Canadian markets noted a broad-based weakening on Monday, July 19, as rising Delta variant COVID-19 cases and falling oil prices hammered investor confidence.

The S&P/TSX composite index sank by 1.3%, or 259.09 points, to settle at 19.726.45, its lowest level since May 2021.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies’ decision to increase the monthly oil supply from August saw oil prices tumble on Monday. The TSX composite energy index, in turn, dropped 3.79%, with the share prices of Parex Resources and Whitecap Resources falling 6.4% and 6.0%, respectively.

As Delta variant cases continue to surge, the uncertainty in commodities saw the base metal sector tumble by 2.65% on Monday. Financial and industrials sectors also declined by 1.95% and 1.20%, respectively. Among the major TSX constituents, only the technology sector moved up by around 0.51%.

1-Year Price Chart. Analysis by Kalkine Group

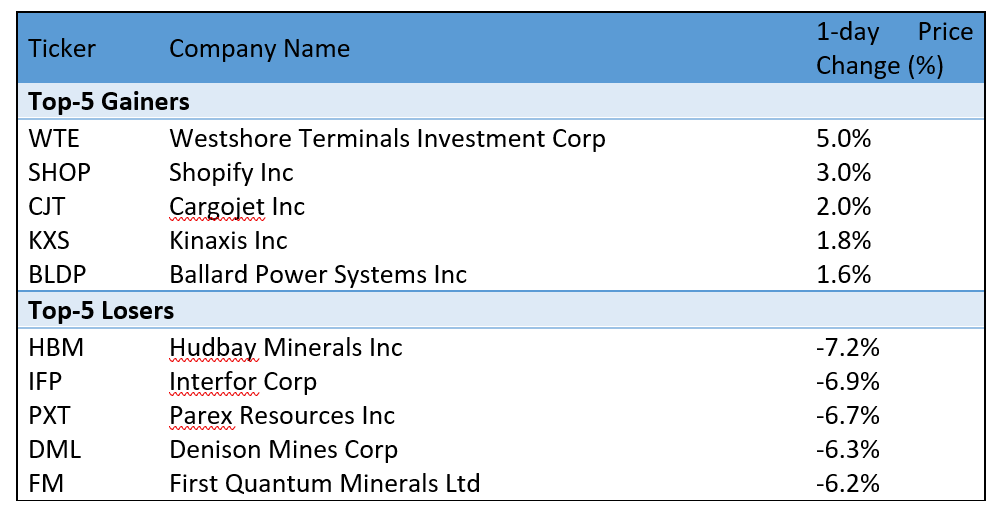

Gainers and Losers

Actively Traded Stocks

The most actively traded stocks on the TSX on Monday were Enbridge Inc, with a trading volume of 14.85 million, followed by Suncor Energy Inc, with that of 12.07 million, and Bombardier Inc, with that of 11.37 million.

Wall Street Update

As regional governments across the US imposed further limitations to combat the Delta strain, Wall Street noted a significant drop on Monday.

In its worst session of 2021 to date, the Dow Jones Industrial Average dropped 2.1% to 33,962,04, the S&P 500 fell 1.6% to 4,258.49, and the Nasdaq shed 1.1% to 14,274.98.

Commodity Update

Gold traded with negative biasness at US$ 1,809.20, down 0.39%.

Following the OPEC and its partners’ decision, WTI Crude Oil slipped 6.63% to US$ 66.42/bbl and Brent Oil fell 6.10% to US$ 68.62/bbl.

Currency News

The Canadian Dollar stood weak against the US Dollar for the fourth straight session on Monday, while USD/CAD closed at 1.2751, up 1.05%.

The US Dollar index stood firm against the basket of major currencies, up 0.24% at 92.88.

Money Market

The US 10-year bond yield tumbled for the fifth day and closed at 1.207, down 4.86%.

The Canada 10-year bond yield, on the other hand, tanked 7.49% and closed at 1.148 on Monday.

.png)