Source: MaxxiGo, Shutterstock

Summary

- While it is quite impossible to predict a stock’s future with certainty, one can study its recent performance to get a better idea.

- An expanding 5G rollout has brought this stock to limelight.

- This stock’s quarterly dividend, which currently stands at C$ 1.08 , grew 6.73 per cent in the past five years.

Investors are always looking for stocks which can grow their income. While it is quite impossible to predict a stock’s future with certainty, one can study its recent performance to get a better idea. So, based on recent stock movements and financial results, which TSX stocks appear to be dream picks for an investor’s kitty? Let’s take a look.

1. Rogers Communications Inc (TSX:RCI.B)

Canadian telecom giant Rogers Communications has been of interest to investors for some time now, especially with its expanding 5G rollout. But the announcement of its acquisition of peer Shaw Communications earlier this week drew even more attention.

As per Rogers’ agreement with Shaw, the merged entity will invest C$ 2.5 billion over a period of five years to expand the 5G network capacity in Western Canada further. It will also see a C$ 1 billion investment to bring high-speed internet services to rural and Indigenous communities in Canada.

©Kalkine Group 2020

While there has been some concerns about Rogers buying Shaw Communications with all its debt, the deal is likely to expand Rogers’ subscriber base and revenue. Once combined, Rogers and Shaw could also give rival BCE Inc a competition in terms of market cap.

Rogers stock offers a quarterly dividend of C$ 0.5, which currently holds a dividend yield of 3.263 per cent at the moment, as per TMX data. The telecom stock grew about 12 per cent in March and nearly seven per cent in the last one year.

2. Royal Bank of Canada (TSX:RY)

The Bank of Canada had stressed through 2020 Canada’s top six lenders were capitalized enough to survive the pandemic without risking their own solvency.

Many worried about this. The Royal Bank of Canada (aka RBC), for instance, saw its net income slide 11 per cent year-over-year (YoY) to C$ 11.4 billion in the fiscal year ending 31 October 2020.

But then came the first quarter of fiscal 2021, ending 31 January 2021, and RBC’s latest financials recorded a 10 per cent YoY jump in its net income of C$ 3.8 billion. This increase was primarily boosted by lower bad loan provisions and reflected Canada’s turn to economic recovery from the pandemic crisis.

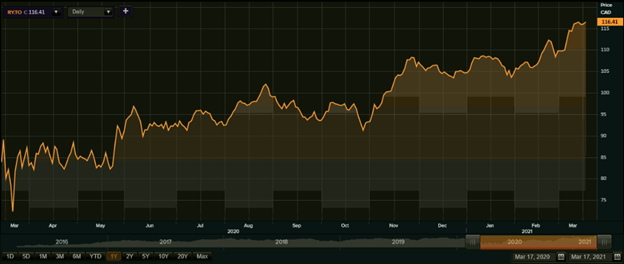

RBC stock rose by nearly 31 per cent in the past one year and by over 11 per cent this year. Its quarterly dividend, which currently stands at C$ 1.08 , grew 6.73 per cent in the past five years.

1-year chart of RBC’s stock performance (Source: Refinitiv/Thomson Reuters)

3. Canopy Growth Corporation (TSX:WEED)

The hope of a Democrat government bringing pro-cannabis bills and federal legalization of recreational pot in the US has been pumping cannabis stocks in Canada for a while now. Within the home country, studies showed that cannabis usage among adults spiked significantly through the pandemic last year.

With all these factors playing a role, stocks of Canopy Growth surged by over 35 per cent this year. Following the release of its Q3 FY21 financials, Canopy Growth scrips soared to a record day high of C$ 71.6 on February 10. The session finally closed at C$ 66.21, Canopy’s highest closing stock price of 2021 so far.

Canopy Growth currently has a presence in three international cannabis markets — Canada, the US and Germany. Over past few years, the Canadian pot manufacturer has been working on expanding its market further and making a stronger presence for itself in the pot industry biosphere.

In terms of expanding its US market, Canopy holds the options to buy New York-headquartered Acreage Holdings as well as acquire a substantial stake in TerrAscend, which reportedly holds a cultivation permit in New Jersey. The company also launched several CBD products in partnership with celebrity chef Martha Stewart last year with the goal of expansion in mind.

©Kalkine Group 2020

4. Magna International Inc (TSX:MG)

Canadian electric vehicle maker Magna International attracted investors’ attentions with its latest financial results last month. Its stocks shot up by over 19 per cent in the span of February, pulling its YTD growth to 27 per cent.

Like most carmakers, Magna too faced major operational and production disruptions in early 2020 due to the rising cases of COVID-19. But the EV maker rebounded from the drop in its performance by the end of the year, reporting a 12 per cent YoY increase in its Q4 2020 sales of US$ 10.6 billion.

Its income from operations (minus taxes) stood at US$ 973 million in the fourth quarter, up from that of US$ 579 million in Q4 2019.

For 2021, Magna expects to secure a revenue in the range of US$ 30 billion to US$ 41.6 billion. It also expects to hit a sales target of US$ 43-45.5 billion by 2023.

As pointed above, a stock’s future movement is not set in stone. Investors should do there own due research before going ahead with any form of investment decisions.

The above constitutes a preliminary view and any interest in stocks should be evaluated further from investment point of view.