Highlights

- BlackBerry Limited (TSX:BB) stocks surged by more than 13 per cent to a value of C$ 14.23 on Tuesday, October 19.

- It noted a trading volume of 6.58 million.

- The tech stock even rose to its highest level in more than a month as it struck a day high of C$ 14.5 apiece on Tuesday.

BlackBerry Limited (TSX:BB) stocks surged by more than 13 per cent to a value of C$ 14.23 on Tuesday, October 19, raking up a trading volume of 6.58 million.

The tech stock even rose to its highest level in more than a month as it struck a day high of C$ 14.5 apiece on Tuesday.

What caused this rise? Let us find out.

Also read: Is BlackBerry (TSX:BB) a cybersecurity stock to buy after Q2 results?

Why BlackBerry Limited (TSX:BB) stock rose?

BlackBerry did not post any new corporate update this week, but earlier this month, the cybersecurity giant has announced more than one new partnerships with prominent tech firms.

On October 13, BlackBerry revealed that it has partnered with tech firms Okta, Mimecast, Stellar Cyber and XM Cyber to help in the extension of detection and response (XDR) ecosystem.

A day before this announcement, on October 12, the former smartphone maker said that it is joining forces with Google and Qualcomm to work on innovations in next-generation automotive cockpits.

Then, on October 7, BlackBerry announced that it is teaming up with Deloitte to support original equipment manufacturers (OEM) and firms developing mission-critical applications protect their software supply chains.

BlackBerry stock performance

Stocks of BlackBerry have skyrocketed by nearly 108 per cent in the past one year and taken a leap of about 69 per cent this year.

In the last nine months, however, the cybersecurity stock has dipped by over nine per cent.

Also read: 5 TSX financial stocks to watch as Libs plan corporate tax rate hike

BlackBerry Q2 FY22 earnings

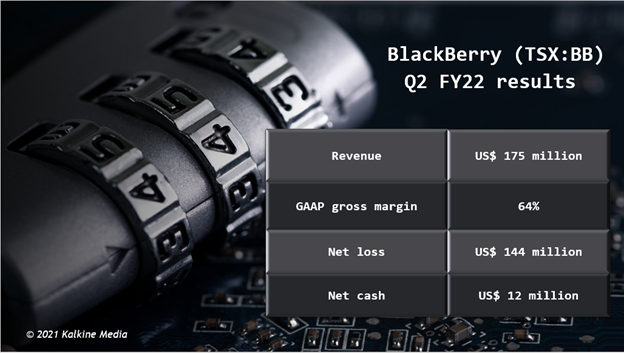

The Canadian cybersecurity firm reported a top line of US$ 175 million in the second quarter of fiscal 2022, notably down from that of US$ 259 million in Q2 FY21.

BlackBerry’s Internet of Things (IoT) revenue stood at US$ 40 million in Q2 FY21, and its Cyber Security revenue was US$ 120 million.

Its net loss, on the other hand, surged to US$ 144 million in this three-month period.

Bottom line

Some market experts believe that over time, its new alliances could boost BlackBerry’s financials and, in turn, drive up BB stocks.

It is, however, important to note that meme stock rallies have likely played a role in BB stock’s latest price surge.