Highlights

- Terra’s fall in May can be said to be the trigger behind the troubles that have gripped the cryptoverse for the last six months

- Celsius and Voyager were two popular names to file for bankruptcy in July, with FTX and BlockFi joining the list in November

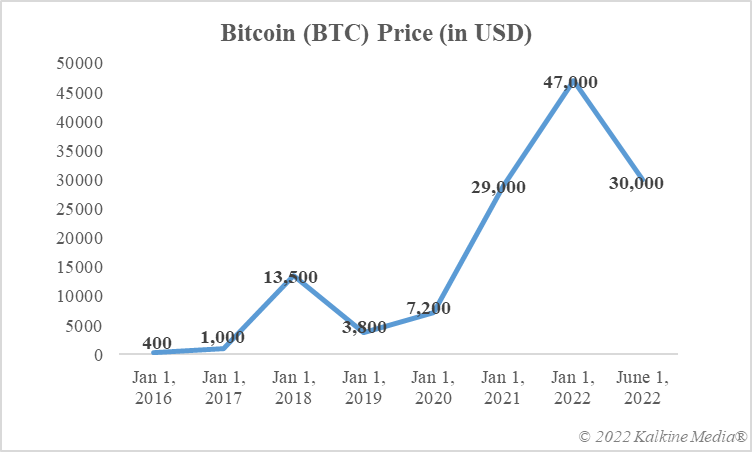

- The year 2022 has been a forgettable year for cryptocurrency enthusiasts with heavy losses endured by Bitcoin and altcoins

The year 2023 is just one month away. Amid year-end festivities and the busiest shopping time -- the Thanksgiving weekend -- the cryptoverse has been hit by another shock. BlockFi, a market participant in the cryptocurrency industry, is the latest name to have filed for bankruptcy. The ongoing year has been a very turbulent phase for the industry that gave spectacular returns to many of its backers last year.

Discussions around ‘bitcoin millionaires’ and ‘hold on for dear life (HODL)’ have faded away with backers now worried about which might be the next to bite the dust after BlockFi. This is because troubles that began with the collapse of the stablecoin project TerraUSD in early May seem to have become entrenched. Many big names have fallen from grace in the last few months, which underlines why cryptocurrency critics have so many reservations regarding these speculative assets.

Here are the top five crypto failures that created shockwaves in the industry in 2022.

1. TerraUSD (UST)

Terra was a broad project with its own blockchain protocol, a stablecoin (UST), and a native reserve token, LUNA. UST was pegged to the US dollar, similar to many other stablecoins that track the value of traditional assets. In early May, UST lost this peg, and the price of one token, which was expected to be US$1 at all times, dropped to almost zero. Billions of dollars were wiped out, and other major assets like Bitcoin also dipped in the aftermath due to negative sentiments.

2. Voyager

Voyager Digital, a listed entity in Toronto, declared bankruptcy amid a scene where a number of cryptocurrency intermediaries had halted withdrawals. Suspending withdrawals was the only way to prevent users from withdrawing their crypto holdings. Voyager cited issues with another big firm, 3AC, a Singapore hedge fund, which had also filed for Chapter 15 bankruptcy. In July, Voyager filed for Chapter 11 bankruptcy.

3. Celsius

Another major lender to take the bankruptcy route in the wake of plummeting crypto prices and users seeking withdrawals was Celsius Network. Celsius’ announcement came only a few days after Voyager’s. The firm cited ‘extreme’ market conditions as the reason behind the move. Most experts said that a sharp sell-off due to extremely adverse sentiments in the cryptoverse was responsible for players like Voyager, Vauld, and Celsius suspending withdrawals.

4. FTX

Things have not completely calmed down after the July announcements of Voyager and Celsius. This reflected in the dull price movement of the biggest cryptoassets, including Bitcoin and Ether. By November, another bad news hit the sector when one of the prominent exchanges, FTX, filed for Chapter 11 bankruptcy. There were allegations of fraud against the top management with many saying that investors’ funds were misused. FTX’s bankruptcy made global headlines.

Data provided by CoinMarketCap.com

5. BlockFi

If FTX fall was not enough, only a couple of weeks later, another big market participant, BlockFi, announced bankruptcy. The crypto lender cited ‘significant exposure’ to FTX as one of the reasons behind the extreme step. BlockFi suffered from a liquidity crisis, mainly due to its FTX exposure via loans to an FTX-related company, Alameda. There were reports that BlockFi also sued one company to recover its shares in Robinhood Markets Inc.

Viewpoint

Cryptocurrencies are risky not for one but for many reasons. The primary reason is that no major country, including the US, China, and Australia, favours the use of cryptos in payments. Many countries like Australia and the US allow their citizens to trade cryptos, but protections like FDIC insurance do not exist. A bankruptcy declared by any crypto intermediary exposes users to the risk of losing almost their entire holding. Would there be another shock by the year-end, or would the cryptoverse bounce back from its lows, is a wait-and-watch game.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.