Summary

- Oil extraction results using a solvent consistently achieved oil yields over 175% of a Modified Fischer Assay

- Australia taking lessons from the pandemic, a sponsored boost to critical minerals domestic supply chain may be anticipated

- Received R&D cashback of $205,000 to be used towards general working capital

- QEM is focussing on the application of effective extraction technology at Julia Creek project

QEM Limited (ASX: QEM), the innovative energy solutions company, released the activities report for the June quarter. During the quarter, the explorer successfully navigated the pandemic environment and progressed on the flagship Julia Creek vanadium and oil shale project in Queensland.

Oil Extraction Test Results in Consistent Oil Yields

A review of the processing routes at the Julia Creek project commenced during the March quarter, HRL Technology Group Pty Ltd was engaged to conduct the oil shale extraction tests. Majority of the oil extraction testing was conducted during the June quarter with the outcomes of the test released recently in July.

The oil yields stood consistently over 175% of Modified Fischer Assay oil yields under varying test conditions. The increase in oil yields is attributable to the addition of the hydrocarbon solvent extracted directly from the oil stream from the Julia Creek project enhancing the cost effectiveness of the solvent.

The test work for Vanadium extraction rates within the shale segments of the Julia Creek project was also conducted during the June quarter by HRL Technology Group Pty Ltd. The results for the test work are anticipated in the present quarter.

As per the company, the excellent extraction test results will form the foundation for further extraction and resource quality optimisation tests during the present quarter. QEM has also collaborated with E2C Advisory Pty Ltd to advance on the engineering and economic activities developing and evaluating the extraction process, including assessment of economic viability of the Vanadium and oil shale project.

Must Read: QEM reports high oil yield during test program, emphasis on a balanced Vanadium-Oil shale recovery

Joint efforts of the Government & QEM to boost development of innovative domestic sources of energy

QEM also reported no material impacts on its activities due to the COVID-19 pandemic. QEM is working in close co-ordination with the Queensland Resource Council (QRC), prestigious Industry experts and the local and state government to mitigate the impact of the pandemic.

QEM has already incorporated the state and national protocols complying to all regulatory requirements into its Health and Safety management system.

QEM believes that the pandemic has emphasised the requirement of strong economic supply chains, especially in matters relating to Australia’s energy supply or overseas sourced key materials. The company’s beliefs were further strengthened by the endorsement of a National Critical Minerals Development Roadmap by the COAG Resources Ministers in efforts to support Australia’s domestic critical minerals supply chain.

As per QEM, initiatives such as these may trigger the domestic production growth of critical minerals benefiting the company in the post pandemic times. During the quarter, QEM received a $50,000 cashflow boost rebate as part of the Australian Government’s response to COVID-19.

QEM also received the research and development (R&D) cashback of over $205,000 from the Australian Taxation Office (ATO). The cashback recognises the innovative initiations take by QEM on advancing the Julia Creek project. QEM plans to utilise the refund received towards the general work capital.

Utilising Capital effectively for sustainable growth

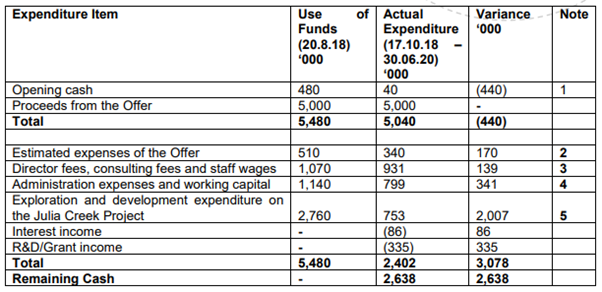

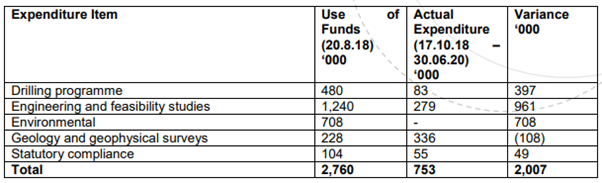

Complying to the obligations stated under the ASX Listing Rule 5.3.4, QEM Limited released the Use of Funds Statement in the Replacement Prospectus dated 20 August 2018 and the actual expenditures since ASX admission of 17 October 2018.

Source: QEM Limited

The exploration and development expenses were attributed to the environmental impact statements, pre-feasibility studies and expenses related to mining applications.

The flagship Julia Creek holds known mineral resources of over 2,760 Mt of Vanadium JORC resource at an average grade of 0.30% V2O5 and a 3C Contingent Oil Resource of 783 MMbbls. QEM has focussed on an economical yet effective extraction process development to tap the extensive Vanadium and Oil shale potential at Julia Creek.

Despite the slow progress due to the factors outside QEM’s control, the explorer now has a promising technology which is currently being evaluated for commercial applications through internal and external consultants.

A total of over $78,000 were paid to the related parties and their associates relating to non-executive director’s fees, executive directors’ salaries and a technical consulting fee to Energy Source LLC during the June quarter. Further, $175,000 were spent on activities relating to Exploration and Evaluation progress, including the oil and vanadium extraction test works.

On 29 July 2020, QEM closed at $0.088 a share, registering an increase of over ~3.5% against the previous close, with a market capitalisation of $8.8 million.

All financial information pertains to Australian dollar unless stated otherwise.

.png)