Highlights:

- Some analysts believe that Russia's decision to invade Ukraine will directly impact Canada.

- Russia and Ukraine have been in a state of conflict since 2014, and on Friday, Russian troops reportedly entered the Ukrainian capital with gunfire and explosions.

- The global equities markets are witnessing turbulent times.

The global equities markets are witnessing turbulent times due to the ongoing crisis between Russia and Ukraine. While the conflict may be happening in some other part of the world, it is expected to affect the entire world.

Some analysts believe that Russia's decision to invade Ukraine will directly impact Canada and is expected to contribute to the rising inflation and increasing commodity prices.

On Thursday, February 24, Russia launched a full-scale military action against Ukraine, and it is probably the largest conventional warfare operation in Europe since World War II.

Russia and Ukraine have been in a state of conflict since 2014, and on Friday, Russian troops reportedly entered the Ukrainian capital with gunfire and explosions.

Also Read: Dollarama (TSX:DOL) & Lululemon: Why are the consumer stocks trending?

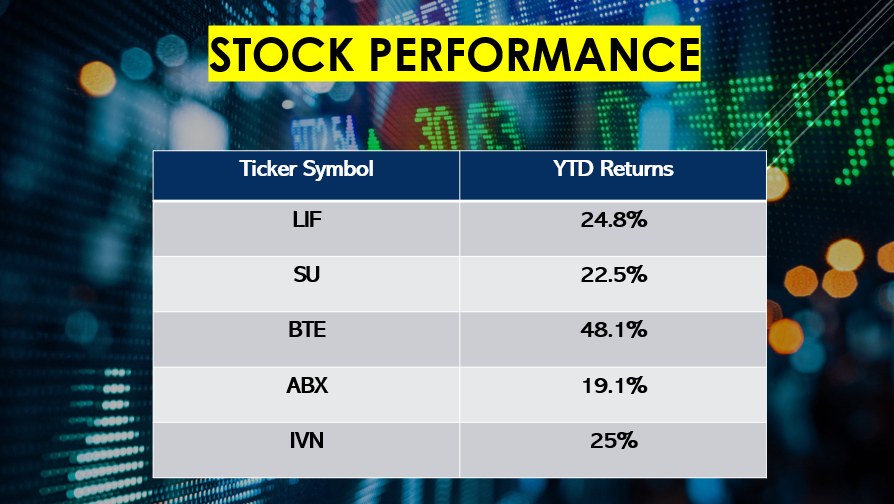

As the ongoing crisis between nations continues and impacts commodities, let's explore five stocks to buy in March.

1. Labrador Iron Ore Royalty Corporation (TSX:LIF)

During times of uncertainty, market volatility, and rising inflation, people often look for additional sources of income. Dividend stocks could be an option for investors, and Canadian investors could look at Labrador Iron.

The Canadian corporation is one of the top dividend stocks listed on the Toronto Stock Exchange, and on Monday, February 28, the LIF stock closed 3.4 per cent higher at C$ 46.82 per share.

Labrador Iron distributes a dividend of C$ 1.15 per unit to shareholders quarterly and holds a dividend yield of 9.8 per cent.

2. Suncor Energy Inc. (TSX:SU)

One of the largest energy stocks in Canada, Suncor Energy is the most actively traded oil and gas stock on the TSX. On February 28, 25.875 million SU shares traded hands, and it jumped 2.4 per cent during the trading session to close at C$ 38.76 apiece.

Despite market volatility, the energy sector performed well in Canada and rose 2.6 per cent on Monday. In Q4 2021, Suncor Energy had reported adjusted operating earnings of C$ 1.29 billion compared to an adjusted operating loss of C$ 109 million in Q4 2020.

Suncor returned C$ 3.9 billion to shareholders in 2021, of which C$ 1.6 billion was distributed through dividends and the remaining through share repurchases.

©2022 Kalkine Media®

©2022 Kalkine Media®

3. Baytex Energy Corp. (TSX:BTE)

If you are not looking to invest in expensive stocks, then Baytex Energy could be a smart option to explore as it comes at a low price. At market close on February 28, the BTE stock was priced at C$ 5.79 per share.

During the trading session, 11.12 million BTE shares exchanged hands on the TSX, and it is one of Canada's most actively traded stocks.

Baytex is engaged in exploring and producing crude oil and natural gas in Canada and the United States. In 2022, the company expects to produce 80,000 to 83,000 barrels of oil equivalent per day.

4. Barrick Gold Corporation (TSX:ABX)

Gold prices soared to a record high when tensions escalated between Russia and Ukraine. However, the rally did not continue for long. Barrick Gold is among the top metals stock in Canada, and its trading volume was 6.78 million shares on February 28.

In 2021, Barrick's production was in line with guidance for the third consecutive year. In Q4 2021, Barrick's net earnings were US$ 726 million, up from US$ 347 million in Q3 2021.

Barrick produced 4,437 thousand ounces of gold in 2021 and 415 million pounds of copper. The ABX shares were priced at C$ 28.65 apiece at market close on Monday.

5. Ivanhoe Mines Ltd. (TSX:IVN)

The stock of Ivanhoe Mines climbed 8.8 per cent to close at C$ 12.9 per share. Ivanhoe Mines is engaged in exploring and developing platinum, nickel, copper, and gold, among other metals.

The company provided guidance for Kamoa-Kakula copper complex and said it expects to produce copper between 290,000 to 340,000 tonnes.

Ivanhoe Mines achieved a record monthly production of 18,853 tonnes of copper in December 2021, and the plant recovery averaged 88.5 per cent.

Also Read: 5 best TSX consumer defensive stocks of 2021

Please note, the above content constitutes a very preliminary observation or view based on market trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.