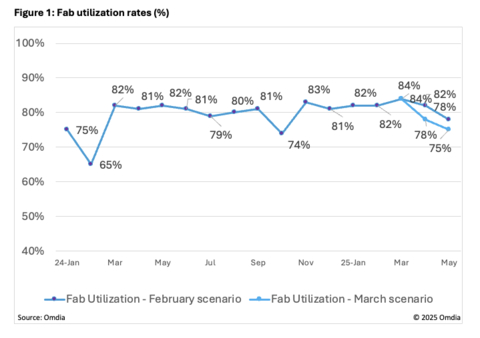

According to the latest report from Omdia’s Large Area Display Production Strategy Tracker, display panel makers maintained a fab utilization above 80% in 1Q25 but are expected to reduce utilization in 2Q25. As the pull-in demand for 1Q25 winds down at the start of 2Q25, set makers are adopting a more conservative approach to panel purchases.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250402228909/en/

Fab utilization rates (%)

Uncertainty surrounding the new U.S. tariffs on display application products including TVs, PCs and smartphones, combined with reduced panel orders from brands and OEMs, is prompting panel makers to scale back capacity utilization. Omdia predicts utilization will drop below 80% in April 2025 and further to 76% in May 2025.

Since 4Q24, panel makers have operated fabs at high utilization levels of 81%-83% driven in part by China’s “swap old for new” subsidy program which has boosted demand for LCD TV panels. Chinese TV manufacturers have accelerated production and shipments to the U.S. to mitigate tariff risks, pushing demand higher in early 2025, particularly for 75 inches and larger LCD TV panels.

However, concerns over new potential U.S. tariffs starting in April and uncertainties in display panel demand have led to PC and TV set makers reduce their panel inventory purchases. Some have already reduced their panel orders for 2Q25. In Omdia’s February 2025 outlook, April utilization was expected to be 82% and May at 78%. However, with some China TFT LCD makers planning extended breaks for the May Labor Day holiday utilization could fall further to around 75% in May.

“With demand slowing and uncertainty around tariff impact, panel makers are shifting from their original high capacity utilization mode back to the production-to-order mode,” said David Hsieh, Senior Director for Display research in Omdia. “This strategy should help stabilize panel prices amid weakening demand. . However, since panel prices have remained elevated over the past six months, TV and PC brands and OEMs may push for further price reductions to offset U.S. tariffs.

Hsieh added, “The display market is entering into a new cycle and will likely stabilize later in 2025. Tariffs and their impact on display demand will be the biggest swing factor in this transition.”

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250402228909/en/

![]()