Summary

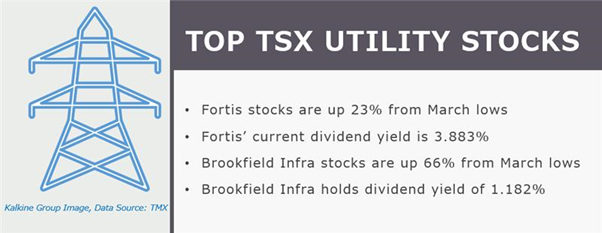

- Fortis stocks have gained over 23 per cent since its March lows.

- It distributed quarterly cash dividend of C$ 0.505 per share.

- Brookfield Infra declared a quarterly cash dividend of US$ 0.12 per stock for its unitholders, payable on December 31, 2020.

- Brookfield Infrastructure stocks have surged almost over 22 per cent in the last three months.

Utility stocks are trading quite swiftly on the Toronto Stock Exchange (TSX), gaining on the back of positive vaccine news. Despite the pandemic-led economic slowdown, Canadian utility stocks traded above average. The S&P/TSX Capped Utilities Index is up over 9 per cent year-to-date.

Here are two top TSX-listed utility stocks worth exploring: Fortis Inc. and Brookfield Infrastructure.

Fortis Inc. (TSX:FTS)

Current Stock Price:

Fortis is a utility transmission and distribution company that operates in Canada and the United States. It has a base of more than 2.5 million power and gas customers.

Fortis’ Board of Directors approved a cash dividend of C$ 0.505 per share for the current quarter. The power distributor holds a current dividend yield of 3.883 per cent. Its three-year dividend growth stands at 5.25 per cent, and the five-year dividend growth is 6.44 per cent.

Fortis Stock Performance

The utility stock has is trading flat in the last three months and posted nearly 4 per cent year-to-date (YTD) decline. However, the stock has gained over 23 per cent since its March lows. Its current market capitalization stands at nearly C$ 24.19 billion.

Fortis made it to TMX’s Top Volume stocklist, a list of actively traded stocks across the TSX and TSX Venture in the last 10-days. Its 10-day average trading volume is 2.35 million units. In the last one month, the stock average trading volume was 1.89 million units.

This Canadian utility stock delivers earnings per share (EPS) of C$ 2.66. Its price-to-earnings (P/E) ratio is 19.50, and the price-to-book ratio is 1.382. Stocks of Fortis offer a return on equity (ROE) of 7.36 per cent and a return on assets (ROA) of 2.24 per cent. Its total debt to equity ratio is 1.44 and its price-to-cashflow (P/CF) is 9.10, as per the TMX portal.

Financial Highlights

In the third quarter of 2020, the utility company delivered net earnings of C$ 0.63 per common unit

The company reported a common share dividend increase of 5.8 per cent in Q3 2020, marking 47 years of the consecutive surge.

The company aims to cut carbon emissions by 75 per cent by 2035.

Fortis’ C$ 19.6 billion five-year capital plan is projected to rise rate base from C$ 30.2 billion in 2020 to C$ 36.4 billion by 2023 and C$ 40.3 billion by 2025, representing three- and five-year compound annual growth of 6.5 per cent and 6 per cent, respectively.

Brookfield Infrastructure Partners (TSX: BIP.UN)

Current Stock Price: C$ 53.05

Brookfield Infrastructure Partners LP holds long-lasting assets that generates stable cash flows. It also acquires infrastructure assets that have low maintenance expenses. The company operates in the following segments: Utilities, Transport, Energy businesses, and Data Infrastructure. We will take a closer look only at its Utility segment.

Brookfield Infra declared a quarterly cash dividend of US$ 0.12 per stock for its unitholders. The infrastructure partners offer a current dividend yield of 1.182 per cent. Its three-year dividend growth is 6.94 per cent, and the present five-year dividend growth stands at 6.44 per cent.

Brookfield Stock Performance

The utility stock has soared almost over 22 per cent in the last three months and up by 5 per cent YTD. The stock has rebounded by nearly 66 per cent since the March market-slump.

Its 10-day average trading volume is 2.57 million units. The stock has actively moved in the markets in the last one month with the trading average volume of 2.52 million units.

Its current market cap is approximately C$ 83.50 billion.

Brookfield’s price-to-book ratio is 2.134. Its present debt to equity ratio is 5.13 and its price-to-cashflow (P/CF) is 8.20, as per the data available on the TMX website.

Utilities Segment Financial Highlight

In its utility segment, the company generated US$ 139-million funds from operations, a 6 per cent rise YoY, gains led by weaker foreign currencies.

In the third quarter of 2020, the company advanced its capital from inflation-indexation, nearly US$ 300 million, guided its North American regulated transmission operations purchased in late 2019.