Summary

- Platinum has registered the highest price since September 2014.

- The strong demand for white metal and supply disruptions has led the prices to hit new records.

- The prices are mainly driven by EV boom and stringent China VI regulations.

Followed by the emphatic industrial metals’ price rally on the expectations of global economic improvements, the prices of the Platinum contract hit ~US$1,291 an ounce on 15 February 2021, highest since September 2014.

The current platinum price rally is on account of much lower supply and bullish broader industry application prospects. The prices of the platinum are primarily dependent on the demand-supply laws rather than the investors' sentiments.

What is driving platinum's rally?

Source: Copyright © 2021 Kalkine Media Pty Ltd.

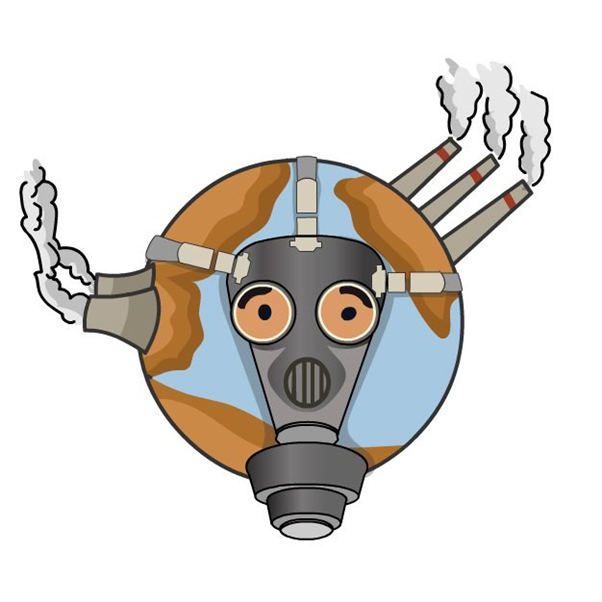

Recovery in industrial demand and the global shift towards clean energy to curb the carbon emissions compounded with the limited supply of precious metal has driven the platinum's rally.

The stringent China VI emission regulations on diesel engines to curb the particulate matter and global target to become carbon neutral by 2050 are creating extra pressure on the white metal supply.

Platinum plays a key role in the conversion of green hydrogen during the electrolysis process. A recent boom in hydrogen technology in the US and Europe is also pushing the precious metal’s demand.

Good Read: Gold Had A Terrific 2020; How Did Platinum Fare?

Source: Copyright © 2021 Kalkine Media Pty Ltd.

The electric vehicle euphoria worldwide primarily driven by Europe, the US and China has also helped the white metal prices. Despite the big halt in automobile manufacturing in 2020, the precious metal demand was just 3% down on y-o-y basis as per WPIC platinum quarterly Q3 2020.

How is the demand panning?

As per WPIC, the demand for the precious metal was slightly down by 5% in 2020 compared to 2019 due to coronavirus's global impact. A significant jump of 75% was noticed in demand during Q3 2020 while the supply was up 48%

WPIC forecasted a rise in demand for investment in bar and coins and around 24% annual growth in the automotive sector in 2021. China VI move had led to a 68% y-o-y rise in China platinum auto demand in Q3 2020. The car sales in China have increased by 30% y-o-y, notching a ten-month consecutive growth. A 22% fall in demand for autocatalyst for the metal has also been recorded due to a decline in diesel car production in Europe. The Chinese jewellery demand is expected to increase by 13% in 2021.

A Look at the supply side

As per Johnson Matthey's February report, the year 2020 has seen a platinum supply deficit of 390,000 ounces. Platinum's supply progressed towards the third consecutive supply deficit in 2021. The demand is expected to be 240,000 oz more than the supply in the current year.

The supply through primary suppliers has contracted by 20% due to COVID impacts and outages in Anglo American Platinum's converter plant. Power outages at South African mines have also contributed toward’ s the metal’s price rise.

.jpg)