The TSX Composite Index fell again Tuesday, May 10, by 109.63 points, 0.55 per cent, to close at 19,890.06. Considering it touched its all-time high of 22,213.07 earlier this year, there may well be a correction on the cards.

However, base metals gained 0.4 per cent. Tech lost over one per cent and the S&P/TSX Capped Information Technology Index is nearly 40 per cent in the red this year. Meanwhile, healthcare lost 5.5 per cent and the others were in the red as well, including energy and financials.

One-year price chart (May 10). Analysis by © 2022 Kalkine Media®

Volume actives

Enbridge Inc saw 33.4 million shares traded, making it the most active stock. It was followed by Cenovus Energy Inc that saw over 15 million shares switch hands, and Suncor Energy Inc saw 12.7 million shares traded.

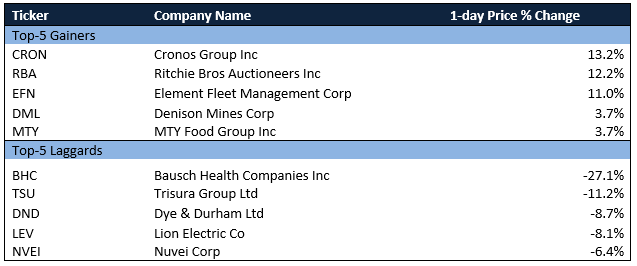

Movers and laggards

Wall Street updates

On Wall Street, there was a bit of a rebound. The S&P 500 was up by 9.81 points, 0.25 per cent, to 4,001.05 and Nasdaq’s benchmark grew by 114.42 points, nearly one per cent, to 11,737.67. The Dow, however, lost 84.96 points, 0.26 per cent, to close at 32,160.74.

Commodities update

Gold was down 0.95 per cent to US$ 1,841.00. The price of Brent oil fell 3.28 per cent and was at US$ 102.46/bbl and that of crude oil sank 3.23 per cent to US$ 99.76/bbl.

Currency news

The loonie lost 0.12 per cent compared to the US dollar while USD/CAD ended at 1.3023. The US Dollar Index was at 103.94 against the basket of major currencies, up 0.28 per cent.

Money market

The US 10-year bond yield fell 1.48 per cent to 2.989 and the Canada 10-year bond yield was down 0.4 per cent to 3.010.