Highlights

- SundaeSwap, a DeFi protocol, has now launched on Cardano network

- Reports suggest a little congestion and errors experienced by users of the SundaeSwap DEX

- ADA price movement would also rely on how SundaeSwap performs in the coming days

Decentralized finance or DeFi is a leading sub-category within the cryptocurrency world.

Cardano, a major competitor to Ethereum’s blockchain network, has also jumped onto the DeFi craze, with SundaeSwap having lunched on Cardano’s blockchain.

What is SundaeSwap?

Allowing swapping and staking of crypto assets, SundaeSwap is the latest entrant in DeFi. Dedicated crypto exchanges like Coinbase differ from DeFi. The former only allow buy and sale of assets, while the latter allow earning prospects from crypto holding without selling.

By depositing crypto holding on the SundaeSwap DeFi, users collectively add to liquidity. The platform also allows yield farming, which is a sort of interest income in the crypto world. Here, users lend their assets and earn new cryptocurrencies as interest.

Also read: Why is crypto market down? 5 key reasons

How is SundaeSwap different?

SundaeSwap is built on Cardano, which allowed deployment of smart contracts after the much-hyped Alonzo hard fork last year.

Other DeFi protocols use Ethereum or Binance Smart Chain. Uniswap is a popular DEX on Ethereum, and PancakeSwap harnesses the potential of BSC.

SUNDAE token

SundaeSwap will have SUNDAE as its governance token. Holders of SUNDAE crypto will be able to participate in voting for governance decisions of the platform.

Cardano ADA price prediction

With the launch of SundaeSwap, Cardano has emerged as a blockchain network of utility.

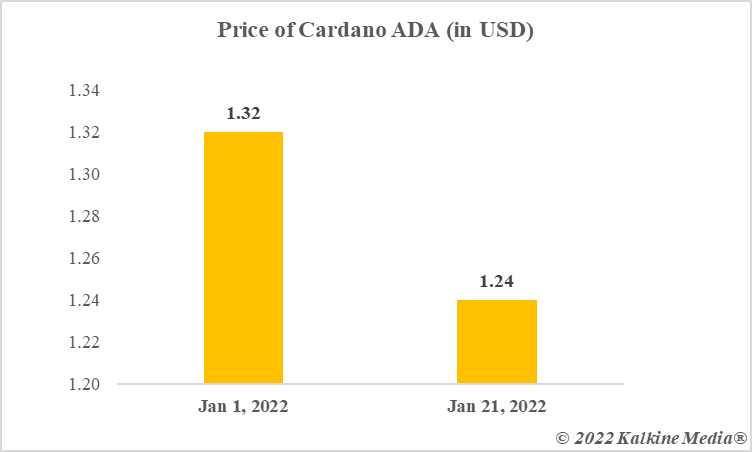

The market cap of ADA is over US$41 billion as of now, but the price per token is US$1.2. This makes ADA one of the lowest priced high market cap cryptocurrencies. Solana (SOL) was priced at the same level in January 2021, but it breached US$100 price level in the following months.

Also read: Why are NFTs valuable?

Cardano’s blockchain may find further use in deployment of more decentralized solutions. This would lead to a demand for the native token ADA, which is used to pay the network fee.

The current subdued price of ADA is also a product of a wider bearish phase in the crypto world. Bitcoin and most other high market cap cryptos have lost value this year. Ethereum’s token Ether is trading at a loss.

But a bullish trend in ADA may take price to over US$10 by the end of first half of 2021. This, however, would depend on how SundaeSwap DeFi stabilizes in the near-term, and on the trajectory of BTC and Ether in the medium-term.

Data provided by CoinMarketCap.com

Bottom line

SundaeSwap establishes the utility of Cardano network in DeFi space. Initial reports claim a few failed transactions on the platform soon after the launch. Both SUNDAE and ADA tokens would rely on how the platform establishes itself in the already-crowded DeFi space.

_09_03_2024_01_03_36_873870.jpg)