Highlights

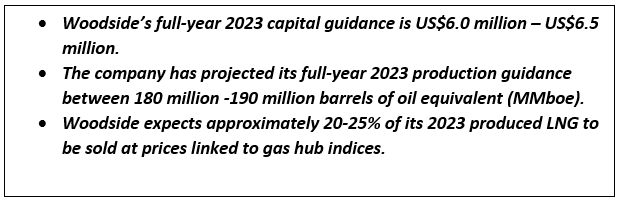

- Woodside said on Tuesday that for fiscal 2023, it expected to produce 180-190 million barrels of oil equivalent (MMboe).

- This is more than the fiscal 2022 production forecast of 151-157 MMboe.

- Woodside expects its fiscal 2023 capital expenditure to range between US$6-US$6.5 billion.

Oil and gas behemoth Woodside Energy Group Ltd (ASX:WDS) shared its 2023 full-year guidance on 29 November 2022 that featured a complete review of its 2023 corporate plan, cost, production and sales forecast figures.

On the same day, Woodside announced the resignation of Fiona Hick, its Executive Vice President Australian operations.

Meanwhile, on 30 November, Woodside shares were spotted trading 0.950% lower at AU$36.480 apiece at 11:50 AM AEDT on the ASX.

Key highlights from the Fiscal 2023 guidance furnished by Woodside

When it comes to the production of oil equivalent, Woodside shared via the release that the first phase of its Sangomar Field Development is hoping to come out with its first oil in late 2023. The phase 2 of Mad Dog is witnessing commissioning, and the company expects production guidance to be proposed during mid-2023. Woodside also shared that a significant turnaround is planned at Pluto LNG in the second quarter of 2023. The duration of the same is anticipated to be around four weeks.

Besides providing with guidance, Woodside also informed the market about the resignation of its Executive Vice President of Australian operations, Fiona Hick. She will now be serving another ASX-listed firm, as per WDS release.

The share price performance of Woodside on the ASX

In the past five trading days on the ASX, Woodside has fallen by 5.12%. In the last month, the energy giant's shares have increased by 1.53% on the ASX. In the previous six months, the shares have gained 22.75%, and in the last one year, the shares have surged 70.46% on the ASX. On a year-to-date basis, the shares of Woodside have accelerated by 61.14% on the ASX (as of 12:10 PM AEDT, 30 November 2022).

_09_03_2024_01_03_36_873870.jpg)