Highlights

- Investors often consider telecommunication stocks while targeting consistent and significant return in long haul.

- A telecom company in Canada hiked its quarterly dividend by 5.2 per cent YoY to C$ 0.327 per share in its latest quarter.

- Another telecommunication service provider posted a return on equity of 17.04 per cent

Investors often consider telecommunication stocks while targeting consistent and significant return in long haul.

Telecom companies are defensive in nature and often produce stable revenue streams. Not to forget, they also commonly provide dividends, which is also a key element that many investors look for while investing in stocks.

So, let us quickly glance the two TSX-listed telecom stocks.

Also read: RBC (RY) hikes dividend by 11%, National Bank's (NA) up 23%. Buy call?

1. TELUS Corporation (TSX: T)

The Vancouver, British Columbia-headquartered telecom operator saw its operating revenues and other incomes grow by 6.8 per cent year-over-year (YoY) to C$ 4.3 billion in the third quarter of fiscal 2021.

Telus recorded a YoY surge of 7.6 per cent in its EBITDA of C$ 1.5 billion in the latest quarter. Its net income stood at C$ 358 billion in Q3 FY2021, noting a YoY rise of 11.5 per cent.

The telecom giant also hiked its quarterly dividend by 5.2 per cent YoY to C$ 0.327 per share in its latest quarter. It is scheduled to pay this dividend on January 4, 2022, against an ex-dividend date of December 9.

Telus’s stock spiked by more than three per cent in the last three months. It also delivered a return of more than 17 per cent in the past 12 months.

The telecom stock closed at C$ 29.45 apiece on Thursday, December 2, up by nearly a per cent.

Telus held a market capitalization of C$ 40 billion and a return on equity (ROE) of 9.62 per cent.

2. BCE Inc (TSX: BCE)

BCE Inc is a Montreal-based company that provides a wide range of wireless, internet and other telecommunication services.

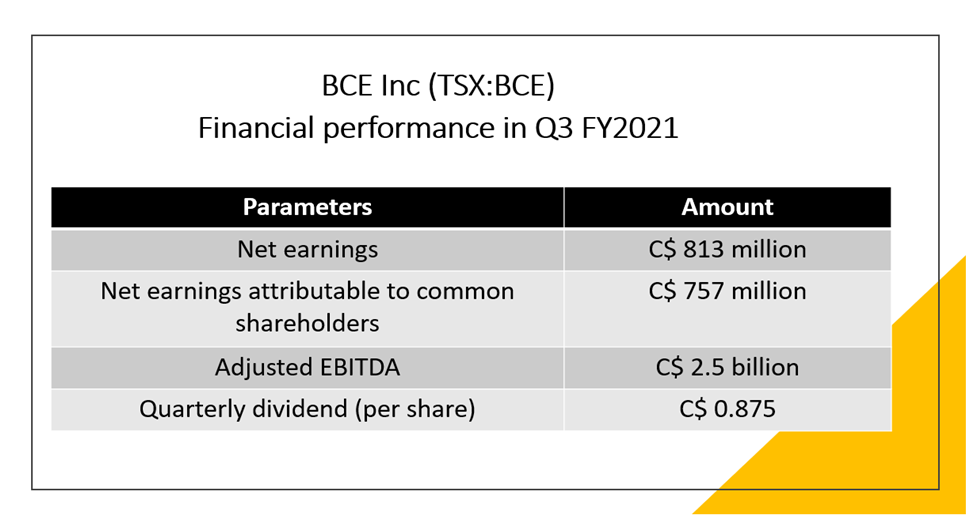

The company saw its net earnings rise by 9.9 per cent YoY to C$ 813 million in Q3 FY2021. Its net earnings attributable to common shareholders also increased by 9.4 per cent YoY to C$ 757 million in the latest quarter.

Its adjusted EBITDA amounted to C$ 2.5 billion in the third quarter of fiscal 2021.

Image source: © 2021 Kalkine Media Inc Data source: BCE Inc

BCE is expected to dole out a quarterly dividend of C$ 0.875 per cent on January 15, 2022. Its ex-dividend date is December 14.

BCE had a market capitalization of about C$ 59 billion and a price-to-earnings (P/E) ratio of 19.6.

BCE stock closed at C$ 65.54 apiece on Thursday, December 2, up by nearly two per cent.

Also read: 2 movie theatre stocks to buy as pandemic restrictions ease

Bottom line

Prominent Canadian telecom stocks can offer notable returns to investors in the long run considering the up-and-coming developments like 5G network.

Investors generally invest in telecom stocks as they exhibit defence capabilities, income-generation, and growth potential.

However, one should be clear about investment goals and risk-return profile while investing in any stocks.