Highlights:

- ASX 200 All Technology index surged by 12.11% in the past five years.

- All Technology index increased by 1.35% on 22 December 2022.

- Meanwhile, ASX 200 increased by 0.49%.

Australian all technology index S&P/ASX 200 All technology (INDEXASX:XTX) features technology companies across a range of sectors, according to ASX. At the time of launch on 24 February 2022, the index comprised 46 companies, and as of March 2022, the index has grown to 72 companies.

Worth mentioning here is that there is no market capitalisation on the number of companies in the index. All technology companies that are eligible for inclusion are included at the time of quarterly rebalance.

All technology index was up 1.35% to 2,026.30 points at 11:17 AM AEDT (as of 22 December 2022). In the past five years, the index has gained 12.11%, and in one year, the index has lost 31.76%. For context, the NASDAQ-100 Technology sector index closed 1.48% higher on 21 December 2022.

Meanwhile, ASX 200 (INDEXASX:XJO) was 0.53% up at 7,152.50 points. Today, ten out of eleven significant sectors were in green along with the index. Information technology sector marked the highest gain of 1.15% as of 11:24 AM AEDT.

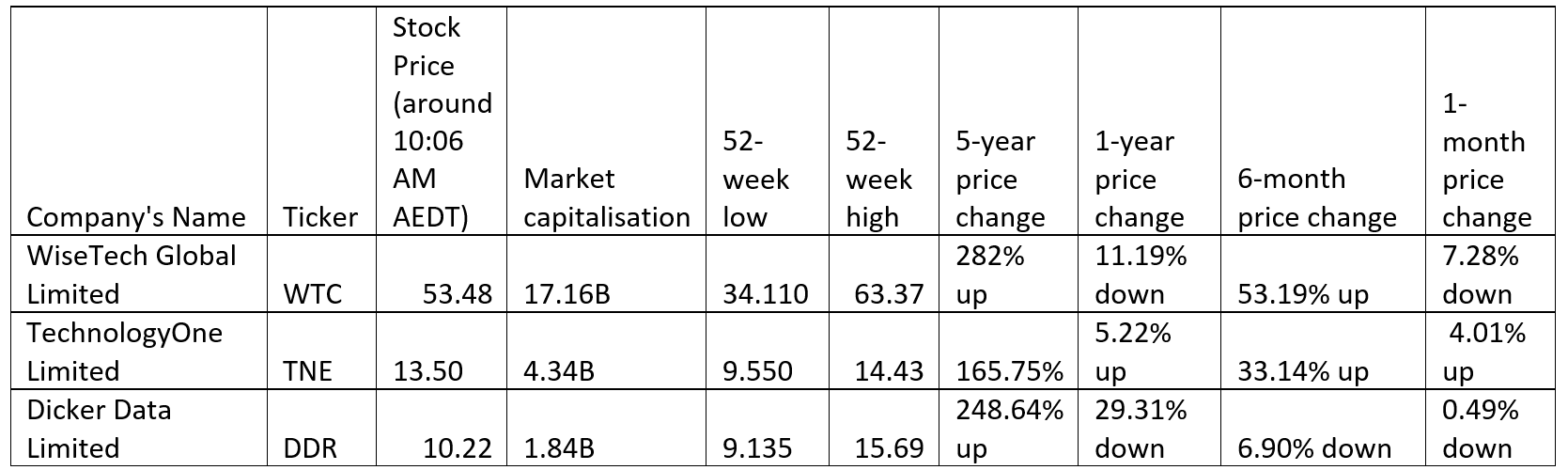

In this article, those ASX technology companies have been discussed, which has gained more than 100% in the past five years. The stocks discussed are WiseTech Global Limited, TechnologyOne Limited, and Dicker Data Limited.

WiseTech Global Limited (ASX:WTC)

The products offered by WiseTech empower those companies that operate and own the supply chain globally. WiseTech was founded in 1994 by Maree Issacs and Richard White. They began by writing code for freight forwarders. To expand its customer base in Australia, the company undertook its first acquisition in 1999.

In 2016, the company got listed on ASX with a value of AU$1 billion (according to the official website), and in 2017, the company marked its entry in ASX 200. In 2021, it entered ASX 50.

This year, WiseTech reported 43 large global freight forwarder rollouts, amongst which ten achieved the top 25 global freight forwarders ranking.

According to the company’s official website, more than 18k customers are using the WiseTech software, 1,199 product enhancements were reported in FY22 (financial year 2022), and around 170 countries are licensed to use the software.

In FY22, the company registered a 25% surge in its total revenue over the previous year. Revenue from the CargoWise platform grew by 35%. The revenue was driven by 89% recurring revenue and an attrition rate of around 1%. EBITDA increased by 54%, operating cash flow by 48%, statutory NPAT by 80% and underlying NPAT by 72% over the previous year.

In FY23, the company expects 20-23% growth in total revenue and 30-35% growth in CargoWise revenue. The expected growth in EBITDA is 21-30%.

TechnologyOne Limited (ASX:TNE)

TechnologyOne offers pre-configured, integrated solutions to its client that help in reducing risk, cost, and time. The company offer its services to local government, government, education sector, financial organisation, health and community organisations and the construction industry.

Established in 1987 by Adrian Di Marco to undertake research and employ technology to create resale products. In 1999, the company got listed on ASX. TechnologyOne said that since the listing, profitability and revenue have doubled every four to five years.

The company has grown via undertaking acquisitions. In 2000, Proclaim, a local government software company was acquired, and in 2007, Avada was bought. In 2015, the company undertook three acquisitions: Jeff Roodra & Associates, Icon, and Digital Mapping Solutions.

In FY22, the company recorded SaaS ARR growth of 43%, total ARR growth of 25%, and net profit after tax increased by 22%. Cash and cash equivalents grew by 22%, and cash flow generation by 21%.

By FY26, the company targets to surpass ARR by AU$500 million and aims at doubling its size in every five years.

Dicker Data Limited (ASX:DDR)

Dicker Data is a technology software, hardware, and cloud distributor with more than 44 years of experience. According to the company’s official website, the company exclusively sell its products and services to its partner base of more than 6,000 resellers.

The company adopts a customer-first approach; that is, the organisation proactively engages with resellers, which helps in shifting dynamically with market conditions.

Founded in 1987, the company distributes a wide portfolio of products from the technology vendors like Microsoft, Cisco, Dell Technologies, HP, Lenovo, Citrix, Hewlett Packard Enterprise and so on.

The last trading update provided by the company was on 31 October 2022. During the third quarter of FY22, unaudited revenue increased by 19% over the previous year, and profit grew by more than 63%. In year-to-date, ending on 30 September 2022, EBITDA increased by 8.9%, and revenue grew by 29.9%.

Dicker Data said that overall profitability was affected by the cost associated with increasing depreciation, amortisation, freight costs, and interest rate.

_12_22_2022_00_49_58_435892.jpg)