Highlights:

- Revenues from U.S. Appraisal were US$ 79.4 million in Q1 2022 compared to US$ 69.6 million, reflecting an increase of 14.1 per cent YoY.

- The significant sources of revenue for Real Matters are two segments- U.S. Appraisal and U.S.

- Real Matters' net income reduced to US$ 2.6 million in the first quarter of fiscal 2022 from US$ 7.1 million in Q1 2021.

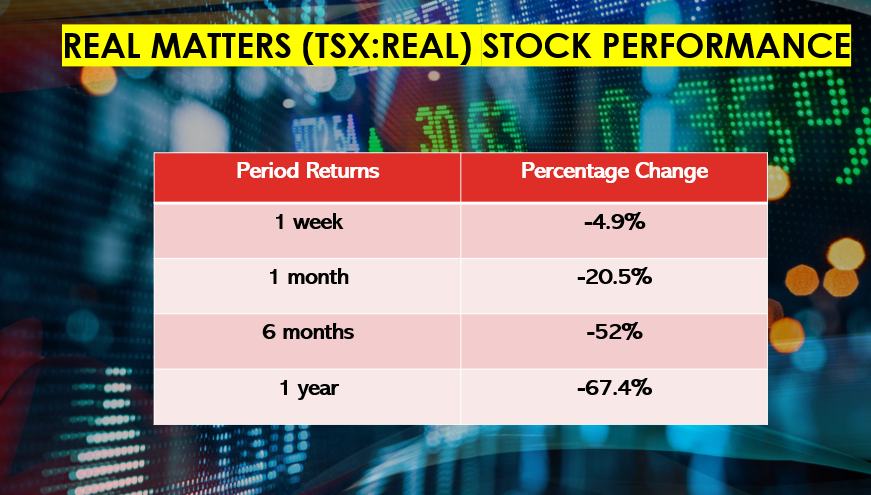

Ontario-based technology company Real Matters Inc. (TSX:REAL) announced financial results for the first quarter of fiscal 2022. The company reported consolidated revenues of US$ 107.8 million.

Real Matters provides services to companies working in mortgage lending and insurance sectors. It is one of the leading network management services providers and helps its customers make informed decisions through leveraging technology.

Also Read: XELA stock jumps 16%: Why is Exela Technologies surging?

The significant sources of revenue for Real Matters are two segments- U.S. Appraisal and U.S. Title. In Q1 2022, the company said its U.S. Appraisal segment registered revenue growth. However, it was offset by a decline in the revenue of the U.S. Title segment.

Real Matters' Q1 2022 Financial Results: Key highlights

Real Matters' U.S. Appraisal purchase and refinance revenues increased a combined 13.9 per cent year-over-year (YoY). However, the U.S. Title revenues declined.

Revenues from U.S. Appraisal were US$ 79.4 million in Q1 2022 compared to US$ 69.6 million, reflecting an increase of 14.1 per cent YoY. Meanwhile, the revenues from U.S. Title declined to US$ 16.2 million from US$ 39.9 million in Q1 2021.

©2022 Kalkine Media®

©2022 Kalkine Media®

The consolidated adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were US$ 5.9 million in Q1 2022, declining by 66 per cent YoY.

Real Matters' net income reduced to US$ 2.6 million in the first quarter of fiscal 2022 from US$ 7.1 million in Q1 2021.

Bottom line

Real Matters is looking to expand, and in Q1 2022, the company added four new lenders and one new channel in one of U.S. Appraisal's lenders.

The financial report claimed that it ranked as the number one vendor with two Tier 2 clients in the U.S. Title segment. In addition, it gave a top performance on Tier 1 scorecards in the U.S. Appraisal segment.

Also Read: Unity Technologies (NYSE:U): A metaverse stock for your portfolio?