Highlights

- Not all stocks in any particular sector would appreciate or lose value at the same time and/ or in the same quantum.

- This is where the concept of holding a diversified portfolio comes in.

- Wheaton Precious Metals pays a dividend of US$ 0.15 on a quarterly basis.

Which stocks are the best? Is it the tech sector or the oil industry that can return capital gains?

These questions are not easy to answer considering not all stocks in any particular sector would appreciate or lose value at the same time and/ or in the same quantum. This is where the concept of holding a diversified portfolio comes in.

For instance, retail and metals are two key sectors of the economy. While the former indicates consumer sentiment, the latter indicates manufacturing activity.

Which are the best retail stocks or metal and mining stocks trading on the TSX? Though there can be no definite answer, mentioned below are two stocks from each of the sectors that are also known to pay dividends.

Dollarama Inc. (TSX: DOL)

Dollarama is in the retail business of everyday products and seasonal goods at a lower-price range. The company operates stores in multiple locations in Canada, including metro cities and smaller towns.

Also read: What is Bundil app & does it have a native crypto token?

According to its financial results for Q3 ended October 31, 2021, Dollarama saw its sales rise by 5.5 per cent to over C$1.1 billion as compared to Q3 FY2021. Its EBITDA rose by 11.2 per cent to nearly C$347 million year-over-year (YoY).

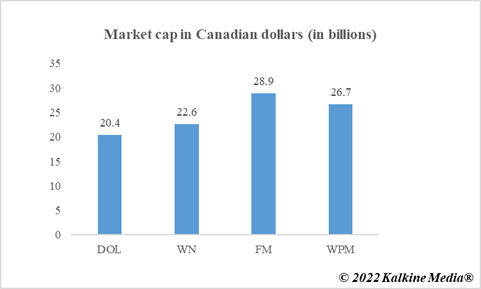

The company’s stock closed at C$ 68.72 on March 29, with its market cap standing over about C$ 20.4 billion. Its year-to-date (YTD) return is nearly 8.5 per cent.

Dollarama pays dividend on a quarterly basis, and its last dividend of C$ 0.05 per share was declared on December 8, 2021.

George Weston Limited (TSX: WN)

Apart from retail grocery business, George Weston is also into real estate. It operates Loblaw, a grocer in which George Weston has a controlling stake. Its real estate division is Choice Properties, an REIT.

Also read: What is Saitama ecosystem? Crypto seeks to educate Gen Z on finance

According to the company’s latest financial statement, George Weston’s adjusted EBIDTA was over C$ 1.45 billion for the 12 weeks ended December 31, 2021. For the 13 weeks ended December 31, 2020, the company’s adjusted EBIDTA was over C$1.39 billion.

WN stock closed at C$154.57 on March 29, noting a YTD return of nearly 5.4 per cent.

The C$ 22.6-billion market cap enterprise pays dividend on a quarterly basis, and its last dividend was C$ 0.6 was declared on March 2, 2022.

First Quantum Minerals Ltd. (TSX: FM)

The company is into production of metals like copper, nickel, gold, and silver. First Quantum Minerals has mining interests in Finland, Zambia, and other locations.

According to its financial results, the company’s adjusted earnings for Q4 2021 were US$306 million as compared to US$197 million for the immediately preceding quarter. Its gross profit for Q4 2021 was US$784 million, which was 28 per cent more as compared to Q3 2021.

Also read: UFO Gaming & Starlink (STARL): 2 dirt cheap metaverse tokens

FM stocks closed at C$42.21 on March 29, having climbed over 39 per cent this year.

The C$ 28.9-billion market cap company pays a dividend of C$ 0.005 apiece on a semi-annual basis.

Wheaton Precious Metals Corp. (TSX: WPM)

The company is into precious metal streaming activity. Vale’s Salobo Mine and Goldcorp's Penasquito mine fall under the projects of Wheaton Precious metals.

According to its financial statement, the company earned US$ 278 million in revenue in Q4 2021. Its full year 2021 revenue stood at US$ 1.2 billion.

Wheaton’s net earnings for Q4 2021 were US$ 132 million, while that for full year 2021 were US$ 592 million.

WPM stock closed at C$59.43 on March 29, having surged by is nearly 9.4 per cent.

Wheaton Precious Metals pays a dividend of US$ 0.15 on a quarterly basis.

Bottom line

The above four stocks pay dividend. Two belong to the retail sector, while two to the mining sector. In the coming months, these can make for a close watch for their roles in Canada’s economy.