A technology company whose business is growing from strength to strength across major geographies, with a 4-year revenue CAGR of ~115%. The stock is up multi folds during the same time, and on a YTD basis has beaten the ASX bench mark indices by a wide margin.

Founded in 2013 by entrepreneur Bevan Slattery in Australia, Megaport Limited (ASX:MP1) provides Elastic Interconnection services worldwide. The company’s technology platform enables customers to connect their network to other services across the Megaport Network quickly.

Megaport currently serves more than 1,842 customers from 700 enabled data centres globally. The company recently expanded into Denmark and Spain, making its platform available across 128 cities in 23 countries.

Megaport has partner agreements with Alibaba, Amazon, Google, IBM, Microsoft, Nutanix, Oracle, Rackspace, Salesforce, and SAP for its cloud and networking services.

Major customers: Amazon, Facebook, Tesla, Salesforce, Adobe, BHP Group Ltd (ASX:BHP), FedEx, ING, Tesla, and Zoom.

Product USP: The Company’s technology platform uses Software Defined Networking (SDN) technology that enables customers to connect their network to other services across the Megaport Network quickly. Customers can control the services based on their requirement via mobile devices, their computer, or using company’s open API. The service allows users flexibility in choosing bandwidth rather than being stuck with long-term deals with higher tariffs.

ASX introduction

The company got listed at A$2.18 on ASX in December 2015 and started trading from 18 December 2015. Since then Megaport’s share price has increased by almost 757% and currently trading at $15.85 (as on 4 September 2020). In the past three years, the share price has increased more than 7x.

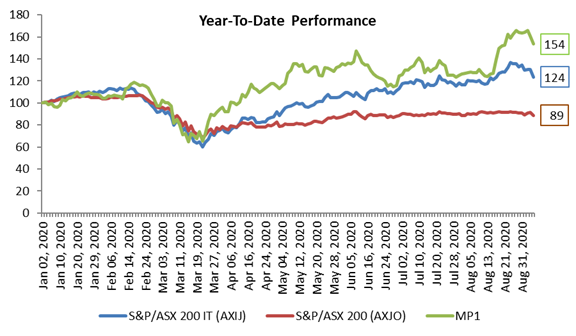

We can see that Megaport has performed incredibly well as compared to benchmark indices S&P/ASX 200, and S&P/ASX 200 IT. On year-to-date, Megaport has delivered a return of 54% as compared to S&P/ASX 200 (-11%) and S&P/ASX 200 IT (24%), as on 04 September 2020.

In the last month alone, the company has experienced a share price rise of almost 25%, demonstrating investor’s interest in the company. The company has been recording continuous positive topline growth since last 4 years. The CEO expects the company to attain a breakeven EBITDA in the near future on the back of the FY 2020 performance.

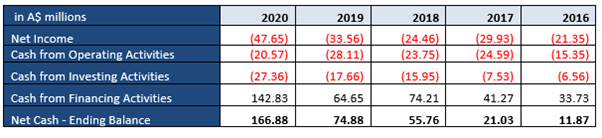

Financial Metrics

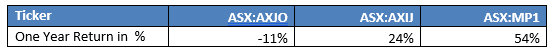

Over the five years to FY20 ending 30 June, the company has grown its topline from $2.68 million in 2016 to $58.04 million in 2020 at a CAGR of 115.72%. The growth has been backed by the increasing demand for cloud based connectivity services in the market along with company’s investment towards business expansion.

Gross profit increased from a negative $1.54 million in FY16 to $29.52 million in FY20. Gross profit went positive in 2018, with a margin of 23%. In FY20, Gross margin increased to 51%.

Except Germany, revenues have increased considerably, across all regions in FY20, to $58.04 million. The United States Market has seen significant growth since 2017, now contributing almost 34% of the total revenue. The Australian market has also experienced a boost with almost 35% to the total revenue.

