Highlights

- Iron prices were recently at their highest level since June 2022

- Pantera Minerals recently received approval for three tenements at the Weelarrana Project

- Genmin Limited has raised AU$7.9 million through a placement

Last year proved to be volatile for iron ore prices because of a lack of demand as economic activities slowed down due to China’s zero-COVID-19 policy. Inventories were also at full capacity, leading to a further fall in production. By the end of 2022, iron ore prices have matched with that of the beginning of the year.

China faced low demand for steel-making ingredients, and the property sector was also in a liquidity crisis. Iron ore demand was hampered as metallurgists had to lower their output to match the demand from constructors.

The Chinese government took pro-growth measures, and the People’s Bank of China (PBoC) has sparked a rally in iron ore prices since November 2022. These efforts have been sufficient to offset the decline faced during the year. Authorities have also lifted the ban on the refinancing of equity of the firms involved in the sector. Liquidity is being continuously supplied to the economy by the PBoC.

Iron prices were recently at their highest level since June 2022, hitting a seven-month high. The cost of raw materials by the end of 2022 had surged by 43% compared to 2021. There is an optimistic view about the top steelmakers relaxing COVID-19 control measures. Factories can restock their inventories due to low levels.

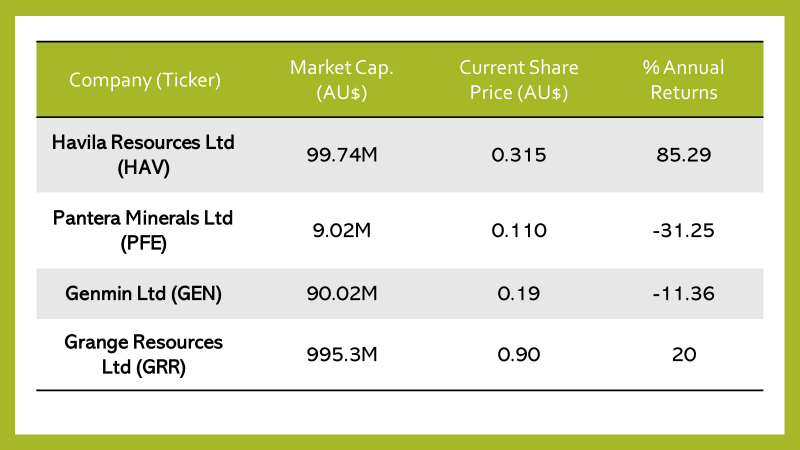

Amid the surge in the price of iron ore, let us analyse the performance of some penny iron ore stocks listed on the Australian Stock Exchange (ASX):

Data: ASX as on 5 January 2023

Havila Resources Ltd. (ASX:HAV)

Australian mineral exploration company Havilah Resources Limited operates in South Australia and the West Kalkaroo gold open pit for the evaluation of mineral resources. The drilling programs of the company have been very successful and have resulted in a JORC Mineral Resource Estimate of 451 million tonnes of iron ore, 1.3 million tonnes of copper, 3.2 million ounces of gold, and 43,400 tonnes of cobalt. The company has systematically accumulated more than 16,000 sq. kilometres of the Precambrian geological terrain.

Havilah Resources recently concluded its AGM Technical Review Presentation for 2022. The strategic planning for the future was revealed along with past year’s achievements. The Grants Basin iron ore project has an exploration target of 3.5 – 3.8 billion tonnes with 24-28% iron. This is significant as only 25% of the iron ore basin has been drilled. Havilah has planned to carry out resource drilling and a scoping study on the western cropping section of the Grants Basin.

Pantera Minerals Ltd. (ASX:PFE)

Western Australia-based mineral exploration company Pantera Minerals Limited have a diverse portfolio of iron ore, copper, lead, zinc, silver and manganese. The company has four projects in Western Australia: Hellcat, Yampi iron ore, Frederick, and Weelarrana.

Pantera Minerals recently received approval for three tenements at the Weelarrana Project to commence onground exploration. The company believes the site has a great potential for manganese mineralisation. The immediate focus is on mapping and rock chip sampling at the project. Pantera will also conduct a multi-element soil sampling for gold-silver mineralisation.

Image: © Johncarnemolla | Megapixl.com

Genmin Ltd. (ASX:GEN)

African iron ore exploration and development company Genmin Limited has several projects in the Republic of Gabon with 100% interest in three projects, which have been granted exploration licences for nearly 5,064 sq. kilometres. The Baniaka and Bakoumba projects consist of 2,445 sq. kilometres of landholding.

Genmin has raised AU$7.9 million through a placement recently. It received strong support from existing and new investors. The company also received positive project economics for the Baniaka project for the first five million tonnes per annum of operations. Genmin plans to use the funds for pre-development activities at Baniaka and targets production by mid-2024.

Grange Resources Ltd. (ASX:GRR)

Grange Resources has been involved in the mining and production of magnetite from the Savage River Mine for more than 55 years. The company is listed on the ASX and is among the most experienced magnetite producers of the country. The company produces iron ore pellets with very low concentrations of impurities, supporting the reduction of environmental impacts.

Grange Resources has recently entered into a binding agreement to re-acquire SRT Australia Pty Ltd.’s (SRT) 30% interest in the Southdown Magnetite Project. SRT is also the joint venture partner of Grange Resources. There is also an off-take rights agreement with Sojitz Corporation, which provides Sojitz with the right to acquire 30% of future production at the Southdown project.