Highlights

- Carnarvon is expected to place 234.8 million shares to professional investors to raise AU$70 million.

- The funding will mainly be used towards the Dorado development project.

- Carnarvon has also decided to keep its securities under trading halt on the ASX from today until further notice.

The shares of the oil and gas explorer, Carnarvon Energy Limited (ASX:CVN), traded last at AU$0.33 per share on 25 March 2022, as the company decided to put its securities on a trading halt on the ASX today (28 March). The company also announced about conducting a fully underwritten institutional placement to its shareholders on the ASX today.

The share price of Carnarvon gained approximately by 22% on the ASX over the past 12 months. On the other hand, Carnarvon’s year-to-date share price fell about 3% on the ASX until today (28 March).

About Carnarvon’s institutional placement:

Carnarvon informed that it is likely to conduct a fully underwritten institutional placement of 234.8 million new fully paid ordinary shares to the professional and institutional shareholders, enabling the company to raise approximately AU$70 million.

The company will issue each share for AU$0.30 per share to the investors to raise gross proceeds worth AU$70 million.

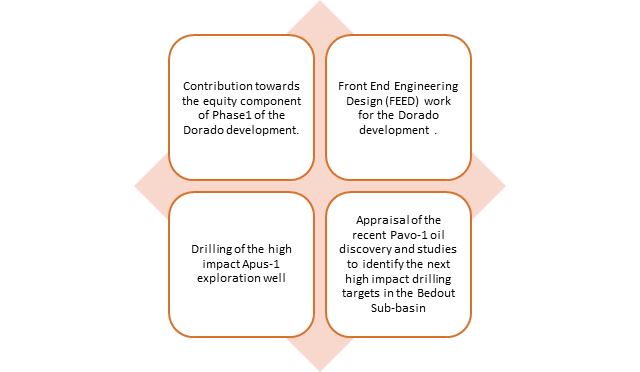

The funding from this institutional placement, along with Carnarvon’s existing cash, will provide funding for several important activities, including:

Image Source © 2022 Kalkine Media ®

Adrian Cook, the Managing Director and CEO of Carnarvon, said that the company would use the funding from the placement to bring the Dorado liquids development to a Final Investment Decision (FID) in 2022. Apart from that, Carnarvon will also use the fund for corporate purposes, overhead expenses, working capital, etc.

Adrian further informed that Dorado is a world-class resource that holds high-quality reservoirs and fluids in shallow water. The company expects that Dorado is an important project as it may deliver strong returns for its shareholders.

Carnarvon is expecting the settlement of the new shares issued under the institutional placement to occur on Monday, 4 April 2022, along with the allotment and regular trading scheduled for Tuesday, 5 April 2022.

Read more: Carnarvon Energy (ASX:CVN) shares zoom 18% on Pavo-1 well update

About Carnarvon’s trading halt:

Image source: © Josepalbert13 | Megapixl.com

Carnarvon announced that it will place its securities under trading halt at its own request, effective from today (28 March). The securities shall remain under trading halt until the company informs about the normal trading update on 30 March 2022, or unless ASX decides otherwise.

About Carnarvon:

Carnarvon Energy Limited is an ASX-listed energy sector company established in 1983 in Perth, Australia. The company mainly deals with oil and gas exploration projects. Some of the big projects of Carnarvon includes the Phoenix projects, Cerberus project, and Buffalo project.

Read more: What made Gold Road Resources (ASX:GOR) slash dividend