Highlights

- As inflation reaches unpalatable highs, small businesses stand at the risk of losing out on consumers.

- Businesses can develop resilience against rising inflation by building higher pricing power and reducing unnecessary expenditures.

- Businesses can also look for investment options that help reduce the inflation risk.

Inflation is a dreaded economic scenario that has quickly garnered the headlines as the world moves on from the pandemic. Rising prices, unaffordable housing and soaring petrol prices have become a painful reality for most people across the world. However, there is no escaping the fact that inflation hurts certain sections of people more intensely than others.

One such sector that is highly vulnerable to rising inflation is the small business industry. Unlike well-established large corporations, most small businesses stand at the risk of facing the worst economic adversities in a highly inflationary environment. They often lose out on customers, find it hard to manage rising costs and are unable to fulfil orders when living costs rise.

Higher prices of goods and services majorly increase production costs for small businesses as the cost of raw materials surges. In the current scenario, inflationary pressures have stemmed mostly from global factors. A faltering global supply chain is the most crucial aspect that has driven an increase in inflation.

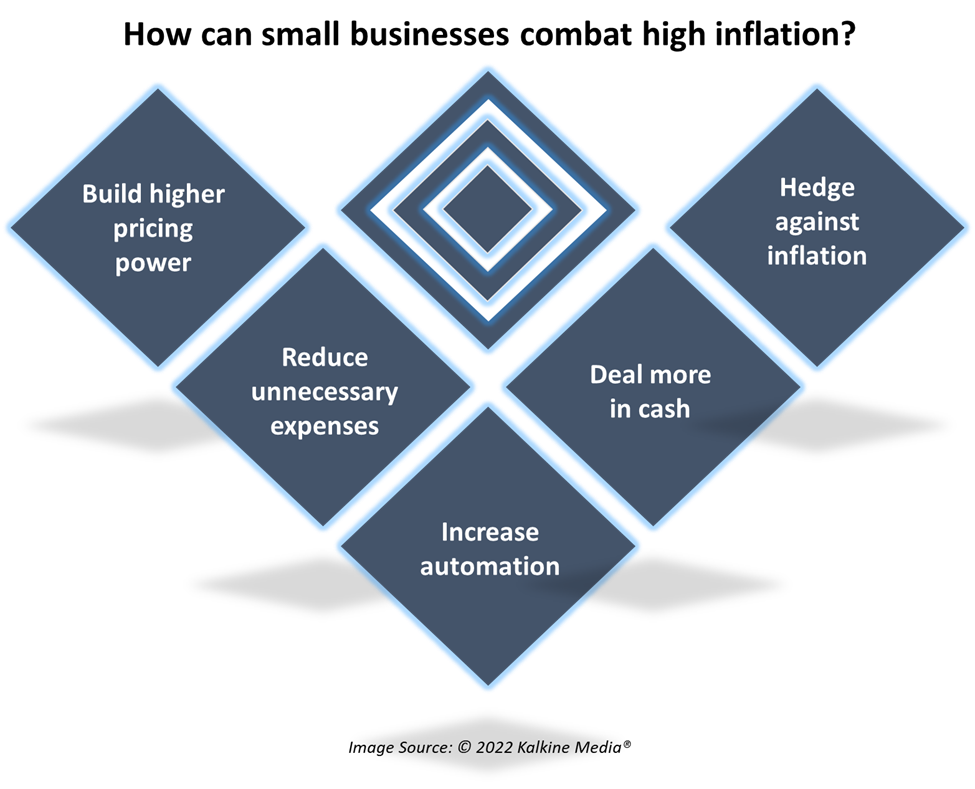

Let us now look at five ways through which small businesses can combat high inflation:

ALSO READ: Do you know about Warren Buffett's dream investment? It's a small candy company

Build higher pricing power

Essentially, pricing power refers to the elasticity of demand, or how the quantity demanded for a product changes with respect to the change in its price. Small businesses can develop a higher pricing power by offering essential services and goods.

These goods continue to remain in demand even when their prices are high as they are essential for daily survival. Alternatively, luxury goods also carry high pricing power as they have few alternatives. However, in an inflationary scenario, consumers may demand essential services more than luxury goods. Thus, small businesses can develop a strong inventory of essential goods and target less price-sensitive customers.

Reduce unnecessary expenses

Another way to tackle the rising prices of goods and services is to reduce unnecessary expenses. This includes downsizing the office and developing a more flexible approach to conducting business. In case of increasing operational costs, businesses can choose to function in a remote setup. This can help them save up on rental costs and electricity costs.

Also, it is a good idea to regularly review all the costs of the company and determine whether they are necessary or not. The items and services that are not being used can be removed from the balance sheets.

ALSO READ: How rebalancing an investment portfolio can help in uncertain times

Increase automation

A crucial method of saving costs is optimising the production and distribution processes. This can be achieved through automation, which essentially saves the cost of labour. Businesses can minimise accounting costs by using appropriate software that can quickly cover the production and distribution process in an error-free manner.

Small businesses can also make use of free online tools in the distribution process, which can help reduce billing costs and the time needed to collect payments and take surveys from customers. Overall, streamlining the workflow can help avoid any unnecessary costs.

A ‘polar surge’ for Australia as we see an abrupt start to Winter - Trending News Australia

Deal more in cash

During inflationary scenarios, dealing with credit can be tricky as the value of money dissolves quickly amid high inflation. On the other hand, making payments in cash can help expedite business processes, allowing owners to easily transfer cash across various stages of production and distribution.

Another aspect is saving enough cash in the account for future requirements. Whenever possible, businesses can prioritise paying in other forms, such as online payments. This would help ensure that more cash goes into the bank account instead of being spent. The longer a payment is due, the more value it loses in an inflationary environment.

Hedge against inflation

Just as the rule goes for individuals, businesses can also hedge against inflation to curb their losses. Investing in inflation-proof investments can help mitigate losses caused by inflation. These investments include gold, real estate, and inflation-proof bonds.

Other types of investments include using financial instruments like options and futures and trading in commodities. However, all these instruments are risky and should only be invested in with thorough knowledge. For those already with an investment portfolio, diversification is a good way to mitigate financial losses from elevated inflation.

ALSO READ: Five investing mantras to help you tame bear market like a boss