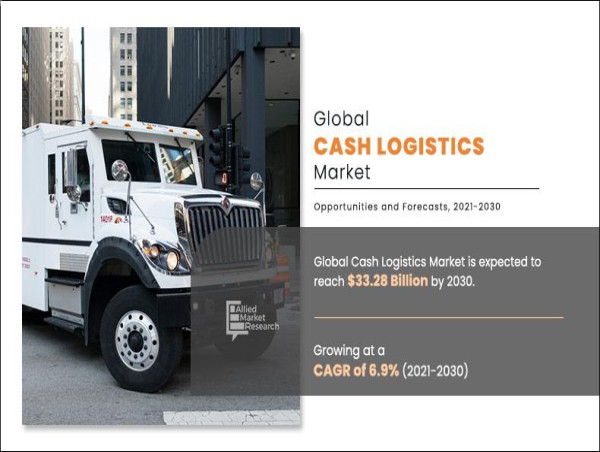

Cash Logistics Market by Service, End User and Mode of Transit : Global Opportunity Analysis and Industry Forecast, 2021-2030

PORTLAND, OR, UNITED STATES, September 28, 2023 /EINPresswire.com/ -- Allied Market Research published a report, titled, "Cash Logistics Market by Service (Cash Management, Cash-in-transit, and ATM Services), End User (Financial Institutions, Retailers, Government Agencies, Hospitality, and Others) and Mode of Transit (Roadways, Airways, and Railways): Global Opportunity Analysis and Industry Forecast, 2021–2030." According to the report, the global cash logistics industry was estimated at $16.83 billion in 2020, and is anticipated to hit $33.28 billion by 2030, registering a CAGR of 6.9% from 2021 to 2030.

Drivers, restraints, and opportunities-

Increase in circulation of cash, surge in demand for safe and vault for cash management, and rise in deployment of ATMs drive the growth of the global cash logistics market. On the other hand, surge in the incidence of cash-in-transit vehicle robberies and growing adoption of digital money impede the growth to some extent. However, emergence of fully automated cash-in-transit vehicles is expected to create lucrative opportunities in the industry.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 - https://www.alliedmarketresearch.com/request-sample/2458

Covid-19 scenario-

Governments across different regions announced total lockdown and temporarily shutdown of industries, which gave way to border closures that restricted the movement of transportation & logistics services, especially during the initial period. This factor impacted the cash logistics market negatively.

However, as the global situation is getting better, the market is anticipated to recoup soon.

The cash management segment to dominate by 2030-

Based service type, the cash management segment accounted for more than two-fifths of the global cash logistics market share in 2020, and is anticipated to rule the roost by 2030. The same segment would also cite the fastest CAGR of 7.7% throughout the forecast period, owing to rise in demand for cash management activities across different institutions.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 - https://www.alliedmarketresearch.com/cash-logistics-market/purchase-options

The roadways segment to maintain the dominant share-

Based on mode of transit, the roadways segment held 94% of the global cash logistics market revenue in 2020, and is expected to lead the trail by 2030. The same segment would also manifest the fastest CAGR of 7.0% from 2020 to 2030. This is attributed to the fact that most of the key players operating in the market are utilizing armored vehicles as the mode of transit for cash.

Europe, followed by North America, garnered the major share in 2020-

Based on region, Europe, followed by North America, held the major share in 2020, generating more than one-fourth of the global cash logistics market. LAMEA, however, would grow at the fastest CAGR of 8.1% by 2030. This is due to the increased demand for cash based transaction across African countries that have lower in internet penetration rate.

𝐈𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 - https://www.alliedmarketresearch.com/purchase-enquiry/2458

Key players in the industry-

CMS

GardaWorld

GSL

GSLS

Lemuir Group

The Brink's Company

Cash Logistics Security AG

Loomis AB

G4S

Prosegur

𝐒𝐢𝐦𝐢𝐥𝐚𝐫 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐖𝐞 𝐇𝐚𝐯𝐞 𝐨𝐧 𝐋𝐨𝐠𝐢𝐬𝐭𝐢𝐜𝐬 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲:

Secure Logistics Market - https://www.alliedmarketresearch.com/secure-logistics-market-A14801

Logistics Market - https://www.alliedmarketresearch.com/logistics-market

FMCG Logistics Market - https://www.alliedmarketresearch.com/fmcg-logistics-market-A08768

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

_02_05_2025_05_53_40_418159.jpg)