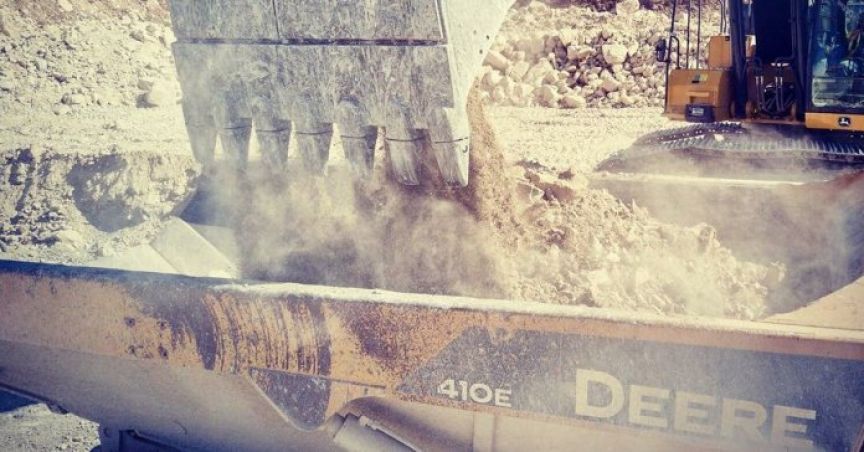

Blackham Resources confirmed the new high-grade mineralisation at Williamson gold deposit located 18km south of Blackhamâs Wiluna gold plant. It undertook the drilling activities from December 2018 to February 2019, comprising 46 Reverse Circulation holes and 9 Diamond Drilling holes aimed at confirming resources and testing for extensions of the cutback pit design.

Perth-based gold miner, Blackham Resources Limited (ASX:BLK), stated that mineralisation appears to be widening at depth and is significantly wider than original resource interpretation. This confirms the mineralisation over a strike length of 1km and up to the depth of 250m with the potential for significantly extended mine strike length.

Blackhamâs exploration strategy is designed to strengthen and lengthen the free-milling mine life by progressively converting the large free-milling 1.3Moz Resource base, 22.8Mt @ 1.76g/t, to Reserves. The company stated that mining economics should improve through the earlier access to ore in the southern extensions without the significant waste stripping.

The assay results pertain to the first 39 holes as the remaining assays are due to be received by the company. Williamson is a wide, bulk tonnage free-milling orebody hosted in a stock-worked monzogranite. Its pit cutback is scheduled to be mined from August 2019.

Going forward, the company plans to take further reserve definition drilling to follow up mineralisation that appears to improve in tenor at depth and to test additional targets further along strike. Further, it is expected that the resource model and mine design will reportedly be updated by March and April, respectively.

Recently, Blackham Resources has upgraded its hedge book to capitalise on the strength in the Australian Dollar gold price by hedging an additional 20,000 ounces of gold production at a forward price of A$1,836/oz.

The company told that the revised gold forward sales contract position is for the delivery of 38,123oz at an average price of A$1,773/oz over the next 10 months. This allows Blackham to secure price protection for approximately six months of gold production.

Blackham also forwarded the progress on Lake Way as announced by Salt Lake Potash on Wednesday. ASX listed miner, Salt Lake Potash Limited flagged the commencement of Lake Way Evaporation Pondsâ construction following the receipt of the final approval from the Department of Water and Environmental Regulation (DWER).

The northern end of the Lake is primarily covered by a number of Mining Leases, held by Blackham Resources Limited. As per the report, the construction and operation of the First Phase of Lake Way Evaporation Ponds at Wiluna, Western Australia has begun, which is positioned as the first Commercial Scale on-lake Sulphate of Potash (SOP) evaporation ponds in Australia.

In todayâs trading session, BLK stock price slipped by 3.571% to last trade at $0.027 on 7 March 2019. Over the past 12 months, the stock has witnessed a negative performance change of 47.17% including a plunge of 33.33% in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.