Highlights

- Tech stocks have significantly lost their value in 2022, including Shopify (TSX:SHOP).

- During the first quarter, Shopify saw a 16 per cent growth in gross merchandise volume.

- Shopify looks to expand, and in May, it announced the acquisition of Deliverr.

This has been a horrific year for technology stocks in Canada after riding high in the last two years when the world was forced to stay indoors. The S&P/TSX Capped Information Technology Index declined around 36 per cent year-to-date (YTD), and the majority of the tech stocks have significantly lost their value in 2022, including Shopify (TSX:SHOP).

The technology titan from Canada has witnessed one of the most shocking declines this year in this digital downturn. The SHOP stock declined 73 per cent YTD, and it appears that Shopify's future growth will not resemble that of the pandemic era.

We are saying this as there are significant challenges for the economy. People's discretionary income is being reduced by inflation, and since life has returned to normal, they aren't doing all of their buying online.

As market volatility is expected to remain for quite some time, let's find out if the Shopify stock is worth exploring right now:

Is Shopify stock worth exploring in 2022?

Despite certain difficulties Shopify is having, it is expected that the e-commerce business will continue to grow worldwide. A 2022 report by ResearchAndMarkets suggests that the global e-commerce market has the potential to reach US$ 55.6 trillion by 2027 and grow at a compound annual growth rate of 27.4 per cent. In 2021, the online market was valued at US$ 13 trillion.

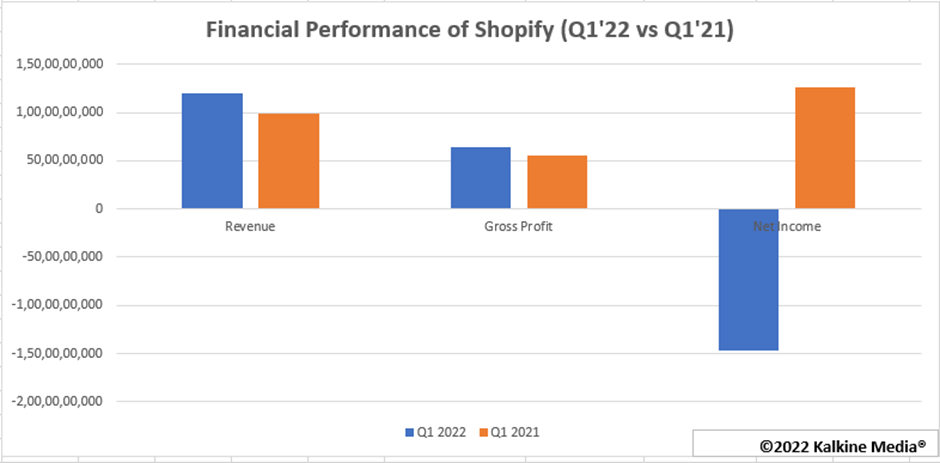

Its financials back Shopify, and despite tough market conditions, the company's total revenue climbed 22 per cent year-over-year (YoY) to US$ 1.2 billion in Q1 2022.

During the first quarter, it saw a 16 per cent growth in gross merchandise volume, and due to the lack of COVID-related growth triggers, this does not appear to be that terrible.

Shopify's difficulties stemmed partly from business being too brisk despite lockdowns and people remaining at home due to COVID-19. During the pandemic, its growth rate accelerated to levels that are inherently unsustainable over the long term:

Hence, investors will have to adapt to a slower growth rate as the pandemic-like surge is highly unlikely at the moment due to rising inflation and recession fears.

Bottom line

The SHOP stock displayed some resilience in the past week and was up by nine per cent as of writing. Shopify looks to expand, and in May, it announced the acquisition of Deliverr, a fulfilment technology provider.

In a statement, the company said that Deliverr has the potential to extend its reach through faster deliveries. Shopify is expected to acquire the company for around US$ 2.1 billion.

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.