Highlights

- BHP Group Limited (ASX:BHP) released its third-quarter results on Thursday.

- The mining giant’s energy coal production during the quarter tumbled 13% relative to the December 2021 quarter.

- Looking forward, the Company is well guided to attain its full-year iron ore production and cost guidance.

Australian mining giant BHP Group Limited (ASX:BHP) on Thursday released its third-quarter results, depicting a significant drop in output across the board. BHP anticipates that skills shortages and overall labour market tightness in Australia and Chile will continue in 2023.

BHP’s results come a day after Whitehaven Coal Limited (ASX:WHC), a leading producer of premium-quality coal, also blamed a tight labour market as one of the key reasons for its lower coal sales.

The crippling labour market has become one of the major challenges in Australia. The availability of skilled labours has shrunk since the commencement of the pandemic due to a lack of migration and workers returning to their country of origin.

Though the number of coronavirus cases has declined, its long-lasting impacts are still affecting various businesses across the globe.

Also Read: RIO, BHP and FMG: ASX miners in focus as iron ore hits 1-month high

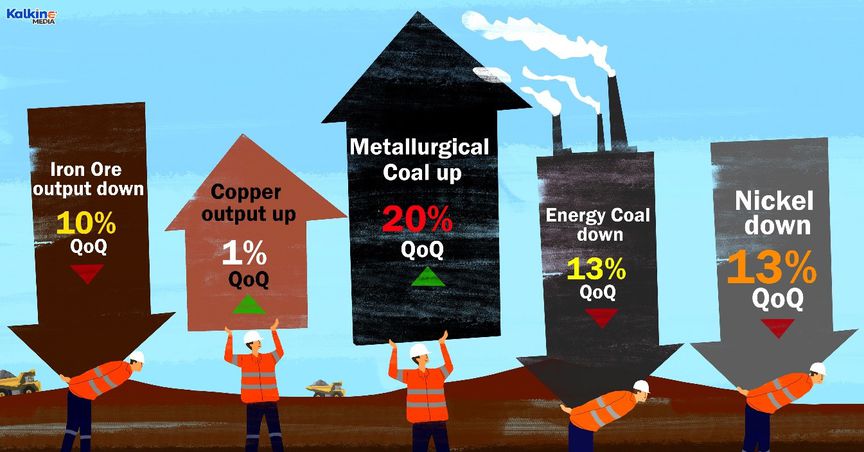

Source: © 2022 Kalkine Media® | Data Source: BHP Announcement 21/04/22

Crippling labour market dented BHP’s Q3 production

BHP’s gross iron ore and nickel production during the third quarter tumbled nearly 10% and 13%, respectively, relative to the last quarter. The mining giant blamed the decline in production on temporary labour constraints and workforce shortage amid COVID-19 restrictions.

BHP’s energy coal production during the quarter also tumbled 13% when compared to the previous quarter ending December 2021, due to continued wet weather and COVID-19-related labour constraints.

Besides this, BHP’s struggle for copper production during the quarter was not only due to labour shortages. A planned smelter maintenance campaign also played a role in squeezing the output, but the miner managed to ramp up the production later and logged a marginal gain of 1% on the last quarter's production figures.

Must Watch: A positive start for the ASX | BHP’s copper production down

Metallurgical coal was the only commodity division where the miner logged a significant production gain of 20% during the period vs the December 2021 quarter, thanks to lower rainfall and strong operational performances.

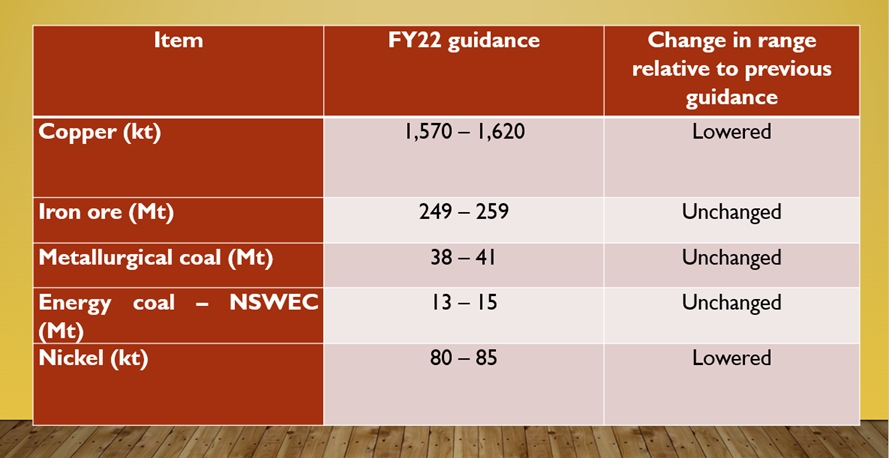

FY22 Guidance

Looking forward, the Company seem to be well guided to attain its full-year iron ore production and cost guidance as it navigates effectively from the major COVID-19 wave.

In copper, the Olympic Dam smelter is performing strongly, and production at the Spence copper mine is ramping up, enough to offset the production affected at the Escondida mine by impacts from COVID-19 and public road blockades in Antofagasta.

Source: © 2022 Kalkine Media® | Data Source: Company announcement (21 April 2022)

The Company’s Jansen potash project is on track with good progress on the shafts in the underground mining systems. Furthermore, the merger of BHP’s petroleum assets with Woodside has progressed and is set for completion in June 2022.

Also Read: Why is ASX-listed BHP gaining attention today?

Bottom Line

Australia’s BHP Group has logged a significant decline in its Q3 iron ore, coal, and nickel production due to a tight labour market, COVID-related absenteeism, and wet weather events. However, the Company is committed to achieving its FY22 guidance.