Highlights

- Some people are talking about Canada's electric vehicle (EV) market as Stellantis N.V. and LG Energy Solutions, on Wednesday, March 23, agreed to form a joint venture of over C$ 5 billion to build a ‘large-scale’ lithium-ion battery production plant in Windsor, Ontario

- This plant is expected to have an annual production capacity of over 45 gigawatt-hours (GWh), and is said to have the full support from local, provincial and federal governments

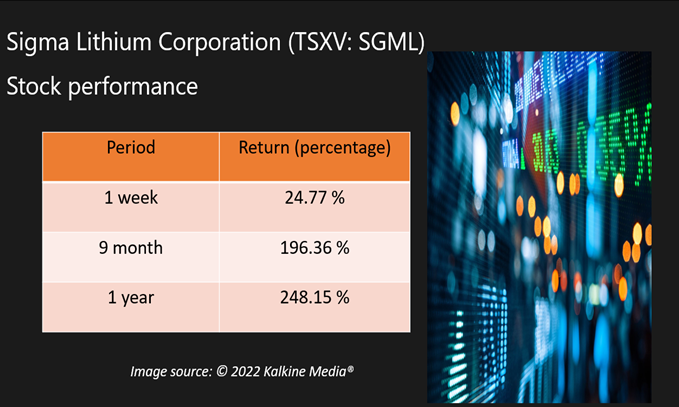

- The SGML stock rocketed by approximately 248 per cent in the last 12 months

Some people are again talking about Canada's electric vehicle (EV) market as Stellantis N.V. and LG Energy Solutions, on Wednesday, March 23, agreed to form a joint venture of over C$ 5 billion to build a "large-scale" lithium-ion battery production plant in Windsor, Ontario.

This plant is expected to have an annual production capacity of over 45 gigawatt-hours (GWh), and is said to have full support from local, provincial and federal governments.

Last week, on March 16, the Canadian government also said it would invest in Honda's Alliston factory, which reportedly would manufacture hybrid electric vehicles (EV).

So, let us discuss two TSXV lithium stocks amid new developments in the lithium and EV market.

Sigma Lithium Corporation (TSXV:SGML)

Stocks of Sigma Lithium galloped by about 20 per cent week-to-date (WTD) and closed at C$ 17.93 apiece on Wednesday, after recording a day high of C$ 18.10. SGML stock rocketed by approximately 248 per cent in the last 12 months.

In December last year, Sigma Lithium started construction of its production plant’s foundation at its 100 per cent owned Grota do Cirilo project. It also secured 38 critical lead items needed for this project, which is expected to begin production in Q4 2022.

Also read: LAC and SLI: Time to bag lithium stocks as Canada invests in EV dream?

Standard Lithium Ltd (TSXV:SLI)

Stocks of Standard Lithium swelled by over 12 per cent in the past one week and closed at C$ 8.82 apiece on Wednesday, after hitting a day high of C$ 9.33. The SLI stock zoomed by almost 118 per cent year-over-year (YoY).

Standard Lithium entered into an agreement with LANXESS corporation for its first commercial lithium project located in Arkansas. Under the agreement, Standard Lithium would have a 51 per cent ownership interest in the project, at a minimum. It may retain as much as a 100 per cent stake in this project and a 100 per cent equity stake in the South West Arkansas Project.

Bottom line

The demand for lithium could increase with the growing emphasis on green energy and net-zero emission targets. Plus, new developments happening in the lithium market may bolster the performances of Canadian lithium producers like Sigma Lithium and Standard Lithium.

Also read: GPV and VMC: 2 TSXV EV stocks to see as Canada invests in Honda plant

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.