Summary

- The Chinese economy is showing a strong rebound and an impeccable recovery with retail sales and other micro indicators showing signs of growth amid the suspension of the cross-provincial travel restrictions.

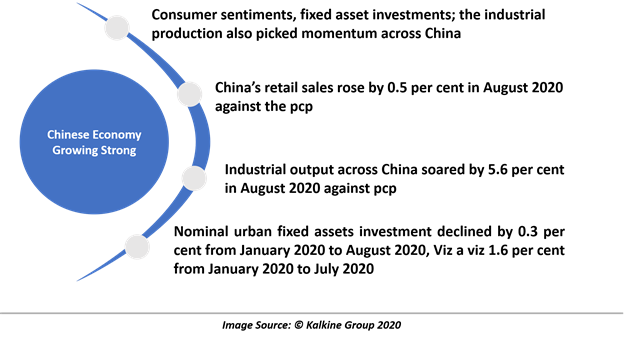

- Apart from a recovery in consumer sentiments, fixed asset investments; the industrial production also picked momentum across China, prompting the consumption of base metals.

- China’s retail sales rose by 0.5 per cent in August 2020 against the previous corresponding period.

- Nominal urban fixed asset investment observed a drastic improvement in August 2020.

- The industrial output across China soared by 5.6 per cent in August 2020 against pcp, marking the quickest growth since December 2019.

- In the wake of a robust economic recovery and a surge in the industrial output, the demand for resources across China has improved considerably in the recent past, turning attention towards Australian mining companies such as BHP Group Limited (ASX:BHP), Fortescue Metals Group Limited (ASX:FMG), which hold a strong customer base in China.

Despite challenging external conditions, the Chinese economy is gaining traction due to solid growth dynamics at home with retail sales and other micro indicators showing signs of growth with the suspension of the cross-provincial travel restrictions.

Furthermore, the investment activity across the country also improved in the recent past, reflecting on the strong development of both the traditional and new infrastructure projects.

Apart from a recovery in consumer sentiments, fixed assets investments; the industrial production also picked momentum across China, prompting the consumption of base metals.

However, despite all the recovery, the red dragons still face a risk as the pandemic-led damage across major trading partners is still deep.

China Economic Figures and Growth Stimulus

Consumer Sentiments Recover

China’s retail sales rose by 0.5 per cent in August 2020 against the previous corresponding period. Also, the retail sales witnessed an improvement over the previous month of July, when the retail sales declined by 1.1 per cent against pcp.

- The increase in retail sales in August marks a strong gain since the COVID-19 outbreak, beating flat reading expectation of the market.

- On a monthly basis, retail sales witnessed an increase of 1.2 per cent (on a seasonally-adjusted basis), marking an improvement over the expansion of 0.6 per cent observed in July 2020.

The rebound in retail sales further reflected on the underlying strength of the Chinese economy.

Fixed Assets Investment Declines Restrained

Nominal urban fixed assets investment declined by 0.3 per cent from January 2020 to August 2020, observing a drastic improvement from a decline of 1.6 per cent from January 2020 to July 2020 or during the first seven months of the year 2020.

- On a monthly basis, the nominal urban fixed assets investments surged by 4.2 per cent in August 2020 (on a seasonally adjusted basis).

The improvement in the fixed assets investment further reflected upon an upturn in the tertiary sector along with an upturn in the subsectors of the primary and secondary sectors.

Industrial Output Posting the Quickest Growth Since COVID-19 Outbreak

The industrial output across China soared by 5.6 per cent in August 2020 against pcp, marking the quickest growth since December 2019.

- The recovery witnessed in the industrial output in August remained above the growth of 4.8 per cent seen in July 2020 against pcp, and the details suggested that the manufacturing output remained steady in August 2020, energy sector gained steam, and the mining sector posted a strong rebound.

- On a monthly basis, the industrial output increased by a unit per cent (on a seasonally-adjusted basis) in August, remaining in line with the previous month.

Moreover, the trend of the industrial output improved slightly with the annual average reaching 1.6 per cent in August 2020 as compared to the previous average of 1.5 per cent in July 2020.

Steel Production and Consumption Growth

The domestic steel production and consumption, which is one of the strongest readings on the Chinese economy, is currently robust with the steel production in China reaching 94.8 million tonnes in August 2020, marking an increase of 8.4 per cent against pcp.

- On a monthly basis, domestic steel production in China increased slightly in August as compared to the previous month when the total monthly production reached 93.4 million tonnes.

After witnessing a deep plunge in both the production and consumption, the steel industry recovered substantially since the onset of the second quarter of the year 2020.

To Know More, Do Read: China Poised to Grab the Global Steel Trade as Economies Open up for Trade

Australian Miners To Gain Focus?

In the wake of a robust economic recovery and a surge in the industrial output, the demand for resources across China has improved considerably in the recent past, especially for base metals like copper and steelmaking raw materials such as iron ore and metallurgical coal.

The spike in demand for such resources might now turn attention towards Australian mining companies as some of them such as BHP Group Limited (ASX:BHP), Fortescue Metals Group Limited (ASX:FMG) hold a strong customer base in China.

Furthermore, there are many copper mining companies coming in the radar of the global investing community with the recent strong recovery demonstrated by the commodity amid strong demand from China.

To Know More, Do Read: Copper Rush Drawing Australian Titans; Australia To Climb the Supply Ladder?

Apart from copper miners, the local iron ore miners are also expected by the market to remain in the focus of the global investing community.

In the recent past, China has improved its quality measures check, and Australian miners have been very optimistic over the same with BHP even suggesting that the improved quality check would eventually build a strong business for the Company.

To Know More, Do Read: Iron Ore Resurgence And Improved Rating For ASX Miners, Goldman Upgrades BHP Shares

However, while the market perspective around Australian mining companies looks optimistic, as inferred from a recent recovery in the share price of many base metals and iron ore miners, considerable risks are still looming.

One major risk is related to the recent halt in the copper rally. Copper prices have climbed the price ladder swiftly in the recent past over improved demand and supply lags; however, with the onset of June 2020 quarter, many major mining operations across the globe have restarted with some even reaching full capacity, which could leave a dent in the copper price over the short-run.

The Australian copper or base metals miners have just woken up from hibernation over a considerable rally in the gold and copper price, and any setback could put pressure on such miners.

The intensity of the competition over capturing the Chinese market amid improved demand for resources in China might depend on the ability of Australian miners and their global peers to sustain any low-cost environment.

To Know More, Do Read: Copper Rally Halts– A Potential Casualty Over Supply Chain Restoration