Summary

- Microsoft launched the Xbox Series X and Xbox Series S next-generation consoles on November 10.

- Sony PlayStation 5 consoles will be rolled out online on November 12 for the US and Canadian market.

- Great Canadian Gaming Corporation will be acquired by Apollo Global Management Inc for deal valued at more than C$3.3 billion.

Resurgence of Covid-19 cases across the globe has once again forced people indoors. In this homebound economy, the popularity of video games is certainly increasing. Cashing in on this opportunity, video gaming companies are pulling out all stops by rolling out new next-generation consoles and offering games for free.

There have been some significant developments in the gaming sector this week, and the stocks of Microsoft Corporation (NASDAQ: MSFT, MSFT:US), Sony Corporation (NYSE: SNE, SNE:US), and Great Canadian Gaming Corp (TSX:GC) are gaining traction.

Microsoft launched the Xbox Series X and Xbox Series S next-generation consoles for gaming enthusiasts on November 10. Sony PlayStation 5 consoles will be rolled out online on November 12 for the US and Canadian market.

In another development, Apollo Global Management Inc is set to acquire the struggling Toronto-headquartered casino operator Great Canadian Gaming Corporation in deal valuing the later at more than C$3.3 billion. This deal is approved by the Great Canadian board and is expected to close in the second quarter of 2021. The casino industry is among the worst-hit industries due to pandemic with people gathering in large numbers being restricted.

Sony PlayStation 5 consoles will be up for grabs on Amazon, Best Buy, Target, and other online retailers from November 12 for gaming enthusiasts in Canada, the US and Japan or on November 19 (depending on region). However, no units will be available for in-store purchase in the safety interest of retailers and customers amidst Covid-19 fear. The pre-orders of PS5 have already been sold out since early September.

Meanwhile, due to low stock in Amazon fulfillment centers, some customers from Canada and the UK will be facing delivery delays of Xbox Series X/S into December.

Let us dig into the stock performance and financials of these gaming stocks.

Microsoft Corporation (NASDAQ:MSFT)

Current Stock Price: US$211.01

The stock is up 33.80 per cent this year with US$6.19 earnings per share. Its price-to-earnings (P/E) ratio is 35.30, price-to-book (P/B) ratio is 12.93, price-to-cash flow (P/CF) ratio is 25.30, and debt-to-equity (D/E) ratio is 0.58, as per details on the TMX.

The stock has positive returns on equity (RoE) and return on assets (RoA) at 41.40 per cent and 16.38 per cent. Quarterly dividend payout declared by the company is US$0.56, yielding 1.062 per cent.

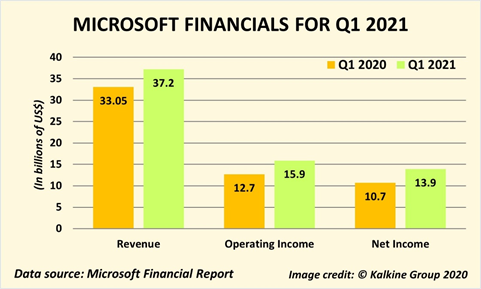

Microsoft’s revenue for first quarter of FY2021 (ended September 30, 2020) increased by 12 per cent year-over-year (YoY) to US$37.2 billion. The operating income went up 25 per cent YoY to US$15.9 billion, and net income surged 30 per cent YoY to US$13.9 billion. At the start of this fiscal 2021, the commercial cloud revenues jumped up 31 per cent YoY to US$15.2 billion.

The company’s revenue from gaming sector has increased significantly amid the pandemic with the revenue from Xbox content and services up by 30 per cent YoY in the latest quarter.

Sony Corporation (NYSE: SNE:US)

Current Stock Price: US$85.91

Tokyo-based conglomerate Sony Corporation is into consumer electronics, entertainment content, semiconductors and devices, and video game consoles. Current market capitalization of the company is US$105.97 billion. Current earnings per share is US$6.38. The stock gained 26.33 per cent YTD. The stock holds P/E ratio of 12.30, P/B ratio of 2.178, P/CF ratio of 7.10 and D/E ratio of 0.50.

The company announced semi-annual dividend of US$0.228, yielding 0.53 per cent. Its operating income increased 38.8 billion-yen YoY to 317.8 billion-yen in Q2 2020, while consolidated sales decreased by 8.8 billion yen to 2 trillion 113.5 billion yen.

The net income for the quarter increased due to improvement in operating income and 214.9-billion-yen reversal of deferred tax assets. The net income for the second quarter was 459.6 billion yen. Consolidated operating cash flow increased by 80 billion yen to 630 billion yen in Q2 2020.

Sony stock has positive return on equity (RoE) and return on assets (RoA) of 20.49 per cent and 3.90 per cent.

Great Canadian Gaming Corp (TSX:GC)

Current Stock Price: C$28.91

Great Canadian Gaming Corporation is into gaming, hospitality and entertainment businesses catering to all of Canada with offerings that include casinos with slot machines, community gaming spots, outdoor horse racing tracks, table games, and other services. The company generates half of its revenue from the Ontario region.

The stock price plummeted at the onset of the pandemic, from C$43.04 at the beginning of the year, to now crawling towards a slow recovery currently priced at C$28.91. The stock declined 33 per cent YTD. Current market capitalization of the firm is C$1.59 billion and earnings per share is C$2.68. The stock holds price-to-earnings (P/E) ratio of 10.50, P/B ratio of 3.059, P/CF ratio of 4.90, and debt-to-equity (D/E) ratio of 4.22. The stock has positive return on equity (RoE) and return on assets (RoA) of 15 per cent and 2.86 per cent, respectively.

In the third quarter of 2020 (period ended September 30), Apollo Funds managed by affiliates of Apollo Global Management, Inc. will acquire all outstanding shares of Great Canadian Gaming Corporation for C$39 per share. Due to temporary closure of its gaming properties from March 16, 2020, the corporation suffered net loss from continuing operations of C$36.5 million. It also incurred negative free cash flow of C$54.8 million, and C$62.2 million in capital expenditures owing to capital developments in Ontario.

As of September 30, the corporation manages to maintain stable capital and liquidity with a cash balance of C$471.9 million, and undrawn credit from credit facilities of C$1,062.5 million.