Source: Marko Aliaksandr, Shutterstock

Summary

- Natural Gas Futures Prices doubled during the period of June 2020 till October 2020, making a series of higher highs and higher lows on the weekly chart.

- Natural Gas Futures prices are witnessing correction from the higher levels and fell more than 32 percent from the high made on February 17, 2021.

- Currently, the prices are trading around the trend line support level, where the 21-period simple moving average (SMA) also rests, acting as the major support for the commodity.

- As per the weekly data released by the US Energy Information Administration (EIA), working gas in underground storage fell by 11 Bfc for the week ending March 12, 2021.

NYMEX Natural Gas Futures (NYME: NGc1) traded in a sharp upward trend from the latter half of June 2020 till October 2020, makinig a series of higher highs and higher lows on the weekly chart. Prices doubled during the period and witnessed a robust gain of ~137 percent from the low of USD 1.432 per mmBtu to the high of USD 3.396 per mmBtu.

© Hoosierstu | Megapixl.com

In the past 5 months (November 2020 to March 2021), prices have been volatile and trading in the range of USD 2.238 per mmBtu to USD 3.316 per mmBtu. Currently, prices are under correction from the higher levels and fell more than 32 percent from the high of USD 3.316 per mmBtu made on February 17, 2021, to the recent low of USD 2.238 per mmBtu.

Natural Gas Futures Technical Analysis

Natural Gas futures prices are trading along an upward sloping trend line (orange color line in the below chart) for the past 10 months and took support thrice after testing the trend line. Currently, the prices are trading around the trend line support level of USD 2.360 per mmBtu where the 21-period simple moving average (SMA) also rests, acting as the major support for the commodity. Volume is showing a decreasing trend with the falling prices, indicating a lack of participation during the recent fall.

Source: Refinitiv, Thomson Reuters, Analysis: Kalkine Group

On the weekly chart, RSI is trading at ~48 levels indicating a neutral stance for the commodity. RIS reversed after testing the overbought zone in June 2020 and thereafter the momentum indicator cooled down. The prices are trading above the 50-period SMA (red color line in the above chart), acting as the major support for the stock, however, 21-period SMA (green color line in the above chart) is serving as the immediate resistance for the commodity. The trend-following indicator Parabolic SAR is also above the current market price, further indicating a negative stand for the commodity.

Currently, the prices are trading at crucial levels and either side move will decide the short-term trend for the commodity. A move on the upside from here might put the bulls in the driver’s seat and the momentum is expected to hold till the immediate resistance level of USD 3.000 followed by a major resistance level of USD 3.300. On the other hand, any decisive breakout below the USD 2.355 level may bring odds in favor of bears and see the price drift towards the support level of USD 1.795.

US Natural Gas Storage Data Analysis

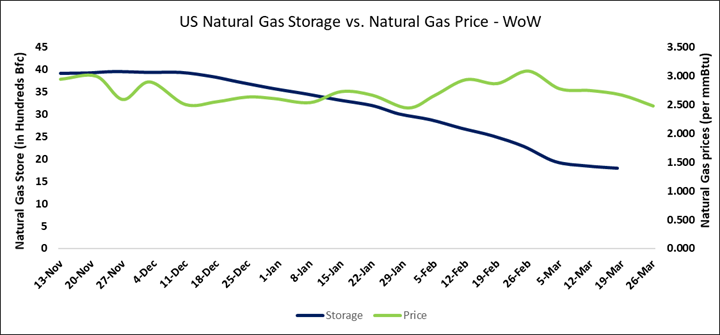

As per the weekly data released by the US Energy Information Administration on March 18, 2021, working gas in underground storage stands at 1,782 billion cubic feet (Bfc) compared to 1,793 Bfc in the prior week, a fall of 11 Bfc for the week ending March 12, 2021. The storage is down by 12.40 percent compared to a year ago and 5.00 percent below the 5-year average (2016-20). The following chart represents a comparative analysis of US Natural Gas storage and price action for the past 4 months.

Data Source: U.S. Energy Information Administration; Refinitiv, Thomson Reuters; Analysis: Kalkine Group

As per the above chart analysis, the working gas in underground storage has been decreasing continuously and fell over 50 percent as compared to October 30, 2020 and reached around its 2-year lows. Currently, the prices are in the correction phase and trading around the major support level. Any upside move from the current levels might end the correction phase of the commodity.

Natural Gas prices are in the correction phase; however, considering the recent price action, major support level, and the US working gas in underground storage data, the market participants would be closely monitoring the charts for cues. USD 2.350 level could be seen as a major support level.