Knowing the differences between inflationary and deflationary crypto can help you to create a balanced portfolio that can hedge against inflation. These varying types of cryptocurrency have their own pros and cons, which can impact how your portfolio performs.

It’s also worth noting that most cryptocurrencies are not decidedly inflationary or deflationary. This means that although a crypto may have some characteristics of inflationary cryptocurrencies, it may not fit into this category, and vice versa.

In this article, you’ll find out what inflationary and deflationary crypto is, so you can tell the difference when trading. We’ll also talk about the pros of each and give a few key examples. So, let’s begin!

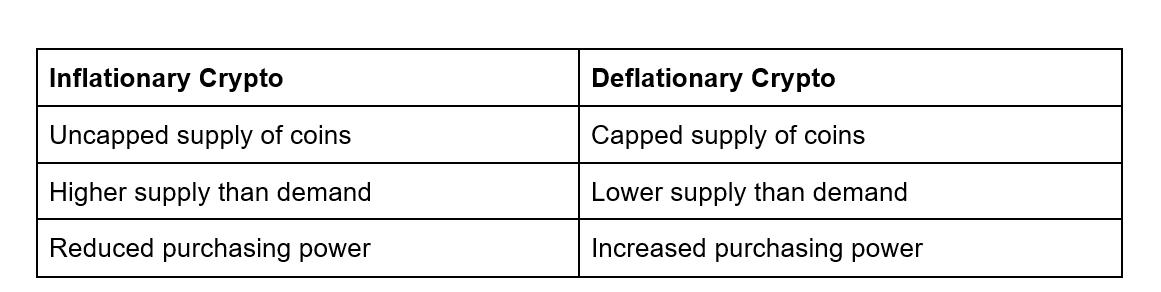

Inflationary Vs Deflationary Crypto Quick Guide

Check out this guide to help you learn the main differences between inflationary and deflationary crypto!

What Is Inflation and Deflation?

To understand how inflationary and deflationary cryptocurrencies work, you first need to know what inflation and deflation are.

Inflation refers to a big price increase over a specified period of time. This affects most aspects of an economy, including the cost of essential items, luxury goods, transport, medical care, utilities, and other services. As the prices continue to rise, the value, and therefore, purchasing power of fiat currencies, decreases.

On the flip side, if consumer prices begin to drop over a certain time period, this is known as deflation. Deflation means that the value of a fiat currency (such as the Euro, Dollar, or Pound) will rise, which also increases its purchasing power.

Similar to price inflation and deflation, crypto can be inflationary or deflationary.

How To Invest in Inflationary and Deflationary Cryptocurrencies

Before we dive into the main differences between inflationary and deflationary cryptocurrencies, we want to explain how to invest in either type of these coins. After all, one type of crypto is not necessarily better than the other.

As you’ll soon find out, both inflationary and deflationary cryptocurrencies have their own pros and cons. Whilst one type may be best suited for a certain trader, this may not be the case for you.

Diversifying Your Portfolio

If you want to build up a stable crypto portfolio, then you must understand the importance of diversification. For a trader’s portfolio to be balanced and have a better chance of securing a steady, long-term profit, it’s vital to invest in a variety of coins. You can do this in a few different ways. For instance, you can choose to invest in coins with varying market caps, prices, use cases, and risk levels. You can also choose to invest in a mix of both inflationary and deflationary crypto.

By investing in both of these types of crypto, you can help your portfolio withstand economic pressures, prevent crypto inflation, and even offset losses. Of course, even with a diversified portfolio, you, or any other trader, are not guaranteed to make a profit. The crypto market is unpredictable, so it’s impossible to avoid losses.

However, making a balanced portfolio can still give you a large advantage. So, if you cannot decide whether to invest in inflationary or deflationary cryptocurrencies, the answer is: Invest in both!

Seeking Additional Guidance

For many, trading crypto may seem easier said than done. After all, the crypto industry has built up a reputation for being quite complex. But if you do want to start trading crypto, you don’t have to enter the market and buy crypto assets alone!

There are lots of services that can help give new traders the push they need. For example, crypto brokers provide specialised tools for traders. Usually, these tools have been tailored towards beginners, making brokers a great option for first-time traders. Many brokers also act as a guide for traders, making the crypto trading process much less daunting.

Finding the best broker for your trading needs can be tricky. For a start, there are hundreds, if not thousands, of crypto brokers around, each claiming to be better than the last. It can be hard and time-consuming to find and analyse each of these brokers, which may be why many traders avoid them altogether.