Operating expenses increased from $24.02 million in FY16 to $106.17 in FY20. The operating expense is primarily driven by Selling, General and Admin Expenses which is around 89% of the revenue in FY20.

Expenses as a Percentage of Sales

Company Posts Impressive FY20 results

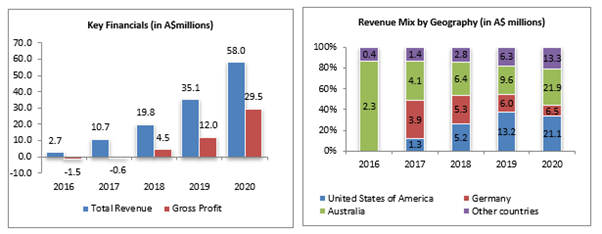

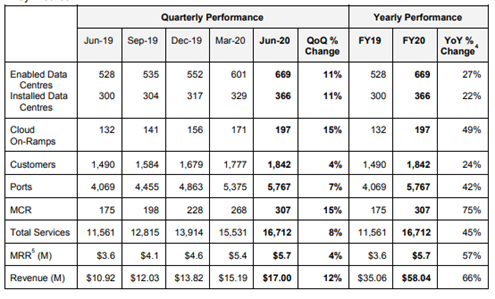

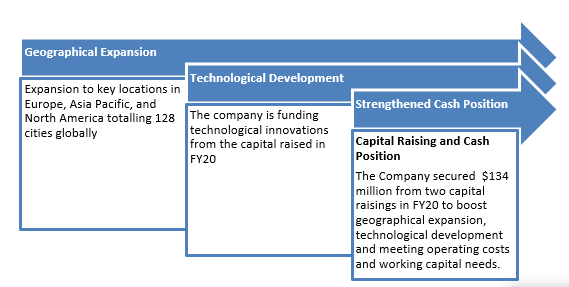

FY20 ending 30 June 2020 Megaport witnessed revenue growth of 66% to $58 million with monthly recurring revenue (MRR) hitting $5.7 million (57% increase YOY). The growth in monthly recurring revenue has been attributed to annual business growth of 94% in North American business which contributed $26.3 million in FY2020. Expansion in other locations in Europe and Asia has also led the company to make its services available in 23 countries with 669 enabled locations that included 366 installed data centres in 128 cities globally. Expansion in Japan is also strategically motivating as Megaport is the first global neutral interconnection fabric in the market.

Source: ASX Update, 19 August 2020

Other FY20 highlights are:

- The business recorded a profit after direct network costs of $29.5 million, demonstrating a 147% increase YoY

- Customer count reached 1,842 by adding 352 customers (24% YoY increase)

- Ports increased by 42% to 5,767.

- MCRs increased by 75% to 307.

- Total Services increased by 45% (5,151) to reach16,712.

- Average Revenue per Port increased to $980 (by $93 or 10% YoY) in June 2020.

- The company recorded a net loss of $47.7 million for FY 2020

The company enhanced its clientele significantly with verticals such as Financial Services, Healthcare, Manufacturing, and Digital Media recorded increased demand for cloud connectivity and data requirements.

Capital Raising and Cash Position

Megaport ended the financial year with $166.9 million cash in hand. The Company secured $134 million from two capital raisings in FY20 with the intention to boost geographical expansion, upgrade existing capacity, technological development and innovation, and take care of operating costs and working capital needs.

MegaPort’s Business Focus

According to Chief Executive Officer, Vincent English, the company is expected to become EBITDA breakeven soon, backed by the investments in human resources, technology, and building network footprint worldwide, capitalising upon the growing demand for cloud-based services.

Megaport Virtual Edge offering is considered to be a key driver in propelling the company towards more business growth and meet the demand for elastic interconnection.

To Sum Up

Technology companies are going from strength to strength across the world and within Australia as well. There has been a relentless investor interest in this sector and the same is reflected in the stock price performance both on the broader IT index level as well as individual stocks. Investors need to thoroughly gauge the business fundaments and consider the valuation picture before investing.