Highlights

- There are growing calls for a better regulation of the cryptoverse after the failure of names like FTX

- In 2022, the space was first dealt a severe blow due to the crisis in the TerraUSD stablecoin, which immediately gripped all assets

- Bitcoin’s run was marred by a continuous decline in price, which contributed to a sharp dip in the cryptoverse’s overall market cap

Cryptocurrencies emerged as a formidable asset class in 2020 and 2021. Even though these blockchain-based virtual assets drew criticism for their supposed lack of utility, prices of Bitcoin and altcoins like Ether and Solana rose sharply. Since these have found more use as speculative assets, many prefer to use the term cryptoasset. How was the year 2022 for these cryptoassets? By any measure, the year was an extremely dull, forgettable phase for enthusiasts.

It was not just about a sharp drop in the prices of assets and the overall market cap of the cryptoverse but also some unexpected failures that dealt a blow to sentiment. Let us look back at the three significant developments in 2022 that rocked the cryptoverse. Is it possible that the cryptocurrency space can recover from its present lows?

1. Bitcoin’s steady decline

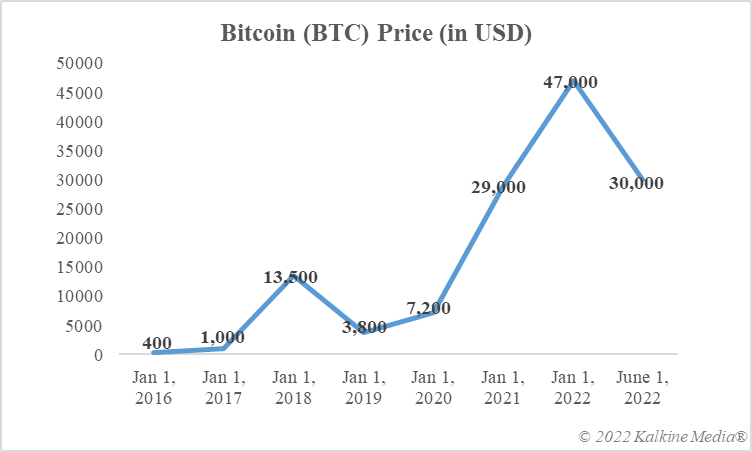

By late January, the price of Bitcoin had dropped under US$35,000. Compare this with a whopping price tag of over US$68,000 only a couple of months back. Except for a few short phases when Bitcoin gained value, much of 2022 was about a steady decline in value. Since Bitcoin is also the biggest contributor to the overall market cap of the cryptoverse, this figure dipped under US$1 trillion in 2022. Many would recall that the total market cap of cryptos topped US$3 trillion in 2021.

Bitcoin is often considered the most important cryptoasset, thanks to its global popularity. But the asset also has its share of criticism, much of which is directed toward the unpredictability of its value. In 2022, the value eventually dipped under US$20,000, a big negative moment for enthusiasts. That said, altcoins like Ether and Dogecoin also booked similar losses during the year.

Data provided by CoinMarketCap.com

2. Terra’s fall

Stablecoin is a sub-category within cryptocurrencies, with Tether’s USDT and Binance’s BUSD as two of the leading players. TerraUSD was also one of the top stablecoins until May 2022. Terra was a broad project with a native blockchain protocol and a token called LUNA. Similar to USDT and BUSD, TerraUSD was also pegged to the US dollar, with the project claiming that the price parity would be maintained at all times.

No one knows exactly what happened, but the TerraUSD token dropped from US$1 to a few cents in May, triggering widespread turmoil in the entire cryptoverse. Bitcoin is notorious for its price volatility, but stablecoins are expected to maintain their value on par with the assets they are pegged to. TerraUSD’s crash came as a reminder that nothing in the cryptoverse comes with a guarantee.

3. NFTs lost sheen

Non-fungible tokens, dubbed NFTs, became a powerful competitor to cryptocurrencies in 2021. Some names like Beeple, CryptoPunks, and BAYC and their related assets gathered huge fan following. Separately, projects like Axie Infinity and Decentraland, which also have native cryptocurrencies, launched NFT assets in digital avatars and virtual land. Some of these assets were sold for millions of dollars in auctions. The year 2022 was not very good for NFTs.

Banking on the success of earlier assets, popular celebrities like Madonna and big brands like Hot Wheels came out with their NFT collections. Companies like GameStop and LimeWire also took a plunge. However, the response in the market was lukewarm. Madonna’s NFTs were in collaboration with Beeple, but they failed to match the prices of Beeple’s earlier works.

Viewpoint

Cryptocurrencies and NFTs did not have a good run in 2022, with Bitcoin losing more than half its value and assets like Jack Dorsey’s tweet NFT failing to attract a high bid. Separate events like bankruptcy filings by FTX, Voyager and others also weighed heavily on the sector. 2023 could be a tough phase considering the fears of a global recession and persistent inflation that can spook investors into speculative assets.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.