Highlights

- Rising inflation has forced the Bank of Canada to continuously hike interest rates.

- The technology sector has taken a hit since the beginning of 2022.

- Canadian real estate sector has declined this year.

Consumer prices in Canada increased 6.8% year-over-year (YoY) in April, up from 6.7 per cent in March, according to Statistics Canada.

Food and shelter prices accounted for the majority of the year-over-year increase in April.

Rising inflation has forced the Bank of Canada to continuously hike interest rates. Some analysts believe that the central bank could further raise interest rates if the global economy continues to suffer.

After performing well in 2021, the S&P/TSX Composite Index continues to remain affected due to macroeconomic factors as the market is going through heavy turbulence at the moment.

Let's look at two top stocks that have declined massively this year:

Altus Group Limited (TSX:AIF)

Altus Group is a Canada-based real estate company that provides advisory services, software, and data solutions to companies involved in the real estate sector.

Not just Canada, the United States, Europe, and the Asia Pacific contribute to the company's revenue. At the time of writing, the AIF stock was trading three per cent lower at C$ 43.21 per share, slightly above the 52-week low of C$ 42.76 apiece.

Also Read: 3 TSX tech stocks to buy on the dip as sector slips 35% YTD

Despite the low share prices, the Altus Group's financials were strong in the first quarter of 2022. In Q1 2022, Altus said it delivered a 22 per cent YoY growth in its revenue and three per cent growth in adjusted EBITDA.

The consolidated revenues were C$ 167.6 million, and the consolidated adjusted EBITDA was C$ 17.7 million.

Shopify Inc. (TSX:SHOP)

Shopify is an e-commerce giant, but its stock has declined massively as the technology sector has dipped significantly this year. Compared to its 52-week high of C$ 2,228.73 per share, the stock was trading at just C$ 413.55 apiece at the time of writing.

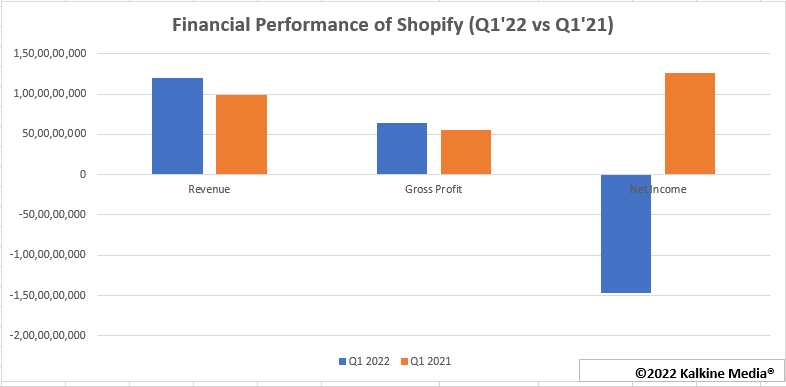

In Q1 2022, Shopify's revenue was US$ 1.2 billion, representing a YoY increase of 22 per cent. Meanwhile, the monthly recurring revenue jumped 17 per cent YoY.

The gross merchandise volume of the e-commerce giant grew at a two-year compound annual growth rate of 57 per cent to US$ 43.2 billion.

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.