The TSX Composite Index fell on Tuesday, April 5, after it was reported that six of Canada’s major lenders expect a 50-basis-point hike by the Bank of Canada. All the major indices were in the red with energy down 1.6 per cent.

Healthcare lost 2.6 per cent and industrials and base metals over one per cent and four per cent, respectively. Lithium Americas Corp’s stock lost 10.6 per cent. Canada’s benchmark index closed at 21,930.83, down 154.77 points, 0.7 per cent.

One-year price chart (April 5). Analysis by © 2022 Kalkine Media®

Volume actives

Toronto-Dominion Bank saw 16.6 million shares traded, making it the most active stock. It was followed by TC Energy Corporation that saw over 9.9 million shares switch hands, and the Bank of Nova Scotia saw 8.8 million shares traded.

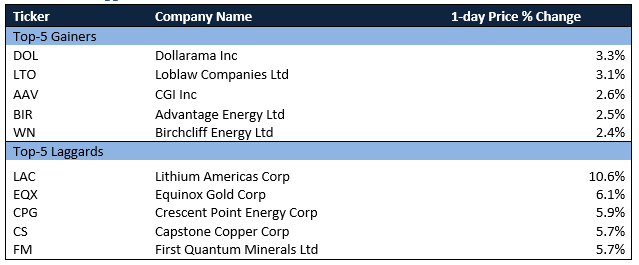

Movers and laggards

Wall Street updates

The Dow sank by 280.7 points, 0.8 per cent, to 34,641.18 points, while the S&P 500 was lower by 57.52 points, 1.26 per cent, to 4,525.12 points. Nasdaq’s benchmark plummeted 328.39 points, 2.26 per cent, to 14,204.17.

Commodities update

Gold lost 0.33 per cent to US$ 1,922.90. The price of Brent oil was down 0.83 per cent and was at US$ 106.64/bbl and that of crude oil was down 1.28 per cent to US$ 101.96/bbl.

Currency news

The loonie gained 0.01 per cent compared to the US dollar while USD/CAD ended at 1.2485. The US Dollar Index was at 99.48 against the basket of major currencies, up 0.49 per cent.

Money market

The US 10-year bond yield was up by 6.73 per cent to 2.554 and the Canada 10-year bond yield was up by 3.28 per cent to 2.516.

.jpg)