Summary:

- Crude oil and natural gas are currently undergoing a period of extreme volatility.

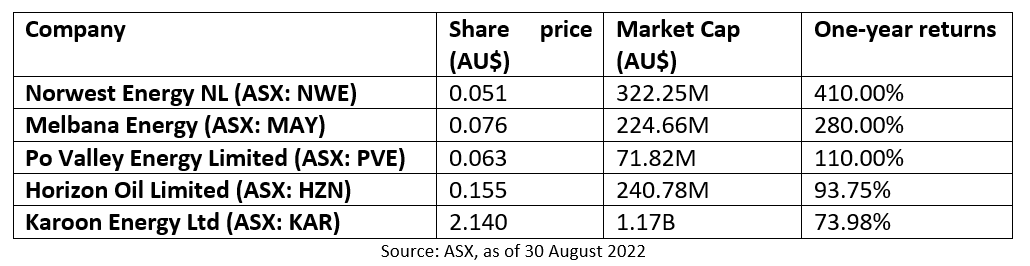

- Many ASX-listed oil and gas companies have given remarkable returns in the last one year.

Conventional hydrocarbons like crude oil and natural gas have a hold over the global energy market as they are among the cheapest and most reliable sources of energy. The affordable and reliable nature is because of the well-developed processing and transportation systems for crude oil and natural gas. Along with this, the worldwide compatibility of crude oil and natural gas makes them energy sources of the utmost importance.

It can be correlated by seeing the influence that global hydrocarbon players like Saudi Aramco, ExxonMobil, and Royal Dutch Shell have in powering the world's economy and by visiting their market capitalisation and profits.

European countries are making huge investments to develop green and more unconventional energy sources. The objective is to reduce their dependency on crude oil and natural gas; however, the infrastructure barrier (in the form of time and money) to developing these resources is one of the reasons for the current European energy crisis.

Currently, the natural gas supply from Russia via the Nord Stream 1 pipeline is only operating at 20% of its capacity. At the same time, 90% of Russian crude oil is already banned under the EU’s sixth package of sanctions against Russia.

Many such factors have caused extreme volatility in crude oil and natural gas prices in last few years. For instance, Brent crude oil prices went to their multi-year low of around US$20 during the COVID-19 outbreak in March 2020 and then rebounded to approximately US$110 in May 2022.

Australian Oil & Gas market scenario:

Backed by strong crude oil prices, Australian oil export earnings for the year 2021-22 hit an estimated value of AU$13.5 billion, which is 81% higher on a year-on-year basis, as per the June 2022 edition of the Resources and Energy Quarterly report. Similarly, export earnings from Liquified Natural Gas (LNG) are estimated to have reached AU$70 billion in 2021–22, up from AU$30 billion in 2020–21.

The primary goal of every investor is to book huge profits and accumulate higher returns from their investments. Investors are always attracted to companies working in the exploration and production of oil and gas, offering high returns; however, certain risks are associated while investing. Hence, they need to consider a few factors before entering any investment or trading opportunity in crude oil markets, including

- The cyclic nature of the market.

- Volatility due to global geopolitical conditions.

- Production uncertainty due to the subsurface's geological conditions.

- Environmental issues of using crude oil products.

- Operational safety issues associated with crude oil products.

With this backdrop, we at Kalkine Media® will discuss some of the ASX-listed oil and gas stocks that have delivered remarkable growth in the last one year.

Norwest Energy NL (ASX:NWE): The Perth-based oil and gas explorer reported cash and cash equivalents of A$22,808,000 on 30 June 2022. The company raised AU$18.3 million from a strongly supported placement and a share purchase plan during the June quarter.

Norwest remains in a strong financial position to advance its comprehensive appraisal and ongoing exploration programs.

The company is witnessing transformational growth further to the significant conventional gas discovery at Lockyer Deep-1 late last year.

In its recently released quarterly report, the company updated that the Absolute Open Flow Rate from Lockyer Deep-1 is estimated at 190 MMscf/d. The gas-in-place connected to the Lockyer Deep-1 well is estimated to be 70 Bcf to 110 Bcf within the well test maximum radius-of-investigation (area of approximately 3km2).

Based on the comprehensive analysis of reservoir pressure data and post-drill structural interpretation, the best estimate of the potential resource area has increased from 92km2 to 100km2.

Melbana Energy Limited (ASX:MAY): Melbana Energy operates in Cuba and the Bonaparte Gulf region in Australia.

In its quarterly activities summary for the June 2022 quarter, the company highlighted the second structure (Alameda) independently estimated to contain 2.3 billion barrels of oil in place (OIP) for 148 million barrels of the prospective resource. It lies in PSC Block 9 in Cuba, where Melbana has 30% interest.

The company’s planning has commenced for drilling an appraisal well for all three oil-bearing units in the Amistad structure encountered by Alameda-1 and for the future development of Block 9.

The company’s cash reserves stood at AU$35.569 million at the end of the quarter.

Po Valley Energy Limited (ASX:PVE): Having more than 20 years of experience, Po Valley Energy is an emerging player with many prospects in the oil and gas sector, backed by its portfolio of natural gas fields in northern Italy.

The company recently entered into a deal with TESI Srl to install a gas plant and pipeline for the Podere Maiar gas field in Italy. Podere Maiar remains on track for first gas production at the start of Q2 CY2023.

The company’s cash reserves stood at AU$979,000 as on 30 June 2022. Also, PVE further boosted its financial position with a recently completed AU$4.5-million placement.

Horizon Oil Limited (ASX:HZN): Horizon is an upstream oil and gas company active across the Asia-Pacific region. In its FY22 full-year results update, the company highlighted sales revenue of US$108.1 million and an underlying profit after tax of US$24.3 million.

The company had net cash of US$42.8 million at the end of the period. Total distribution to the shareholders stood at approximately US$34 million.

The company is delivering on its strategy by continuing to invest in production growth, maximising free cash flow and further distributions to the shareholders.

Karoon Energy Ltd. (ASX:KAR): The company posted US$89.6 million in underlying Net Profit After Tax (NPAT) in FY22, representing its first full year of production at Baúna. The development indicates the company's disciplined cost control, high operational uptime, and strong realised oil prices.

The oil revenue increased to US$385.1 million in FY22 from the FY21 value of US$170.8 million. The company’s cash and cash equivalents stood at US$157.7 million on 30 June 2022.