Highlights

- Amid the ongoing market volatility triggered by inflationary pressures, the Russia-Ukraine geopolitical tensions and other factors, some investors seem to be inching away from the growth-led stocks.

- However, considering that growth stocks are generally an investment option meant for the long term, some investors continue to show interest in stocks that are likely to grow in the future.

- In Q4 FY2021, a Canadian energy producer’s earnings rose by about 774 per cent year-over-year (YoY).

Growth stocks are often sought after because these companies are either players in an industry that is expected expand in the future or are themselves businesses that are projected to grow.

Amid the ongoing market volatility triggered by inflationary pressures, the Russia-Ukraine geopolitical tensions and other factors, some investors seem to be inching away from the growth stocks, especially those from the tech space.

However, considering that growth stocks are generally an investment option meant for the long term, some investors continue to show interest in stocks that are likely to grow in the future.

Also read: Barrick Gold (ABX) & Franco (FNV): 2 top TSX gold stocks to watch

So let’s explore two TSX growth stocks that you could pick in 2022.

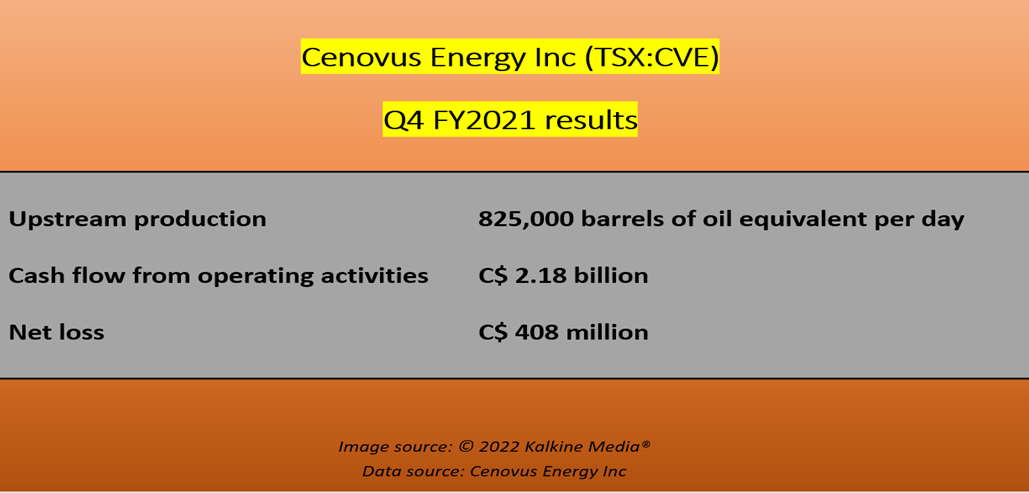

Cenovus Energy Inc (TSX: CVE)

The C$ 39-billion market cap oil company, on December 8 last year, said that it expects its total upstream production to be around 780-820 million barrels of oil equivalent (boe) on an average in 2022. This was up by four per cent from its 2021 guidance.

In Q4 FY2021, the Canadian energy producer’s earnings rose by about 774 per cent year-over-year (YoY) to C$ 2.18 billion.

Stocks of Cenovus closed at C$ 19.6 apiece on Friday, February 18, having skyrocketed by over 116 per cent in a year.

Waste Connections Inc (TSX: WCN)

Waste Connections, on February 16, said that it increased its revenue by 13 per cent YoY to US$ 6.15 billion in fiscal 2021.

The waste management company added that it expects double-digit growth in its revenue and adjusted free cash flow (FCF) in 2022, depending on “strong pricing” and acquisition.

Stocks of Waste Connections closed at US$ 154.35 apiece on Friday, having gained about 24 per cent in the last 12 months.

Also read: Air Canada (AC) triples operating revenues in Q4. A cheap stock to buy?

Bottomline

Considering that investors seem to be showing tepid interest in the growth-led tech stocks amid the current market volatility, an energy player like Cenovus and a utility company Waste Connections could be one to watch.

However, investors are advised to measure their risk capacity and follow their investment goals while taking any investment decisions.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.