 3 possible reasons

5. Uniswap (UNI)

Heard of decentralized crypto exchanges where crypto assets are traded in a manner that no centralized authority wields power? Uniswap is a leading player in this category.

Uniswap’s governance model is underpinned by decentralization, which is facilitated by the UNI token. The Uniswap project claims to be an ecosystem that houses wallets, an analytics platform, insurance, and even a Fei stablecoin specially built for decentralized finance platforms. Uniswap also enables lending and borrowing in crypto assets that allows returns without the need to sell the holding.

UNI is the governance token of the platform, which lets users of Uniswap vote on governance decisions. UNI was a top 25 crypto asset as of writing, and the use case of Uniswap in decentralized finance makes UNI a crypto to watch in the long term.

Bottom line

All cryptos are volatile. But in the longer run, cryptos with use cases may shine better than others. The above five have different use cases, and this makes them a close watch.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.