Highlights

- Nutrien Ltd (TSX:NTR) stocks have been gaining attention from investors in the wake of the release of its financial results for the fourth quarter of fiscal 2021 on Wednesday, February 16.

- The agriculture stock closed higher at US$ 95.28 apiece on Wednesday, with 1 million shares exchanging hands.

- It was up by over three per cent, trading at C$ 98.4, at 10.20AM EST on Thursday morning.

Nutrien Ltd (TSX:NTR) stocks have been gaining attention from investors in the wake of the release of its financial results for the fourth quarter of fiscal 2021 on Wednesday, February 16.

The agriculture stock closed higher at US$ 95.28 apiece on Wednesday, with 1 million shares exchanging hands. It was up by over three per cent, trading at C$ 98.4, at 10.20AM EST on Thursday morning.

Nutrien is known for its integrated agricultural business in North America that sells crop inputs like fertilizers, seeds, nutrients etc., through its stores and online platforms.

Let us get straight to its latest earnings release and 2022 outlook.

Nutrien Ltd (TSX:NTR) Q4 FY2021 financial results

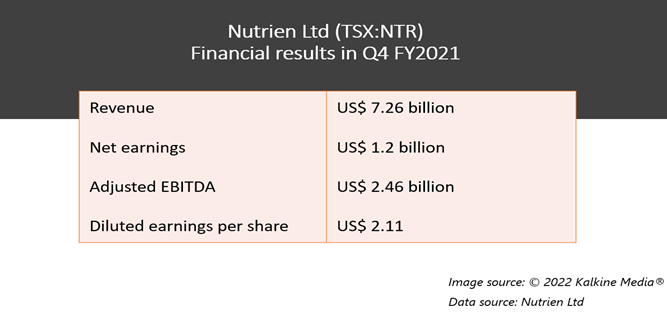

The Saskatoon, Saskatchewan-based company said that its sales grew by 79 per cent year-over-year (YoY) to US$ 7.26 billion in Q4 2021.

Nutrien’s net earnings catapulted to US$ 1.2 billion in the latest quarter, up 282 per cent YoY. The US$ 54-billion market cap company posted an adjusted EBITDA of US$ 2.46 billion in Q4 FY2021, noting an increase of 221 per cent over the past year.

Nutrien's diluted earnings rose by 284 per cent YoY to reach US$ 2.11 per share in the latest earnings.

Also read: Shopify (SHOP) stock is plummeting despite 41% Q4 revenue growth. Why?

The crop nutrients provider also recorded a free cash flow (FCF) of US$ 1.54 billion in the fourth quarter of 2021, up 690 per cent from the same quarter a year ago.

Nutrien said that is has hiked its quarterly dividend from US$ 0.46 per share to US$ 0.48 per share, payable on April 14.

Nutrien's 2022 outlook

The agriculture company has said that it expects its adjusted earnings per share to be between US$ 10.20 and US$ 11.80 in 2022. Nutrien company expects its adjusted EBITDA to be in the range of US$ 10 billion and US$ 11.2 billion.

The company also projected its potash and nitrogen sales volumes to increase this year, adding that it is "well positioned" on fertilizers and crop protection product inventory to kick off the planting season in North America.

Nutrien stock performance

Stocks of Nutrien galloped by almost 33 per cent in the last 12 months. The crop nutrient stock expanded by over 44 per cent from its 52-week high of US$ 66.05 (April 21, 2021).

Bottomline

Interim President and CEO of Nutrien Ken Seitz stated that the outlook for the international agriculture and crop input market is "very strong". Mr Seitz added that Nutrien is "well positioned" to capture the market opportunities and capitalize on the "earnings and free cash flow" front.

However, investors should do their own research about a company an its industry before investing.

Also read: Is Virgin Galactic (SPCE) a cheap space stock to buy?

Please note, the above content constitutes a very preliminary observation or view based on industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.