Summary

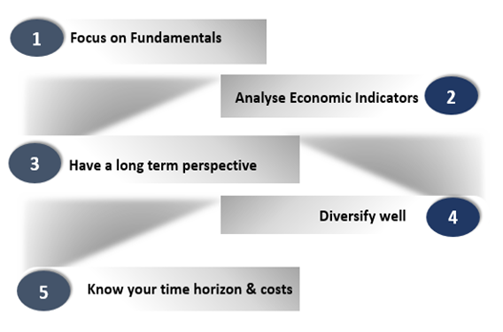

- Most wise investors believe in long term investing.

- Long term investment requires investors to focus on fundamentals and have a vision for growth.

- Sectors where innovation is vital or subjected to minimal impact of economic cycles often attract long term investors.

American billionaire investor Charlie Munger once said - waiting helps as an investor since many people just can't stand to wait. The amount of success achieved in investing is directly proportional to the period of investment. Extended investment periods bring in more benefits as short term volatilities die and financial goals are achieved. Also, it is challenging to time the market, so investing for a more extended period proves beneficial for investors.

Fundamentals to identify sectors for long term Investing

Copyright © 2021 Kalkine Media

Long term investing works on a different frame of reference. Investment opportunities identified in this light can be hidden diamonds. With this point of view, let’s look at the

Best sectors for long term investment-

Technology

- The advent of cloud computing, e-commerce and data explosion has set the technology sector for constant evolution. Innovation is what leads this sector. Technology has a presence everywhere, right from retail trade to big data.

- New technology niches like 'Med-Tech' and 'Agri-tech' have also cropped up. Constant research and development make this sector always a good bet in terms of future growth potential. Any innovation demands get converted into profitable businesses. The thriving ecosystem gives it the needed boost.

Healthcare

- Advances in biotech and pharma-tech are making the healthcare sector future-oriented. It is a 'defensive sector' as demand here isn't affected by any recessions. The sector includes hospitals, drug manufacturers, biomedical companies, healthcare research firms and even medical instrument makers.

- The Australian federal budget also gave significant importance to this sector in FY21-22. Funds have flown to in mental health and aged care sectors.

- The long pandemic and increased awareness of healthcare are making this sector lucrative for investors.

Image source: © yakobchuk | megapixl.com

Consumer staples

- As it goes with the name, this is another defensive sector that is not affected by market trends. Products like Milk, Retail food items are always in demand. Even during the pandemic, consumers were buying staples.

- Investors need to know the difference between consumer staples and consumer discretionary. Staples are daily essentials, while discretionary and suitable for pleasure or brought from extra income.

- These stocks provide the needed stability for long term fund needs. Most ETFs in Australia and around the world have these stocks in their portfolio.

Metals

- The world runs on metals. They are used for producing electricity, running combustion or battery-operated vehicles and all sorts of producer machines. Few precious metals and minerals like gold, platinum, etc., also have retail consumer demand.

- The need for clean fuels has shifted the world to batteries which again use lithium, copper, etc. Battery metals alone are going to be a billion-dollar industry by 2030.

Financials

- Businesses in this industry include Banks, AMCs, Financial planners, wealth management firms, fund houses etc.

- Though susceptible to economic cycles, good financial stocks with strong P/E or PB ratios can be considered for long term investing. In addition, most banking and AMC stocks also tend to pay regular dividends.

- Furthermore, the rise of fin-tech and growing financial awareness makes it a prospective sector for the long term.

Related Article: Why should you become debt-free before starting long-term investments?

.jpg)