A novated lease is a popular salary packaging option that allows employees to lease a vehicle using pre-tax income. This arrangement reduces taxable income and also leads to significant savings on running costs. However, understanding the savings and monthly payments can be difficult without the right tools.

This is where a novated lease calculator comes in handy. This particular calculator from car finance company, Fincar is one of the popular we’ve seen. Uniquely, it allows the user to choose low-emission vehicles at the outset. These often allow for extra tax exemptions (as at February 2025)

A novated leasing calculator helps individuals estimate their total financial commitment, tax savings, and monthly repayments with precision. This comprehensive guide will explore how the calculator works, the benefits of using one, and key factors that impact calculations.

What Is a Novated Lease?

A novated lease is a tri-party agreement between an employee, employer, and a leasing company. Under this arrangement:

- The employer subtracts lease payments from the employee’s salary before taxes.

- The leasing company finances the vehicle purchase and manages associated costs.

- The employee gets to drive the car while benefiting from tax savings and reduced expenses.

This tax-effective solution is widely used in Australia and offers an attractive alternative to traditional vehicle financing.

How a Novated Lease Calculator Works

A novated lease calculator simplifies financial planning by estimating various cost components, including:

- Monthly Lease Payments – The fixed lease repayment amount based on vehicle cost, lease term, and interest rates.

- Tax Savings – The reduction in taxable income due to salary packaging.

- Running Costs – Fuel, servicing, insurance, and registration expenses.

- Fringe Benefits Tax (FBT) Implications – The tax implications of using the car for personal purposes.

- Balloon Payment (Residual Value) – The final lump sum payable at the end of the lease term.

By inputting details such as salary, vehicle price, and lease duration, users receive an accurate breakdown of potential costs and savings.

Key Factors That Impact Novated Lease Calculations

- Vehicle Price and Type

The cost of the vehicle significantly affects lease payments. Luxury cars may attract higher taxes and fees, whereas economical models offer better savings.

- Lease Term Duration

Novated leases typically last between one and five years. A longer lease term lowers monthly payments but could increase the total cost.

- Employee's Gross Salary

Higher salaries often result in greater tax savings since more pre-tax income is allocated toward the lease payments.

- Running Costs

Including vehicle expenses such as fuel, maintenance, and insurance in the lease package enhances cost-effectiveness.

- Fringe Benefits Tax (FBT)

Employees using their car for personal travel may incur Fringe Benefits Tax (FBT). However, some methods, such as the Employee Contribution Method (ECM), can help reduce FBT liability.

Benefits of Using a Novated Lease Calculator

- Accurate Financial Planning

A novated lease calculator provides a clear financial overview, allowing users to budget effectively.

- Maximised Tax Savings

By understanding pre-tax and post-tax contributions, employees can maximise tax benefits and reduce overall costs.

- Comparative Analysis

Users can compare different vehicle options, lease terms, and salary structures to identify the most cost-effective choice.

- Transparency in Costs

A calculator eliminates hidden charges by displaying a complete breakdown of costs, ensuring informed decision-making.

How to Use a Novated Lease Calculator Effectively

To obtain the most accurate results, users should:

- Input Gross Annual Salary – This determines tax savings and after-tax contributions.

- Select Vehicle Price – The cost of the car directly impacts lease repayments.

- Choose Lease Term – Shorter leases have higher payments but lower total costs.

- Include Estimated Running Costs – Fuel, servicing, insurance, and registration must be factored in.

- Review Results Carefully – Compare different scenarios to find the best financial outcome.

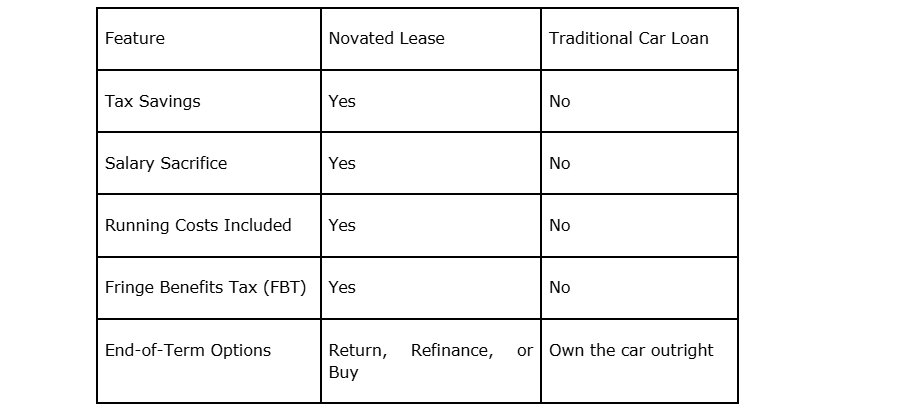

Novated Lease Calculator vs. Traditional Car Loan

Common Myths About Novated Leases

- "Novated Leases Are Only for High-Income Earners."

While high-income earners benefit the most from tax savings, employees of various salary levels can still enjoy financial advantages.

- "You Must Drive a Lot to Make It Worthwhile."

Novated leases cover both business and personal use, so even moderate driving habits can still yield savings.

- "You’re Locked Into a Fixed Contract."

Many leasing companies offer flexible lease terms and exit options, making novated leases more adaptable than commonly assumed.

Best Practices for Choosing a Novated Lease Provider

- Compare Interest Rates and Fees – Ensure competitive pricing to minimise overall costs.

- Check for Hidden Costs – Review contracts carefully to avoid unexpected expenses.

- Evaluate Customer Support – Reliable service ensures a smooth leasing experience.

- Look for Comprehensive Inclusions – Opt for packages that cover maintenance, insurance, and fuel for added convenience.

Conclusion

A novated lease calculator is an essential tool for estimating savings and monthly repayments with ease. By understanding key factors such as salary packaging benefits, tax implications, and vehicle costs, employees can make informed decisions that maximise financial efficiency.

If you’re considering a novated lease, use a reliable novated lease calculator to compare options and determine the most cost-effective solution tailored to your needs.

The article has been provided and sponsored by AMRYTT MEDIA, an innovative and performance-driven marketing agency specialising in content marketing and high-quality backlinks from niche websites.