Highlights

- Seeing the ongoing market environment, some Canadians might want to stick with matured companies with established businesses

- Investors often find bluechip stocks a viable option for stable dividend income apart from earning compound gains in the long run

- A stock mentioned here registered a gain of nearly 59 per cent in nine months

Seeing the ongoing market environment, some Canadians might want to stick with matured companies with established businesses that are lesser volatile than small-caps and mid-caps and have emerged as industry leaders. People are generally familiar with these companies as they have created a brand image for themselves over the last 25 or more years.

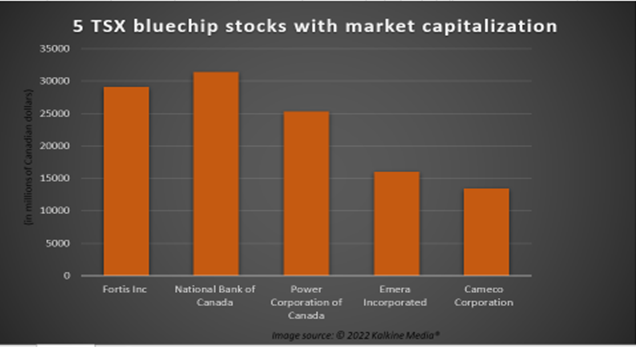

Investors often find bluechip stocks a viable option for stable dividend income apart from earning compound gains in the long run. Following are five TSX bluechip stocks that investors can add to their portfolios.

1. Fortis Inc (TSX:FTS)

Fortis expects to expand its midyear rate base to C$ 41.6 billion by 2026 from C$ 31.1 billion in 2021 under its C$ 20 billion five-year capital plan, which would indicate a five-year compound increase rate of about six per cent. The utility company aims toward a clean energy future and is on its way to achieve a greenhouse gas (GHG) reduction target of 75 per cent by 2035.

Fortis recorded a capital expenditure of C$ 1 billion and a net profit of C$ 350 million in the first quarter of FY2022. The large-cap utility provider is scheduled to pay a quarterly dividend of C$ 3.508 per cent on June 1.

FTS stock jumped by over 11 per cent year-over-year (YoY). According to the Refinitiv data, it appears to be on a bearish trend with a Relative Index Strength (RSI) value of 34.72 as on May 4.

2. National Bank of Canada (TSX: NA)

Some investors expect that bank stocks could gain from rising interest rates. Hence, including one like the National Bank of Canada can provide that exposure to investors. The bank reported a YoY rise of 22 per cent in its net profit to C$ 932 million in Q1 FY2022.

NA stock spiked by almost four per cent in 52 weeks. According to Refinitiv, it had an increasing RSI value of 47.08, and while looking at its Moving Average Convergence/ Divergence (MACD) graph. It might gain momentum in the near future.

3. Power Corporation of Canada (TSX: POW)

Power Corporation is a diversified firm with stakes in financial, communication and other companies in different sectors. Power corporation saw a record high net income of C$ 2.91 billion in the last quarter of FY2021.

POW scrip sank by over 10 per cent in 2022 and had an RSI value of 40.30 as of May 4 (as per Refinitiv).

Also read: EMO, ESK, OCO, ELO, and DSV: 5 best TSXV mining stocks under $5

4. Emera Incorporated (TSX:EMA)

Emera Incorporated saw its net profit grow from C$ 273 million in Q4 2020 to C$ 324 million in Q4 2021. IN APRIL, the C$ 16 billion market cap utility firm declared a quarterly dividend of 0.662, payable on May 16.

Stocks of Emera Inc climbed almost nine per cent over the past year. According to Refinitiv findings, the utility scrip dipped in late April and held an RSI value of 33.43 at the time of writing this.

5. Cameco Corporation (TSX: CCO)

With the growing focus on nuclear energy, uranium stocks like Cameco Corporation have also been drawing investors’ attention from time to time (RSI value was 42.88 on May 4, according to Refinitiv).

Cameco’s net profit declined to C$ 11 million in Q4 2021 compared to C$ 80 million a year ago. Its stock registered a gain of nearly 59 per cent in nine months.

Got $100? 5 best TSX bluechip stocks invest in

Bottomline

The TSX benchmark has been volatile in 2022 due to some major reasons, including inflation, rate hikes and economic sanctions stemming from the Russia-Ukraine crisis. Hence, investors looking for stable investment options that can fetch dividend income could explore the above-mentioned bluechip stocks.

Also read: NTR and IFOS: 2 Canadian fertilizer stocks to buy amid potash deficit

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.