Phoenix, Arizona--(Newsfile Corp. - June 17, 2025) - Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) ("Gunnison" or the "Company") is pleased to provide an update on the high-value-add ("HVA") work programs at the Gunnison Copper Project ('Project') in southeast Arizona. All dollar amounts in this press release are in United States dollars.

"We are excited the HVA programs are underway, progressing on-time and under-budget, with numerous catalysts in the next several months," states Roland Goodgame, Gunnison SVP of Business Development. He adds, "the HVA programs have the potential to enhance the Gunnison Copper Project's robust economics and will provide valuable guidance for the up-coming PFS. We are aggressively moving the Gunnison Open Pit forward, which is one of the largest copper projects in development in America. We are equally excited about our soon-to-be-producing Johnson Camp Mine, all at a pivotal time for copper in Arizona meeting the need for domestic copper production."

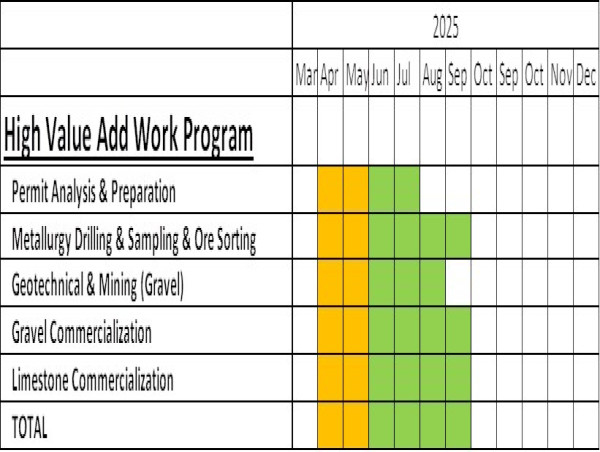

In preparation for the Gunnison Copper Project pre-feasibility study ("PFS") the Company commenced what it identified as the high-value-add work programs (See press release dated April 14th, 2025). These programs are expected to take 3-6 months to complete, which are on schedule and under budget. (See Figure-1). An update on the HVA work programs are below:

Gravel By-Product Revenue - An experienced consulting firm has been engaged to investigate the viability of marketing gravel and limestone. Their geologists and engineers are currently reviewing the data that has been supplied. Once the data review is complete, they will advise the Company on the economic viability of the approximately 760 million tons of alluvial gravel that is expected to be mined during the mine life. The mining of the alluvial gravel is already fully costed as waste in the Gunnison Copper Project Preliminary Economic Assessment ("PEA"). However, it is anticipated that some of this material has commercial value. As detailed in the PEA, if just 10% of this material could be sold for revenue of $5/ton, it could potentially add $380M in revenue to the Project. The revenues associated with such sales are not anticipated to have any material costs (aside from marketing costs) as the material has already been mined and requires minimal further processing*.

Limestone By-Product Revenue - As mentioned above, the experienced consulting firm is investigating the viability of marketing gravel and limestone by-products from the Gunnison open pit. The geologists are currently reviewing the existing drill core in preparation for sampling and analysis (see Figures 2A to 2D). Once the analysis is complete, they will advise on the economic viability of the 85million tons of Escabrosa limestone that is expected to be mined as waste in the Gunnison open pit (additional limestone occurs in the overlying Horquilla formation). The mining cost of this material is already included in the PEA so any value from the sale of this by-product should be highly accretive. For example, crushed limestone is a highly valuable commodity in cement, aggregate, chemical and agricultural industries, selling for between $20/ton and over $60/ton in the region. As detailed in the PEA, if 50% of this limestone could be sold at $20/ton it could generate approximately $850M in additional gross revenue. The revenues associated with such sales are not anticipated to have any material costs (aside from marketing costs) as the material has already been mined and requires minimal further processing*.

Mineralized Material Sorting - Drilling of all 3 holes totaling 3,899 feet targeting oxide mineralization in the Martin and Abrigo formations were competed in May. Drilling costs were cheaper than budgeted due to high drill production rates. The holes are currently being scanned in Salt Lake City using LIBS (Laser-Induced Breakdown Spectroscopy). Following LIBS scanning, the core will be sent for assaying and extensive mineralogical testing. The mineralized material sorting plan has been completed, and testing is scheduled for the weeks of August 4th and 25th. (See Figure-3 for results of early test work completed in 2024)

Permitting - Gunnison's prior permitting and community track record is excellent. There is no federal permitting required. The Gunnison Copper Project is permitted today for in-situ recovery; however, amendments are needed. Trinity Consultants (Air Quality Permit) and Clear Creek (APP) have been engaged and have produced drafts for the permitting process.