Luckily, there is a solution that can help you swiftly find a broker without any hassle. If you think you can benefit from the help of a broker, then we suggest joining a crypto platform. These crypto platforms act as the middleman between traders and brokers, making suitable matches to aid both parties.

Crypto platforms (e.g., BitiCodes) use AI technology to connect their users to brokers they’re most compatible with according to the individual’s own trading goals. Although these platforms are not a necessity, they can help traders save time and avoid the trouble of searching for a well-suited broker themselves.

Extra Preparation

We also suggest doing plenty of research before trading crypto. Ideally, you should have an in-depth knowledge of digital assets, the crypto market, and crypto lingo before you risk any of your money. It’s also a good idea to set yourself long-term goals, think about your risk tolerance, and create a budget before trading.

All in all, investing in crypto isn’t as difficult as it might appear to be! Just remember to never underestimate the risks of trading, and don’t be afraid to seek extra help when needed.

Whenever you’re ready to, you can make your first steps as a trader by choosing inflationary and deflationary crypto to invest in! If you already have experience as a trader, you can select a few different coins to help balance and diversify your portfolio.

But before you do that, let’s look at the key characteristics of both of these cryptocurrencies!

Source: Pexels

Source: Pexels

What Is an Inflationary Cryptocurrency?

Cryptocurrencies that are inherently inflationary have an uncapped supply of coins. This means that the number of coins in circulation will continue to rise through methods such as mining and staking. Similar to inflation, as the supply of a crypto coin rises and overtakes demand, its value falls.

Some cryptocurrencies begin as deflationary but transition into inflationary. For example, the well-known meme coin, Dogecoin (DOGE), began with a hard supply cap of 100 billion coins. But, in 2014, Dogecoin’s supply cap was removed. Now, this coin has an uncapped circulating supply, making it inflationary crypto.

Advantages of Inflationary Crypto

Due to the nature of inflationary cryptocurrencies, they discourage traders from hoarding coins. If you own inflationary crypto, such as Ethereum, as time goes on, you’ll have to use more ETH for any purchase since the purchasing power is continuously decreasing.

So, the more you hold on to these assets, the less value you’ll get out of them. This motivates traders to spend their coins which encourages mainstream adoption and allows these coins to fulfil their true purpose - being used as a form of payment.

Many inflationary cryptocurrencies also use deflationary mechanisms, helping them to hedge against inflation. This can be done through either burning tokens or limiting how many coins can be mined over a certain time period.

Examples of Inflationary Crypto

- Dogecoin (DOGE)

- Ethereum (ETH)

- Polkadot (DOT)

What Is a Deflationary Cryptocurrency?

Deflationary cryptocurrencies are basically the opposite of inflationary cryptocurrencies. These cryptocurrencies do have a fixed supply, which helps them rise in value over time. As the demand for a deflationary crypto rises, it overtakes the coin’s supply, making each token increase in value.

Some coins also utilise other deflationary measures, such as halving, which is an approach that Bitcoin famously uses. A Bitcoin halving event takes place every four years, and during this event, the reward for mining Bitcoin coins is cut in half. The next Bitcoin halving event is expected to take place in 2024.

As opposed to inflationary crypto, these cryptocurrencies encourage traders to hold (or HODL) onto their assets since they are expected to be worth more as time goes on. If you choose to hold on to your deflationary crypto investments, you will need to spend less of it to make the same purchase as you would have done before.

Advantages of Deflationary Crypto

Deflationary cryptocurrencies are a better option for traders who want to hold on to their investments over a longer time period. This also means that deflationary crypto is more resistant to inflation and counteracts other economic pressures.

Examples of Deflationary Crypto

- Bitcoin (BTC)

- Polygon (MATIC)

- Ripple (XRP)

- Binance Coin (BNB)

Final Thoughts

To conclude, inflationary and deflationary cryptocurrencies have key differences that affect their role in the crypto economy. Both types of crypto differ from fiat currencies and are not as harshly impacted by price inflation and other factors. In some cases, certain crypto coins have even been used by traders to hedge against inflation.

Knowing the key differences between inflationary and deflationary crypto can help you to build a trading portfolio that reflects your personal goals. For example, if you want to use crypto for the sole purpose of making transactions, you’ll benefit more from investing in inflationary crypto. On the other hand, if you want to hold onto your investments for a long time period without your assets losing too much value, then it’s best for you to invest in deflationary crypto.

Regardless of your trading goals and portfolio size, you should always do a lot of research before acting. This includes reading about the crypto market and any coins you’re interested in investing in. This will help you gain experience as a trader and gives you a much better chance at making profitable investment decisions.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.