Highlights

- Stocks of Nkarta Inc (NASDAQ: NKTX, NKTX: US) slid by over 10 per cent on Tuesday, April 26, after rocketing by nearly 141 per cent on Monday.

- The health stock rose on Monday after the company announced positive preliminary results from some latest studies.

- Nkarta is a South San Francisco-based biopharmaceutical firm that develops engineered natural killer (NK) cells for cancer treatment.

Stocks of Nkarta Inc (NASDAQ: NKTX, NKTX: US) slid by over 10 per cent on Tuesday, April 26, after rocketing by nearly 141 per cent on Monday.

The health stock rose on Monday after the company announced positive preliminary results from independent dose studies for Phase 1 of its engineered natural killer (NK) cell therapies, NKX101 and NKX019.

Nkarta is a South San Francisco-based biopharmaceutical firm engaged in developing engineered natural killer (NK) cells for cancer treatment. It is focused on utilizing the natural potent power of these cells to spot and kill abnormal cells. These cancer-fighting cells also recruit adaptive immune effectors to produce specific and durable responses.

The biotech company said that it will continue to enrol patients in 1.5 billion NK cells per dose for three-dose regimens under both the cell programs.

Let us quickly look at Nkarta’s financials and stock performance.

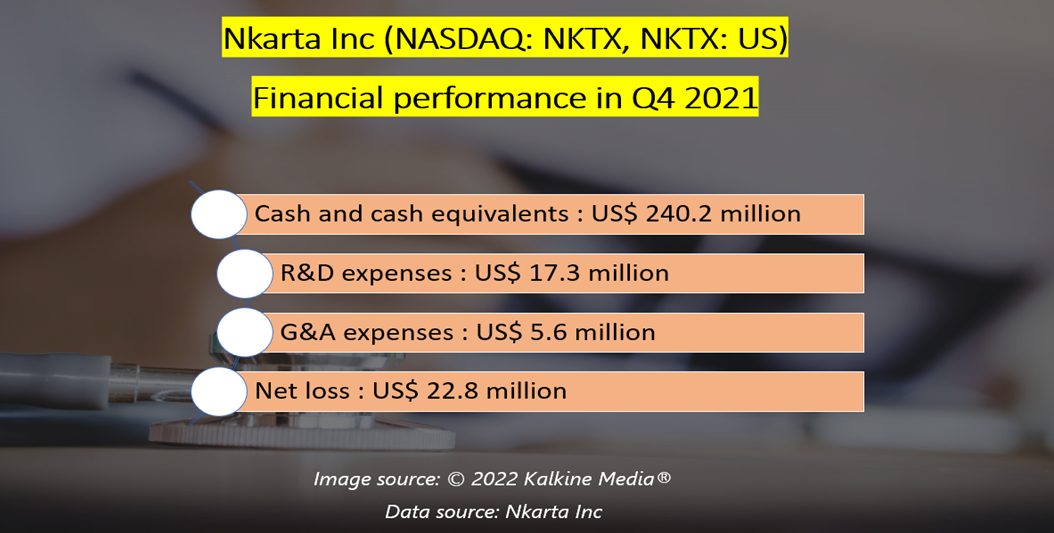

Nkarta Inc (NASDAQ: NKTX, NKTX: US)’s financial performance in Q4 2021

The US$ 617-million market cap company reported cash and cash equivalents of US$ 240.2 million at the end of December 31, 2021.

The healthcare player posted research and development expenses of US$ 17.3 million in Q4 2021. Its net loss amounted to US$ 22.8 million in the latest quarter.

Also read: Can this Canadian social media stock be your alternative for Twitter?

Nkarta Inc’s stock performance

Nkarta stock fell by almost 50 per cent in 12 months. However, the health stock zoomed by nearly 99 per cent in the last one week and closed at US$ 16.79 per share on Tuesday.

Bottomline

Nkarta announced the pricing of US$ 15 per share for an upsized public offering of about 13.3 million shares on April 25. The healthcare company said that it intends to direct these proceeds towards clinical development of the two NK cell therapies, internal manufacturing capabilities, fund working capital and general corporate requirements.

The stock is likely to have surged on Monday following the preliminary results from its latest Phase 1 studies. The fall in the price could have been a correction.

Also read: OTEX, MG and POW: Should you buy these 3 TSX value stocks in May?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.