Sulfide Investigation - Sulfide mineralization occurs in the bottom of the Gunnison Copper Project open pit design. Due to the previous ISR mining method the sulfide potential has been mostly untested. The plan is to collect appropriate samples and initiate metallurgical test work. The sulfides have the potential to add mine life, production rate and excite strategic interest such as the recent interest from Nuton LLC (a Rio Tinto Venture) who have an agreement with Gunnison to test the suitability of its proprietary sulfide leaching technology for the Project's sulfide resources (see press release dated March 3, 2025). As an example, one of the recent HVA drill holes intersected coarse grained copper sulfide mineralization in quartz veins related to porphyry dyke intrusions at depth in hole NSM-16 (see Figure-4). This hole is yet to be assayed.

Figure-1. Gunnison High-Value-Add work program shown in the table above.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/255792_d2a778d354217b93_002full.jpg

Figure-2A to 2D Limestone Core. The four images above show limestone material in core from Hole NSD-41 at the Gunnison project. Figure 2A shows the white limestone starting at ~395 below surface, immediately below the base of the alluvium (gravel) overburden. Figure 2B shows the limestone at 575 feet. Figure 2C shows the limestone at 775 feet and Figure 2D at 975 feet, demonstrating an extensive thickens of limestone. These drill core samples have not yet been assayed for mineral content and the Company will provide disclosure of assay data when available.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/255792_gunnfig2ato2d.jpg

Figure-3. Red-brown and green-blue copper oxide mineralization shown in drill core above is highlighted by the green boxes. This mineralized material is confined to discrete mineralized intervals between un-mineralized waste. Material sorting has the potential to separate the visibly distinct mineralized material from the waste. Samples sent to a material sorting laboratory in 2024 (bottom images) showed 100% separation of mineralized material from waste material simply based on the presence of green coloration (copper oxide) in the sample. The HVA drilling program is collecting a number of bulk samples for further testing.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/255792_d2a778d354217b93_011full.jpg

Figure-4. Example of copper sulfide mineralization intersected in NSM-16 from the recent HVA drilling program. For scale the drill core is 85.0 mm (3.345 inches) in diameter.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/255792_d2a778d354217b93_012full.jpg

* This does not include the costs of making this material marketable, and there is no guarantee it can be made marketable.

All dill holes have been drilled using diamond drill rigs to generate PQ sized core and assays are underway for all holes. All samples are prepared from manually split or sawn PQ core sections on site in Arizona. Split drill core samples are then sent to independent laboratory Skyline Assayers & Laboratories in Tucson, Arizona for Total Copper and Sequential Copper analyses. Standards, blanks, and duplicate assays are included at regular intervals in each sample batch submitted from the field as part of an ongoing Quality Assurance/Quality Control Program. Pulps and sample rejects are stored by Gunnison for future reference.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Gunnison exists to develop and operate copper mines in Southern Arizona to produce fully Made in America finished copper cathode to directly supply American energy, defense, and manufacturing supply chains. Gunnison proudly hires locally, purchases locally, and sells its products for use in America. Gunnison invests in its employees, their families, and the communities around it. Gunnison operates safely and responsibly with a focus on technology and positive societal impact, while also emphasizing long-term value creation for stakeholders.

Its flagship asset, the Gunnison Copper Project, has a measured and indicated mineral resource containing over 831 million tons with a total copper grade of 0.31% (measured mineral resource of 191.3 million tons at 0.37% and indicated mineral resource of 640.2 million tons at 0.29%), and a preliminary economic assessment ("PEA") yielding robust economics including an NPV8% of $1.3Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

In addition, Gunnison's Johnson Camp Asset, which is under construction with first copper production expected in Q3 2025, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company's technical report entitled "Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment" dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Mr. Twyerould has reviewed and is responsible for the technical information contained in this news release. Mr. Twyerould has verified the data disclosed in this news release, including sampling, analytical and test data underlying the information disclosed in this news release. Mr. Twyerould has verified that the results were accurate from a visual inspection of the core samples.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Shawn Westcott

T: 604.365.6681

E: [email protected]

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the future development plans for the Gunnison Project; (ii) the details of the HVA including its objectives, expected results and timelines; (iii) the results of the PEA including operating and capital costs estimates, along with the economics of the Gunnison Project; (iv) the intention to mine the Gunnison Project and future production therefrom; (v) risks and opportunities associated with the Gunnison Project; (vi) expectations regarding permitting of the Gunnison Project; and (vii) the future completion of a PFS.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects" or "does not expect", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the Company will continue to have access to financing to support operations, the estimation of mineral resources, the realization of resource estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be commenced at the Gunnison Copper Project, risks relating to the failure to raise new financing to support operations, variations in mineral resources, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company's business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255792