Highlights

- Self-managed super funds (SMSF) are super funds that members manage on their own. Besides, members are trustees of the fund.

- Anybody aged 18 and above can become a member or a trustee of the SMSF. However, they should not be under any legal disability.

- Funds in the superannuation account grow ideally without any tax implications until retirement or withdrawal.

Self-managed super funds (SMSFs) are gaining massive attraction globally. The demand for such funds has been on the rise for years. So, for the people who are new to this journey, let’s decode all the basics of SMSFs and open the doors to save, invest and grow your finances for the future in a unique way!

To understand self-managed super funds, let’s first glance at what are “super funds”?

Super funds are made under a superannuation pension program set by an organisation for the long-term benefits of its employees. Funds in the superannuation account grow ideally without any tax implications until retirement or withdrawal. Additionally, there are several types of super funds and different types of accounts for the same, and one of the types is self-managed super funds.

©2022 Kalkine Media®

GOOD READ: Three technical indicators to help gauge market volatility

What exactly are SMSFs?

As the name suggests, self-managed super funds are super funds that members manage on their own. Additionally, under this, members are also the trustees of the fund. In Australia, a self-managed super fund can have up to six members. These members create a superannuation account and add funds into the account for their retirement and future plans.

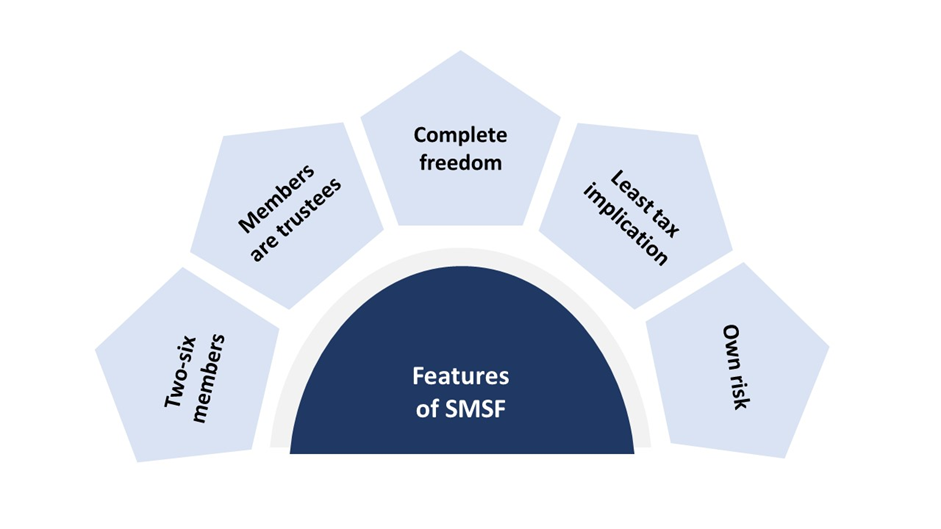

Features of SMSF

Source: © 2022 Kalkine Media®

Who can become SMSF holders or investors?

Anybody aged 18 and above can become a member or a trustee of the SMSF. However, they should not be under any legal disability. Any SMSF needs at least two trustees. The members' primary responsibility is to control and manage the funds and comply with the legal regulations. Each member is a trustee and vice versa. No member can be an employee of the other member unless they are relatives.

So, the superannuation market is exponentially expanding across Australia. Why exactly people are getting into Self-managed super funds? -Let’s find out!

GOOD SECTION: 5 must-read crypto trading tips for beginners

What are the benefits of self-managed super funds?

Tax benefits: Like other industry super funds, SMSF comes with tax benefits. The taxes implied on SMSFs are much lower than the usual taxes people pay on their earned income.

Control over the funds: One of the most crucial benefits of SMSFs is that one can control the funds entirely. Wherever they want to invest, whether, in residential property, rare assets, or including family members, they have the freedom to deal with the funds.

What to do if your Superannuation Fund fails Apra Test?

However, there are always two sides to the coin; thus, investing in self-managed super funds has cons as well. - Let’s look at the risks involved!

Strict compliance: Members of the SMSF have to strictly comply with the rules and regulations set by the state. In case of breach of any law, heavy fines are imposed on the members.

Own risk: When people invest independently, they have to bear the entire risk solely. Thus, if they don’t have optimum investment experience, they can lose the funds in any lousy investment decision.

ALSO READ: How to make most out of capital gain tax exemptions

All in all, SMSFs could be the right choice for people who think they have sufficient investment information, enough time to manage funds, and bear the legal expertise and a large super balance.