Highlights

- Increased global energy demand coupled with the Russia-Ukraine war is expected to drive the demand for non-Russian oil & gas.

- The war is expected to change the global energy dynamics, with the US pushing more of its oil & gas to the European market.

- Largest LNG exporter Australia eyes to tap the emerging opportunities.

The troubles in Eastern Europe are fast changing the global energy supply chain dynamics. Russia has asked the European countries to pay in roubles for their imports of oil & gas. Also, several EU countries are planning to place an embargo on Russian energy supplies, including oil & gas, coal, and other resources.

Related read: Crude oil rises on IEA supply warning

US President Joe Biden, during his recent visit to Brussels, ensured Europe that the US would keep sending LNG tankers to reduce their dependency on Russian supplies. But how far those supplies could go? The United States has a huge reserve of natural gas and could boost production in the short term. The only issue with exports is the lack of LNG terminals both in the US and Europe.

Europe’s gas infrastructure is developed in line with the Russian oil & gas supply through pipelines. There are not enough LNG regasification terminals in Europe to depend entirely on LNG supplies. Also, natural gas is treated and compressed nearly 600 times under cryogenic conditions to convert them into LNG for shipments.

Building LNG facilities takes several years of planning and huge investments. The US has limited capacity for LNG production, and that too cannot be beefed up on such a short notice.

Also read: Up over 500% YTD: Why this oil explorer is drawing attention amid sizzling oil rally

Also, the US will have stiff competition from Australia and Qatar for their share of the LNG market in Europe. Australia is already the world’s largest exporter and producer of LNG. It has established markets in Asia-Pacific, China, and Japan.

Image Source: © Dpsfotogmailcom | Megapixl.com

Australia has a nameplate capacity of nearly 88Mt of LNG production annually. In 2021, Australian LNG exports stood at around 77Mt. With new projects, including Woodside’s Scarborough and Pluto Train 2 projects, a substantial increase in LNG capacity could be expected.

Data from the Australian government’s Resources and Energy Quarterly December 2021 edition suggests that the Aussie LNG players made an investment of nearly AU$16.5 billion in the sector. This is the largest investment in the LNG upstream sector in over a decade.

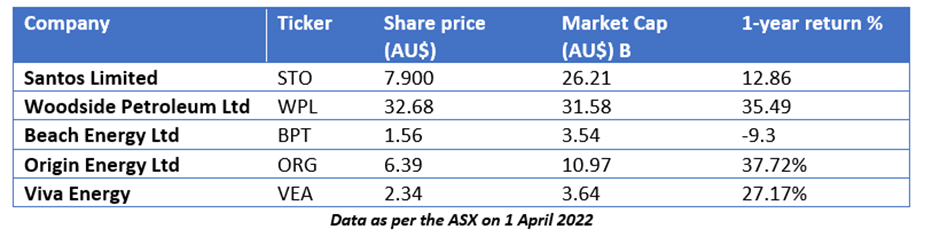

On that note, let us walk through some of the ASX-listed LNG players.

Woodside Petroleum Limited (ASX:WPL) is the largest oil & gas producer in Australia. The Company announced Final Investment Decision (FID) on the Scarborough and Pluto Train 2 Project in November 2021. Once the project becomes operational, WPL will add 5Mt of LNG to the country’s production.

Related read: Rising crude oil prices push Woodside (ASX:WPL) shares up on ASX

Santos Limited (ASX:STO) produced 92.1 MMBoe of oil and gas in 2021. The Company’s sales revenue was up by 39% to US$4.71 billion for 2021. Santos has provided sales volumes guidance in the range of 110-120MMBoe for 2022.

Related read: Santos (ASX:STO) shares in focus ahead of dividend payment date

Another prominent LNG player, Beach Energy Limited (ASX:BPT) is engaged in the development of the Waitsia Stage 2 Project. The Company’s production for 1H of FY22 was 11.02MMboe, and it was successful in clocking 66% higher profit than 1H FY21 during the period.

Origin Energy (ASX:ORG) is a utility company with exposure in upstream oil & gas projects. The Company operates the Australia Pacific LNG project with global oil & gas majors ConocoPhilips and Sinopec. Recently, the Company divested 10% of its interest in the project to ConocoPhilips for US$2 billion.

Interesting read: MAY & PCL: Two ASX energy stocks under $1 with over 400% YTD gains

Viva Energy (ASX:VEA) is developing an LNG terminal in the Victoria region. The proposed terminal is expected to solve the energy shortages in Victoria and reduce reliance on coal for power generation.