Highlights

- The energy demand is rising at a rapid pace and the conventional means of meeting this demand is feared to disturb the environment.

- Renewables are playing a very important role in maintaining the ecological balance of the planet.

- Leading economies of the world have already created milestones to meet their target and pushing corporate firms to curb their emissions.

With the growing population and improving standard of living, the energy demand is rising at a rapid pace and thus disturbing the ecosystem of the Earth. Rising population means more energy requirement and meeting this demand through conventional means lead to greenhouse gas concentration. The rising greenhouse gas concentration on the Earth can increase the global temperature, giving an invitation to various disasters like floods, avalanches, sea-level rise, melting of glaciers, etc.

Renewables on the other hand play a very important role in maintaining the ecological balance of the planet. The energy generated from renewable sources help to satisfy the global energy demand to some extent if not 100% and at the same time do not add to the greenhouse gas concentration levels.

Related Article: Five ASX listed stocks to look at amid renewable and clean energy boom

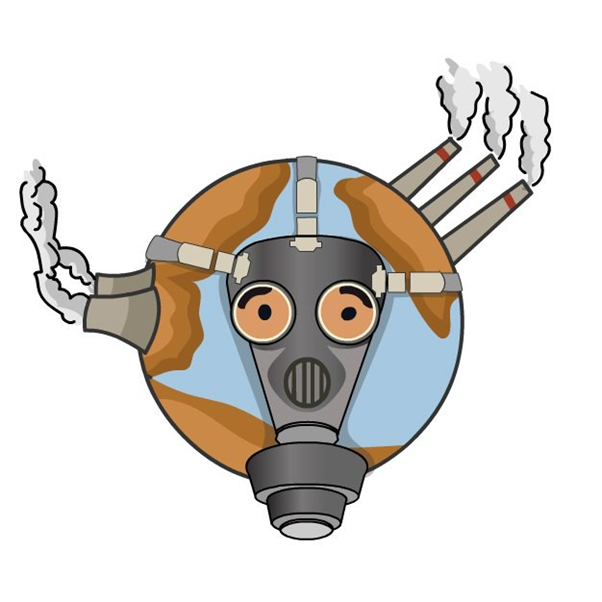

Curbing global greenhouse emissions

Renewable has become a hot topic in todays time. Most of the countries are having a substantial investment plan in renewable energies. Countries across the globe are trying hard to limit their greenhouse emission, as a part of their long-term goal to attain carbon neutrality by 2050.

Curbing greenhouse emission | Source: Copyright © 2021 Kalkine Media

Leading economies of the world have already created milestones to achieve their target and warned corporate firms to curb their emissions. The whole world has joined hands to combat the issue.

Countries like China and India where most of the electricity comes through coal-fed power plants may soon witness renewable energy contributing a significant portion of their entire needs.

Interestingly, investors are also looking at companies who are supporting renewables, into their portfolio, ditching companies who are still relying on fossil fuels.

How can investors participate in the bourgeoning renewable energy market?

As per the Responsible Investment Association Australasia (RIAA), the companies that are supporting renewable energy and energy efficiency are the most popular choices among ethical investors in 2021.

Being a shareholder of an ethically responsible company, one can also contribute and encourage better environmental practices. Let us try to understand as to how one could make an active contribution to back the renewable energy sector in Australia.

Related Article: Scientists update forecasts on the need for a better climate modeling

How to Invest in Renewable Energy in Australia?

There are various categories of renewable energy including wind energy, solar energy, geothermal, biomass, tidal, nuclear, hydro, etc.

Here are a few ways one can opt for investing in the renewable energy sector.

- ASX listed Renewable Energy Stocks: Investors can purchase the shares of renewable energy companies that are listed on the Australian Securities Exchange (ASX).

ETF | Source: © Timbrk | Megapixl.com

- Sustainability ETFs: ETFs are exchange-traded funds that contain a bundle of stocks, usually hundreds that track a stock index. However, the Australian renewable sector is relatively small and doesn’t have too many options, rather investors can opt for global exchanges.

- International Stocks: Various leading renewable energy stocks are listed on the stock exchanges of the US and Canada. Australian investors can access and invest in these stocks through a broker that offers international stock investment.

Related Article: Which are the most exciting ASX-listed ethical ETFs?

Bottom Line

The energy demand is rising at a rapid pace thus opening opportunities for not just companies to thrive in but also their investors. Renewables can play a vital role in controlling the rising greenhouse emissions of the Earth while fulfilling the burgeoning energy demands.