S&P/TSX Composite, the broad Canadian equity Index, settled higher for the second consecutive day (September 25), bagging ~153 points or 0.96% to 16,065.35. Technology and utilities stocks stole the show. At the closing, TSX featured a dividend yield of 3.61% and traded at a Price-to-Earnings (PE) multiple of 17.63x.

Five-day price chart (as on September 25, 2020, after market close); Source: Refinitiv (Thomson Reuters)

Post two consecutive days of rise, the index traded above its crucial long-term support levels of 100-day and 200-day Simple Moving Averages (SMAs). However, it traded below the short-term crucial support levels of 50-day and 30-day SMAs.

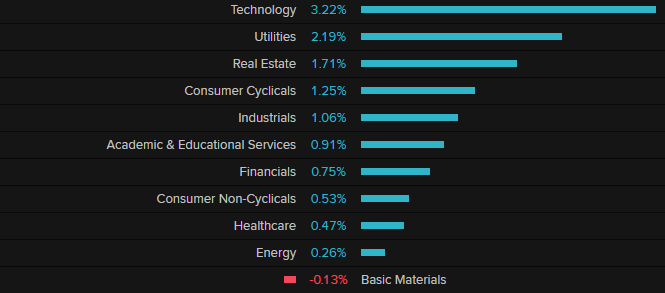

TSX Sector Summary

Gainers: Technology (up 3.22%), Utilities (up 2.19%) and Real Estate (up 1.71%)

Losers: Basic Materials traded in red (down 0.13%).

Source: Refinitiv (Thomson Reuters)

Stock Cues*

Top Gainers: Cascades Inc (up 8.24%), Brookfield Renewable Partners (up 6.84%) and Shopify Inc (up 6.09%) respectively.

Top Laggards: First Majestic Silver Corp (down 6.87%), Vermilion Energy Inc (down 6.73%), Seven Generations Energy Ltd (down 5.08%) respectively.

Volume Leaders: Just Energy Group Inc., Zenabis Global Inc. and Bank of Nova Scotia

On Wall Street: Stocks on the Wall Street extended gains for the second straight day, with the Dow Jones Industrial Average bagging 358.52 points or 1.34% to 27,173.96. Nasdaq Composite Index gained 241.30 points or 2.26% to 10,913.56, and the S&P 500 index surged 52 points or 1.60% to 3,298.46.

Commodity Cues*

International crude oil benchmark Brent went down marginally on Friday and settled at US$ 41.92/bbl. The WTI Crude Oil declined 0.15% to US$ 40.25/bbl.

Gold Futures impaired gains it accumulated in the previous trading session and declined 0.56% to US$ 1,866.3/oz on Friday.

*Details as on 25 September 2020 (after markets close)