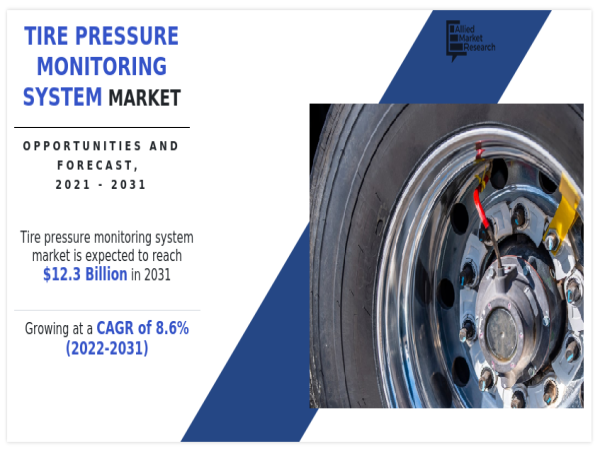

Tire pressure monitoring system market to grow at 8.6% CAGR by 2031—Allied Market Research

WILMINGTON, DELAWARE, UNITED STATES, September 22, 2023/EINPresswire.com/ -- The tire pressure monitoring system market size was valued at $5.3 billion in 2021, and is estimated to reach $12.3 billion by 2031, growing at a CAGR of 8.6% from 2022 to 2031.

Based on type, the Direct Tire Pressure Monitoring System segment held the largest market share in 2021, holding more than four-fifths of the global market, and is expected to maintain its leadership status during the forecast period. In addition, the same segment is expected to cite the fastest CAGR of 9.0% during the forecast period. The market also analyses other segments such as the Indirect Tire Pressure Monitoring System.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭@ https://www.alliedmarketresearch.com/tire-pressure-monitoring-system-market/purchase-options

Based on sales channel, the OEM segment held the largest tire pressure monitoring system market share in 2021, holding nearly 90% of the global market, and is expected to maintain its leadership status during the forecast period. The aftermarket segment, on the other hand, is expected to cite the fastest CAGR of 11.8% during the forecast period.

Based on vehicle type, the passenger vehicles segment held the largest market share in 2021, holding nearly three-fifths of the global market, and is expected to maintain its leadership status during the forecast period. The heavy commercial vehicles segment, on the other hand, is expected to cite the fastest CAGR of 9.3% during the forecast period.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬- https://www.alliedmarketresearch.com/request-sample/7531

Based on region, the market across Europe held the dominating tire pressure monitoring system industry share in 2021, holding more than one-third of the global market, and is expected to maintain its leadership status during the forecast period. In addition, the same segment is expected to cite the fastest CAGR of 9.5% during the forecast period. The report also includes regions such as North America, Asia-Pacific, and LAMEA.

The key players analyzed in the global tire pressure monitoring system market report include Continental AG, Delphi Technologies (BorgWarner Inc.), Denso Corporation, Hamaton Automotive Technology Co., Ltd., Hampton Auto Repair, Hitachi Astemo, Ltd., Huf Hülsbeck & Fürst GmbH & Co. KG, InnotechRV (WiPath Communications LLC.), NIRA Dynamics AB. Orange Electronic Co., Ltd., Pacific Industrial Co. Ltd., Renesas Electronics Corporation, Robert Bosch GmbH, Sensata Technologies Inc., The Goodyear Tire & Rubber Company, Valeo, and ZF Friedrichshafen AG.

𝐌𝐚𝐤𝐞 𝐚𝐧 𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠- https://www.alliedmarketresearch.com/purchase-enquiry/7531

The report analyzes these key players in the global tire pressure monitoring system market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance and operating segments by prominent players in the market.

David Correa

Allied Analytics LLP

+1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn