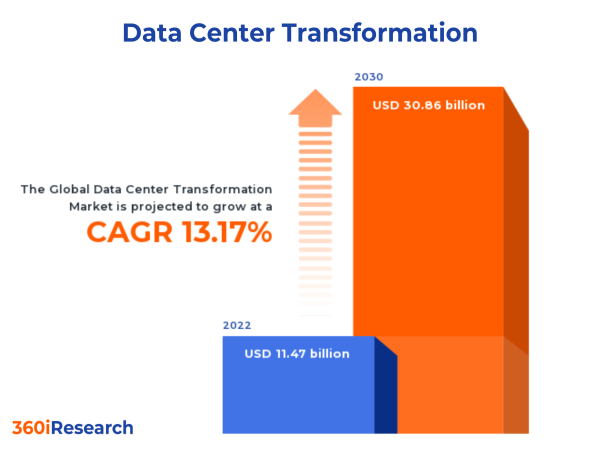

The Global Data Center Transformation Market to grow from USD 11.47 billion in 2022 to USD 30.86 billion by 2030, at a CAGR of 13.17%.

PUNE, MAHARASHTRA, INDIA , November 10, 2023 /EINPresswire.com/ -- The "Data Center Transformation Market by Offering (Services, Software), Tier Type (Tier 1, Tier 2, Tier 3), Data Center Size, Vertical, End-User - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Data Center Transformation Market to grow from USD 11.47 billion in 2022 to USD 30.86 billion by 2030, at a CAGR of 13.17%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/data-center-transformation?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The data center transformation market encompasses various services, technologies, and solutions to modernize and enhance data centers' efficiency, agility, security, and performance. This market serves IT and telecom, banking, financial services and insurance (BFSI), healthcare, retail & eCommerce, and government & defense organizations. Increasing data center traffic due to rising communication devices and enterprises using SaaS-based applications encourages a trend of shifting to cloud services from client to server, driving market growth. In addition, growing expenditure on data center technologies has led organizations to adopt virtualization techniques for cost-effective operational expenses and flexibility solutions. High upfront costs of modernizing existing infrastructures deter smaller businesses from adopting data center transformations. Issues pertinent to security and privacy can hinder the seamless implementation of new technologies and methodologies. Innovations and research areas within the data center transformation technologies and relocation or consolidation of data centers across different platforms for better resource utilization create significant growth opportunities.

Tier Type: Wider adoption Tier-3 or Tier-4 data centers for large enterprises

Tier 1 data centers offer basic functionality with a 99.671% uptime, suitable for small businesses or startups due to lower costs and simplicity. Tier 2 data centers provide higher redundancy with approximately 99.741% uptime, featuring redundant power supply components to protect against equipment failures. This tier serves medium-sized businesses seeking a balance between affordability and reliability. Large enterprises requiring high availability and redundancy opt for Tier 3 data centers offering at least 99.982% uptime. These facilities ensure high fault tolerance levels and have dual-powered equipment and multiple distribution paths for power and cooling systems. Tier 5 is an emerging concept that provides next-generation data center solutions with enhanced security features, sustainability measures, and modularity for rapid scalability. Choosing the appropriate tier largely depends on cost efficiency, redundancy levels, and infrastructure capabilities suited to an organization's specific requirements. Small-to-medium businesses can rely on the cost-effectiveness offered by Tier-1 or Tier-2 facilities without heavy compromise on uptime, while large enterprises may opt for Tier-3 or Tier-4 when better guarantees are crucial.

End-User: Increasing implementation by cloud service providers large-scale deployment

Cloud service providers (CSPs) necessitate scalable, high-performance data centers with global connectivity to support diverse workloads. Colocation providers concentrate on delivering secure data center space with redundant power and cooling systems at competitive prices. Enterprises seek tailored data center transformation solutions that address specific business needs such as cost savings, enhanced performance, improved security, and regulatory compliance. Recognizing the preferences and priorities of each end-user segment is vital for evaluating opportunities in the data center transformation market. Recent developments demonstrate that all segments adopt innovative technologies to enhance efficiency while addressing dynamic demands in an ever-changing digital environment.

Offering: Growing demand for consolidation services to reduce costs and complexity

Data center transformation services play a crucial role in optimizing the overall performance, scalability, and efficiency of enterprises' IT infrastructure. These services include automation, consolidation, infrastructure management, and optimization services. Automation services enhance operational efficiency by automating repetitive tasks, reducing human error, and expediting processes in data centers. Consolidation services facilitate the merging of existing IT resources into more efficient systems that require less physical space and maintenance. Businesses aiming to reduce costs, lower their carbon footprint, or simplify their IT environment should consider these services. Infrastructure management services encompass the monitoring, maintaining, and optimizing data center hardware and software components. Optimization services concentrate on boosting overall data center efficiency through optimized resource utilization via improved hardware and software configurations. Consolidation services reduce costs and complexity; infrastructure management services improve performance and uptime, and optimization services maximize resource utilization. Software plays an equally important role in data center transformation by providing essential tools for monitoring, managing, analyzing, and securing various components within the IT infrastructure.

Vertical: Rising utilization across manufacturing industries for complex supply chain management

The BFSI sector demands reliable and secure data center infrastructure to support the increasing digitization of financial services driven by fintech innovations, rising online transactions, and stringent regulatory compliance requirements. Data center transformation in the energy sector focuses on managing large-scale simulations and real-time analytics for smart grid systems that improve power generation, distribution efficiency, and sustainability. Governments worldwide prioritize secure and resilient data center infrastructures to store sensitive information and maintain national security-related applications. Data center transformation is essential in the healthcare sector as it plays a crucial role in managing electronic health records (EHR) and meeting the escalating storage demands of telemedicine services, which are experiencing exponential growth due to the increased usage of IoT devices. IT and telecom rely heavily on data centers for managing vast amounts of data from mobile communication, internet usage, and cloud services. Manufacturing industries require efficient data centers to handle complex supply chain management systems, IoT-enabled devices, and real-time analytics for Industry 4.0 implementation. Retailers invest in transforming their data center infrastructures to enhance customer experience using AI-driven personalization solutions while supporting eCommerce operations growth. Data center transformation plays a vital role in transportation by facilitating passenger information systems management, fleet tracking systems optimization, and traffic monitoring network improvement efforts.

Data Center Size: Expanding acceptance of small data centers by small businesses, as affordable option

Large data centers cater to enterprises with substantial storage requirements, prioritizing redundancy, security, and energy efficiency. They typically have a floor space of more than 50,000 square feet and require high-capacity cooling systems, power supplies, and connectivity solutions to manage the massive volume of data traffic generated by enterprises or hyperscale cloud providers. Mid-sized data centers generally range between 5,000 to 50,000 square feet in floor space and are designed to cater to the needs of medium-sized businesses or regional offices of large corporations. They serve small-to-medium enterprises (SMEs) by balancing capacity with cost-effectiveness. Small data centers typically have less than 5,000 square feet of floor space and cater to small businesses or startups that require limited infrastructure support. Small data centers target organizations with limited requirements while ensuring affordability without compromising key features such as security, redundancy, and scalability. Large enterprises benefit from the vast capacity provided by large facilities; SMEs can capitalize on cost-effective solutions offered by mid-sized establishments; small businesses have access to affordable options through smaller-sized facilities tailored to their specific requirements. Manufacturers or providers continue innovating within each segment, improving efficiency, reliability, and scalability to meet the increasing demand for data storage and processing abilities.

Regional Insights:

In the Americas, North America constitutes the most significant share of the data center transformation market due to the widespread adoption of cloud computing, advanced IT infrastructure, and the presence of major data center technology providers. The United States leads in demand for data center transformation services owing to growing awareness about energy efficiency among enterprises and increasing investments in green data centers. South America is also experiencing growth owing to rising internet penetration rates and governments' efforts to develop digital economies in Brazil, Mexico, and Argentina. Europe experiences considerable market growth due to its well-established IT infrastructure network and stringent environmental regulations encouraging data center modernization initiatives. Countries such as Germany, the UK, France, and the Netherlands contribute significantly towards regional growth through increased adoption of advanced technologies such as AI-driven automation and IoT-based monitoring systems. Middle Eastern countries are also witnessing an upsurge in demand for data center transformation services driven by initiatives to transform city-wide IT infrastructure by leveraging cutting-edge digital solutions. Africa is also witnessing a growing demand for efficient data centers due largely to increasing Information and communications technology (ICT) adoption rates across industries. The Asia-Pacific region has emerged as a rapidly growing data center transformation market, primarily driven by factors such as booming digital economies, favorable government policies, and accelerated adoption of cloud services. Countries such as China, India, Japan, and Australia are at the forefront of driving regional demand with substantial investments in data center infrastructure development projects. The rapid adoption of technologies such as 5G and IoT across various industries is expected to further fuel DCT demand in APAC over the coming years.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Data Center Transformation Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Data Center Transformation Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Data Center Transformation Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Accenture PLC, AdaniConneX by Adani Group, Alibaba Group Holding Limited, Arista Networks, Inc., Atos SE, BMC Software, Inc., Bytes Technology Group PLC, Capgemini SE, Cisco Systems, Inc., Cognizant Technology Solutions Corporation, Criticalcase Srl, Dell Technologies Inc., DXC Technology Company, DynTek, Inc., e-Zest Solutions, Eaton Corporation PLC, Emerson Electric Co., Equinix, Inc., exIT Technologies, Fujitsu Limited, General Datatech, L.P., Google LLC by Alphabet Inc., HCL Technologies Limited, Hewlett Packard Enterprise Development LP, Hitachi, Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., InknowTech Pvt. Ltd., Intel Corporation, International Business Machines Corporation, Johnson Controls International PLC, Juniper Networks, Inc., Lenovo Group Limited, Lunavi, Inc., Mantis Innovation Group, LLC, MetalSoft Cloud Inc., Micro Focus International Limited by OpenText Corporation, Microsoft Corporation, Mindteck, NetApp, Inc., Nippon Telegraph and Telephone Corporation, Oracle Corporation, Redwood Software, Inc., SAP SE, Schneider Electric SE, Siemens AG, Sunbird Software, Inc., Tech Mahindra Limited, Tencent Holdings Ltd., VMware, Inc., and Wipro Limited.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/data-center-transformation?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Data Center Transformation Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Services and Software. The Services is further studied across Automation Services, Consolidation Services, Infrastructure Management Services, and Optimization Services. The Services commanded largest market share of 82.43% in 2022, followed by Software.

Based on Tier Type, market is studied across Tier 1, Tier 2, Tier 3, Tier 4, and Tier 5. The Tier 2 commanded largest market share of 32.12% in 2022, followed by Tier 1.

Based on Data Center Size, market is studied across Large Data Centers, Midsized Data Centers, and Small Data Centers. The Large Data Centers commanded largest market share of 42.54% in 2022, followed by Midsized Data Centers.

Based on Vertical, market is studied across Banking, Financial Services, & Insurance, Energy, Government & Defense, Healthcare, IT & Telecom, Manufacturing, Retail & Consumer Goods, and Transportation. The Banking, Financial Services, & Insurance commanded largest market share of 26.95% in 2022, followed by IT & Telecom.

Based on End-User, market is studied across Cloud Service Providers, Colocation Providers, and Enterprises. The Cloud Service Providers commanded largest market share of 40.76% in 2022, followed by Enterprises.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 36.65% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Data Center Transformation Market, by Offering

7. Data Center Transformation Market, by Tier Type

8. Data Center Transformation Market, by Data Center Size

9. Data Center Transformation Market, by Vertical

10. Data Center Transformation Market, by End-User

11. Americas Data Center Transformation Market

12. Asia-Pacific Data Center Transformation Market

13. Europe, Middle East & Africa Data Center Transformation Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Data Center Transformation Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Data Center Transformation Market?

3. What is the competitive strategic window for opportunities in the Data Center Transformation Market?

4. What are the technology trends and regulatory frameworks in the Data Center Transformation Market?

5. What is the market share of the leading vendors in the Data Center Transformation Market?

6. What modes and strategic moves are considered suitable for entering the Data Center Transformation Market?

Read More @ https://www.360iresearch.com/library/intelligence/data-center-transformation?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

[email protected]